Gold prices recently reached a new all-time high. Many commentators have noted that purchases from central banks and Chinese investors have supported the uptrend. In this Macro Flash Note, Senior Economist GianLuigi Mandruzzato looks at the drivers of the gold price and concludes that its recent surge may not be sustainable.

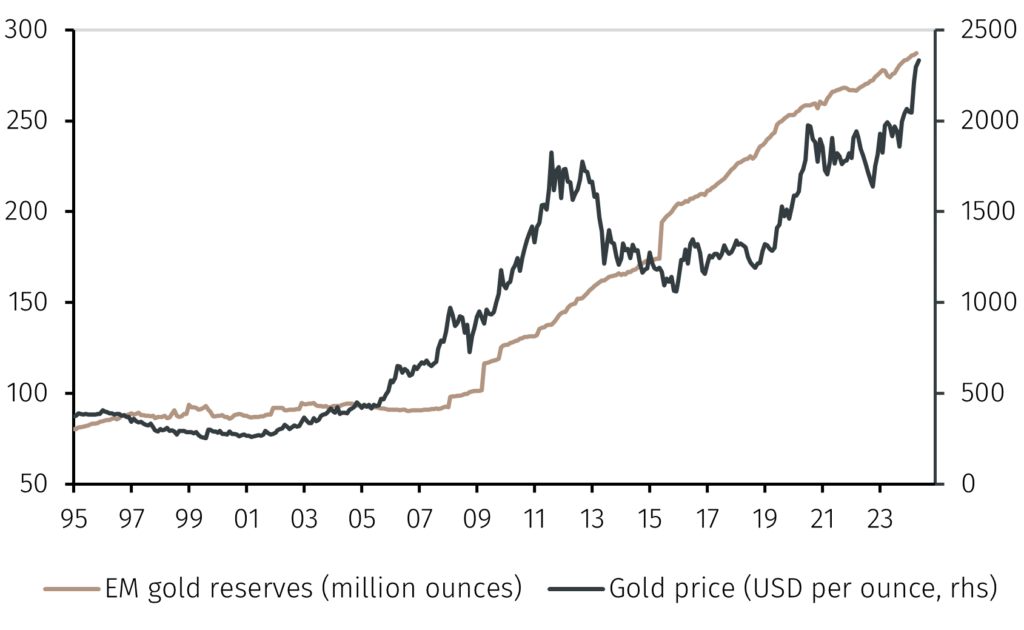

On 20 May, the price of an ounce of gold reached a new all-time high at USD2,425 (see Chart 1). At the time of writing, the gold price is up by 14.3% for the year-to-date, a surprisingly strong performance for a safe haven asset in a year in which the S&P 500 index of large cap US stocks has risen 11% and the VIX index of implied volatility has remained at historically low levels, despite elevated geopolitical tensions. The gold price performance is also surprising against high bond yields and a strong US dollar.

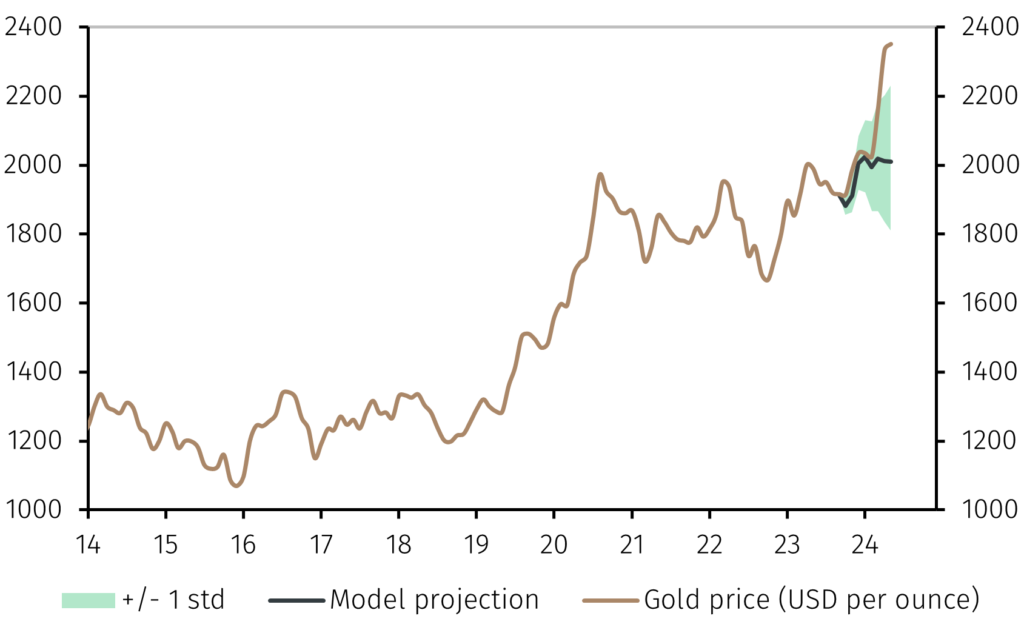

A simple statistical model that considers the trade-weighted US dollar index, the 10-year US Treasury yield and the VIX index explains well changes in the gold price since 2008.1 However, the model does not explain the strong increase in the price of gold since the end of February. In the three months to the end of May, the cumulative estimation error is close to 14%. This can be seen as a warning about the sustainability of the current gold price.

One interpretation is that the model excludes some relevant variables. For example, focusing on the US nominal government bond yield does not allow to differentiate between the impact of the real yield and that of inflation expectations. A rising real yield is associated with an improved growth outlook that should make a safe asset like gold less attractive to investors. Instead, an increase in expected inflation should stimulate the demand for gold as a store of value against the loss of purchasing power of fiat currencies.

From a fundamental demand perspective, many commentators, including the World Gold Council, link the gold price surge to increased emerging market central bank purchases in reaction to the freezing of Russia’s foreign exchange reserves following its war on Ukraine (see Chart 1).2

Chart 1. Emerging market gold reserves and the price of gold

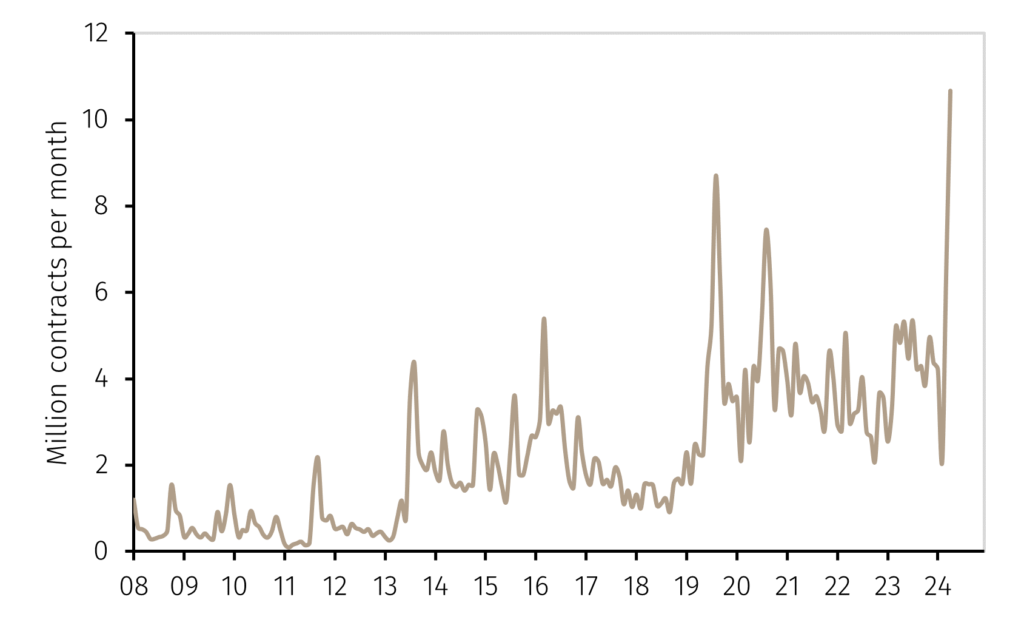

Furthermore, the higher gold price has been seen as reflective of booming demand from Chinese private investors fleeing the real estate sector crisis (see Chart 2).3

Chart 2. Trading volumes on gold futures in Shanghai

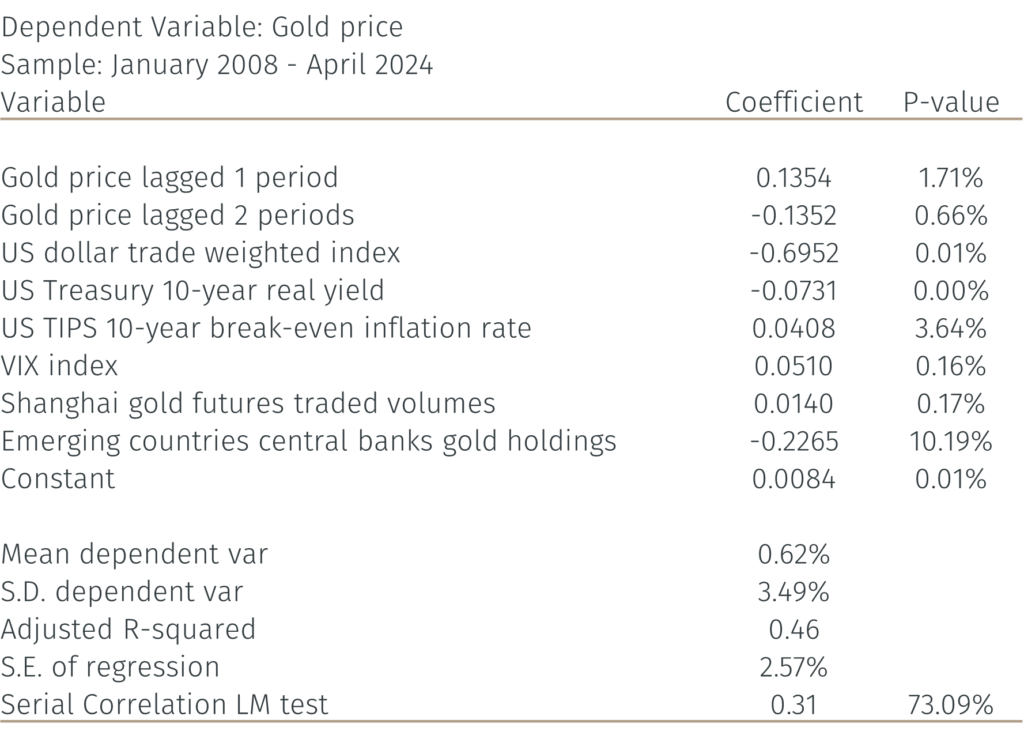

Taking these factors into account, the gold price model was modified as follows:

- The 10-year US government bond yield was split into the real component and the expected inflation component derived from inflation-linked bonds;

- Monthly changes in the gold holdings of emerging countries’ central banks and the trading volume of gold futures contracts at the Shanghai Futures Exchange were added as potential explanatory variables.

The new estimates lead to interesting results. Both the real yield and inflation expectations are statistically significant, and the model’s explanatory power is 35% higher than in its original specification.4 However, even the new specification does not fully explain the gold price surge since February and in the three-month period to the end of May the cumulative estimation error exceeds 13% (see Chart 3).

Chart 3. Gold price and fair value

Adding emerging countries’ central bank purchases and the futures trading volume in Shanghai leads to a moderate increase in the explanatory power of the model, but only thanks to the futures trading volume variable.5

In contrast, emerging market countries’ central bank purchases are not statistically significant. Indeed, the historical observation shows a constant increase in emerging market countries’ holdings of gold reserves rather than an acceleration in the most recent period that could have helped explain the increase in the gold price (see Chart 1).

Despite the additions to the model, the cumulative estimation error of the augmented model in March and April is still high at 11%, leaving the recent surge in the price of gold as a puzzle that is hard to explain based on its long-term drivers.

In conclusion, the strong increase in the gold price from February cannot be fully explained based on the variables that have proven the most correlated with it since 2008. This remains true when adding the trading volume on the Shanghai gold futures contracts and the emerging countries central bank purchases of gold.

It would therefore be unsurprising if, absent new favourable shocks like a weakening of the US dollar, an increase in inflation expectations, or an increase in stock market volatility, the price of gold stabilises at current levels or suffers a temporary correction.

Appendix. Details of the augmented gold price model

All variables are monthly changes in the logarithms of the original values except the US Treasury 10-year real yield and the US TIPS 10-year break-even inflation rate for which the absolute changes are considered.

A P-value of less than 5% means that the hypothesis that the estimated coefficient is zero can be rejected with a confidence of at least 95%.

The Adjusted R-squared value indicates the model explains 46% of the variance of gold price monthly changes.

The P-value of the Serial Correlation LM test indicates that the hypothesis that the residuals of the regression are not autocorrelated cannot be rejected.

1 The model is estimated on the monthly changes of the variables from January 2008 to May 2024 and includes two lags of the dependent variable. The Adjusted R-squared of the model, the statistics that measures the proportion of variance in the dependent variable that can be explained by the independent variables, is 0.32

2 See https://go.pardot.com/e/931253/d-market-commentary-april-2024/46qlm/378805953/h/4Mg_OTw5x-OmQRV7pmzZOek3OZqCmusm8nZ3PzIpUSQ

3 See https://go.pardot.com/e/931253/es-temper-demand-sref-5epPVx10/46qlq/378805953/h/4Mg_OTw5x-OmQRV7pmzZOek3OZqCmusm8nZ3PzIpUSQ

4 The Adjusted R-squared of the modified model is 0.43.

5 The estimation of the augmented model ends in April when the latest observations for the data on the reserves of emerging countries and on trading at the Shanghai Futures Exchange are available.