Declining real wages and political scandals eroded Japanese Prime Minister Fumio Kishida’s approval rating, leading to his decision not to run for re-election as President of the Liberal Democratic Party (LDP). The party leadership election on 27 September therefore guarantees a new Japanese Prime Minister and will also likely see a snap general election called before the end of the year. In this Macro Flash Note, Economist Sam Jochim assesses the recent developments and their implications.

Feeling the pinch

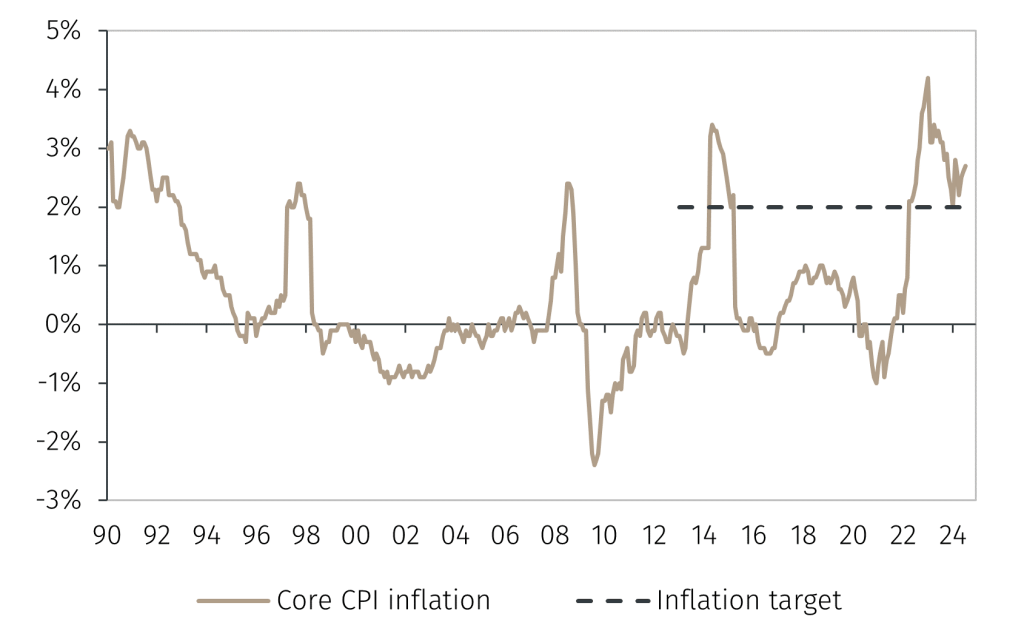

Japanese core consumer price index (CPI) inflation, which excludes fresh food but includes energy, has been at or above the Bank of Japan’s (BoJ) 2% target for twenty-eight consecutive months, a period which stands in stark contrast to most of the last three decades (see Chart 1).1

Chart 1. Japanese core inflation (% change, year-on-year)

The recent rise in inflation has allowed the BoJ to begin normalising its monetary policy. Since March 2024, the central bank has started unwinding unconventional stimulative policies, highlighting its view that 2% inflation will be achieved sustainably over the next couple of years.2 One of the key supporting arguments was the 2024 Shunto results, which saw the largest agreed wage increases in 33 years.3

However, the Shunto results show wage negotiations between labour unions and large employers in Japan, and it takes time for these wage increases to extend to smaller firms. This is evident from the fact that real wages (wages adjusted for inflation) were falling from June 2023 until May 2024.4

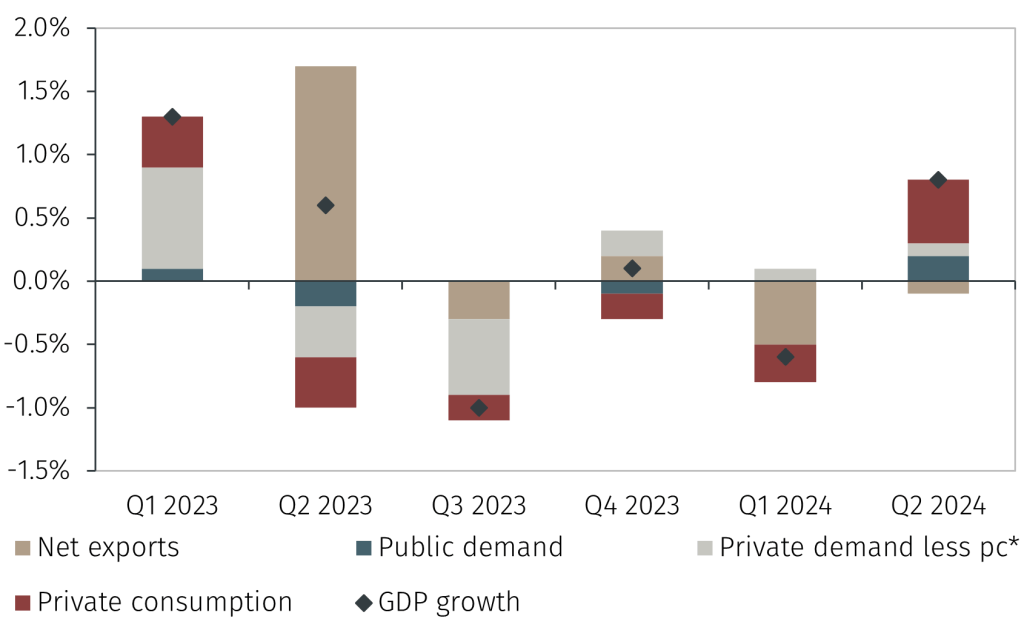

Falling real wages saw consumers struggle to maintain consumption levels, a factor which contributed to Japan flirting with technical recession from Q3 2023 to Q1 2024 (see Chart 2). Japan’s gross domestic product growth then rebounded in Q2 2024, rising an estimated 0.8% quarter-on-quarter, supported by stronger consumption as real wage growth turned positive.

Chart 2. Japanese GDP and components (% change, quarter-on-quarter, and % point contribution)

Crisis of confidence

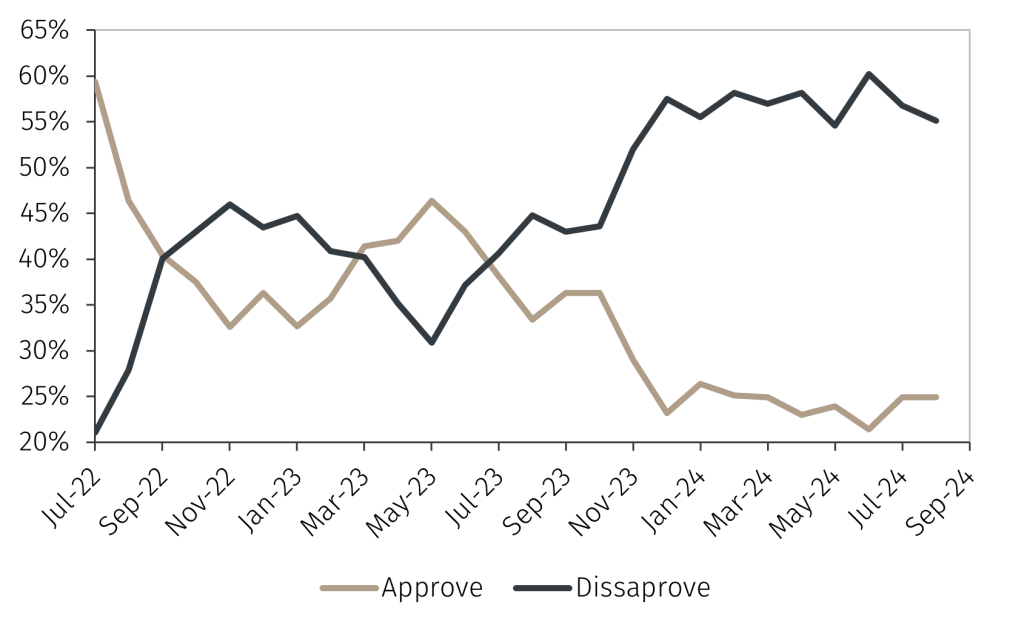

While the rebound in consumption is positive for the Japanese economy, it was too little too late for Prime Minister Fumio Kishida. Declining household purchasing power, as well as an LDP slush fund scandal and controversial ties to the Unification Church which led to the assassination of former Prime Minister Shinzo Abe, led to the Kishida Cabinet’s approval rating declining below 30% for ten consecutive months (see Chart 3).5

Chart 3. Kishida Cabinet’s approval/disapproval rating (%)

Source: NHK and EFGAM. Data as at 02 September 2024.

Kishida announced on 14 August that he will not stand for re-election as President of the LDP. This means that the vote on 27 September will determine a new leader of the LDP and Prime Minister of Japan.6 At the time of writing, four LDP officials have announced bids to lead the Party, and more are expected to do so in the coming weeks. It is therefore unlikely that a single candidate has a 50% majority after the first round of voting and the election will most likely require both rounds of voting. Nonetheless, since the next Prime Minister will still be an LDP lawmaker and will not have been elected by the broader public, policy continuity will remain intact.

How long this continuity lasts is another question. A lower house general election must be held by 31 October 2025, and it is reasonable to expect that a snap general election is called by the new Prime Minister in Q4 2024, attempting to ride the momentum of the Party Presidential election into a nationwide vote. It is still too early to assess the implications of such a move, though it is clear a general election poses risks in terms of political uncertainty due to the potential for a change in government and/or policy direction and, consequently, poses risks in terms of market volatility.

Conclusion

In summary, the return of inflation to Japan has not just had a significant economic impact but also a political one, contributing to the erosion of Prime Minister Fumio Kishida’s public approval. His consequent decision not to run in the election for Party President in September means Japan will have a new Prime Minister. While this will not impact policy continuity, it could see a snap general election called in 2024. Additionally, the uncertainty created by the busy political calendar in Japan over the coming months is likely to mean the BoJ’s monetary policy normalisation is on hold until at least December.

1 The Bank of Japan started targeting 2% inflation in January 2013.

2 See previous EFGAM Macro Flash Notes:

‘Bank of Japan exits its Negative Interest Rate policy’ (March 2024) https://www.efginternational.com/uk/insights/2024/bank_of_japan_exits_its_negative_interest_rate_policy.html and ‘Unwinding the unconventional: BoJ policy normalisation continues’ (August 2024) https://www.efginternational.com/uk/insights/2024/unwinding-the-unconventional–boj-policy-normalisation-continues.html

3 Shunto is a Japanese term which refers to the annual Spring wage negotiations between labour unions and many large employers in Japan: https://www.jil.go.jp/english/jli/documents/2021/028-03.pdf

4 Real wages fell in year-on-year terms from June 2023 to May 2024 according to EFGAM calculations on the Japanese Ministry of Health, Labour and Welfare’s Real Wage Index. It is important to monitor this index since the Shunto results cover less than 20% of Japan’s workforce and are therefore not representative of the broader economy.

5 Slush fund scandal: https://www.ft.com/content/24ca6ce5-8415-4523-ab49-7ea86615cf82

Unification Church ties: https://www.bbc.co.uk/news/world-asia-66704255

6 The LDP President election is a two-round vote involving LDP Diet members and fee-paying party members. If the first round of the vote does not see a candidate receive over 50% of votes, then a second round takes place involving the two candidates with the most votes from the first round.