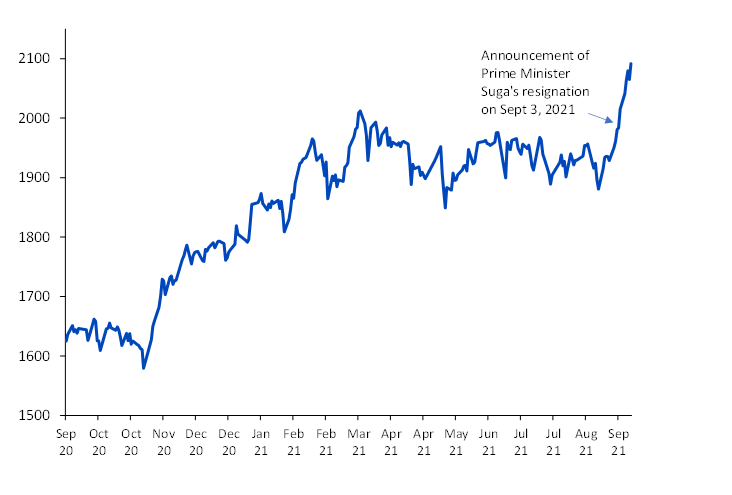

Japanese equities have staged a strong turnaround of 11.2%1, fuelled by the resignation of Prime Minister Yoshihide Suga last week. Prime Minister Suga’s resignation largely stemmed from the confluence of ill health, waning popularity, and his inability to control the Covid outbreak. Japan’s general election, which will be held at the end of November, immediately follows the Liberal Democratic Party’s (LDP) leadership race. Had Suga opted to remain in office, the ruling coalition partner Komeito was expected to lose a number of seats owing to Suga’s declining popularity. But with Suga deciding to step down, the ruling coalition could avoid such an outcome and retain a comfortable majority in parliament as the opposition parties have not seen any increase in public support. We expect the current accommodative macro policy framework to be maintained in the near term. Regardless of who replaces Suga, the new prime minister is expected to deliver swiftly to retain public support. We believe the recent sharp rise in Japanese equity markets is largely a reflection of investors’ hopes for the new administration to employ a new course of action against the pandemic that Suga’s administration had failed to deploy. The potential for further fiscal stimulus in the lead up to the lower house of parliamentary elections is rising, which could lend an additional tailwind for Japan’s equity markets. Historically we have seen Japanese equities perform well in the run-up to the lower house elections and a similar trend appears to be playing out this year.

Figure 1: Topix Index stages a sharp turnaround fueled by Suga’s resignation

Disconnect between earnings and equity performance

The slow vaccine rollout has seen Japanese companies trail global developed counterparts despite the improvement of reported earnings. Japanese companies2 reported the fifth straight beat of quarterly earnings, with aggregate net income beating consensus expectations by 30.6% over the prior quarter. Japan is trading at 14.8x forward Price to Earnings (P/E) ratio, far below major developed market peers such as the US and Europe. Japan’s earnings revisions trend remains the third-best of the major developed markets opening a significant buying opportunity for investors. The vaccination gap with the US & Europe is also closing in with Japan seeking to vaccinate most of its population by year-end. Currently, population above 65 years old have attained 81% full vaccination level, which is equivalent with the US.

External demand to support Japan’s recovery

Owing to their cyclical nature, Japanese equities are poised to benefit from the recovery in developed markets, as the large-cap segment derives nearly 56%3 of its revenues abroad, of which the largest regions are the US and Europe. Japan’s second-quarter GDP was revised up to a 1.9% expansion helped by resilient external demand and an improvement in private consumption and public expenditure, supporting the case that not only did Japan avoid a recession but has held up well amidst the recent COVID-outbreak. However, looking ahead to Q3, the progress in administering vaccines coupled with a new policy package should help boost investor confidence and help soften the blow from weaker household spending, which is expected to be the main drag on Q3 GDP stemming from the extended state of emergency.

Conclusion

We believe the long-term prospects for Japan’s equity market remain favourable given its attractive valuations amidst a continued structural improvement in corporate governance and return on capital. The Bank of Japan has fully tapered its ETF-buying program in recent months, and we are now starting to see foreign inflows garner momentum. Foreign investor flows into Japanese equities posted their largest weekly rise since May 2014, according to Japanese exchanges.

Sources

1 Performance of the Topix (Tokyo Stock Price) Index from 20 August to 10 September 2021

2 listed on the MSCI Japan Index

3 Factset, WisdomTree as of 31 August 2021

Related blogs

+ What’s Hot: Aluminium’s fundamentals keep getting better

+ What’s Hot: Is it time to look at China again?

Related products