The increase in the US unemployment rate in July triggered the Sahm rule that has coincided with the start of recessions since 1960. In this Macro Flash Note, Senior Economist GianLuigi Mandruzzato provides context around the signal the Sahm rule is providing and its implications for the US economic and monetary policy outlook.

The Sahm rule

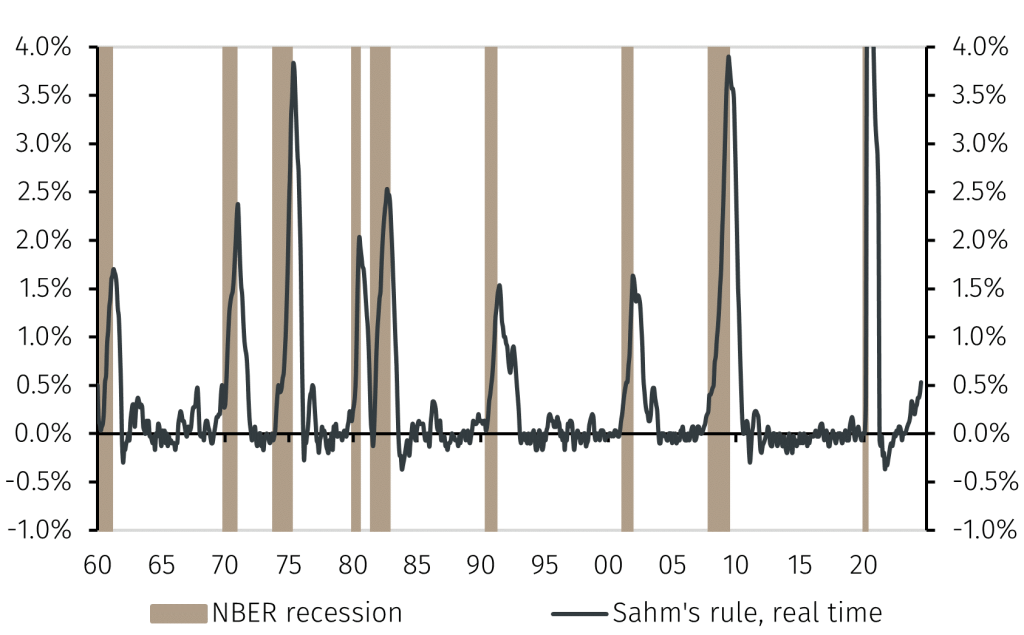

The Sahm rule states that the US economy is in the early stages of a recession when the three-month average of the unemployment rate exceeds its minimum over the previous twelve months by 0.5 percentage points or more.1 This condition was satisfied in each of the nine US economic recessions identified by the National Bureau of Economic Research (NBER) since 1960.2 The increase in the unemployment rate to 4.3% in July saw the three-month average rise 0.53 percentage points above its twelve-month low, triggering the Sahm rule and thus suggesting that the US economy might already be in recession (see Chart 1). This raised market concerns about the health of the US economy and that the Federal Reserve’s monetary policy is too restrictive.

Chart 1. Real time Sahm’s rule and US recessions

Source: FRED, LSEG Data & Analytics and EFGAM calculations. Data as at 08 August 2024.

According to Federal Reserve calculations based on data available in real time, since 1960 the threshold of the Sahm rule has been exceeded on average between 3 and 4 months after the official start of the recession according to NBER dating. The minimum delay was 2 months, and the maximum was 5 months after the official start of the recession. However, the NBER makes its decisions with a considerable delay – often after the recession has ended – and so one can think of the Sahm rule as a much more timely indicator of the onset of US recessions.

What are other economic indicators telling us?

At the current juncture, the Sahm rule would suggest that the US economy has already been in recession for a few months. However, this conclusion appears to contradict recent data.

US quarterly GDP growth was 2.8% annualised in the April-June quarter, higher than in the first three months of the year. Furthermore, despite the increase in the unemployment rate, employment growth has continued in recent months, albeit at a moderate pace, in contrast to what one might expect during a contraction in economic activity. Finally, the ISM and S&P Global Purchasing Managers’ Index surveys for the US economy in July remain consistent with an expansion in activity, supported mainly by the services sector.

Conclusion

Nonetheless, while it seems premature to conclude that the US economy is already in recession, market concerns about the outlook for the US economy are justified. During the last 65 years, once the Sahm rule was triggered, the unemployment rate rose sharply thereafter. Leaving aside the 2020 pandemic-related recession, after triggering the Sahm rule, the unemployment rate rose on average by 1.9 percentage points in the following 12 months and peaked on average 2.4 percentage points higher than its level when the Sahm rule was triggered.

This risk is a further reason why the Federal Reserve should soon start to reduce interest rates.