Japan’s general election on 27 October saw the Liberal Democratic Party (LDP) lose its majority as a governing coalition, the first time this has happened since 2009. In this Macro Flash Note, Economist Sam Jochim discusses some of the implications.

Election miscalculation

Having secured victory in the LDP Presidential election on 27 September, Shigeru Ishiba became the new party leader and Prime Minister of Japan. In a previous Macro Flash Note, we speculated that since a lower house general election was due to be held by 31 October 2025, it was reasonable to expect a snap general election to be called by the new Prime Minister in Q4 2024, taking advantage of Party Presidential momentum into a nationwide vote.1

Indeed, this proved to be the case as Ishiba dissolved the lower house on 9 October, setting the stage for a 27 October general election. As the dust settles from last weekend’s vote, it is clear this move was a miscalculation.

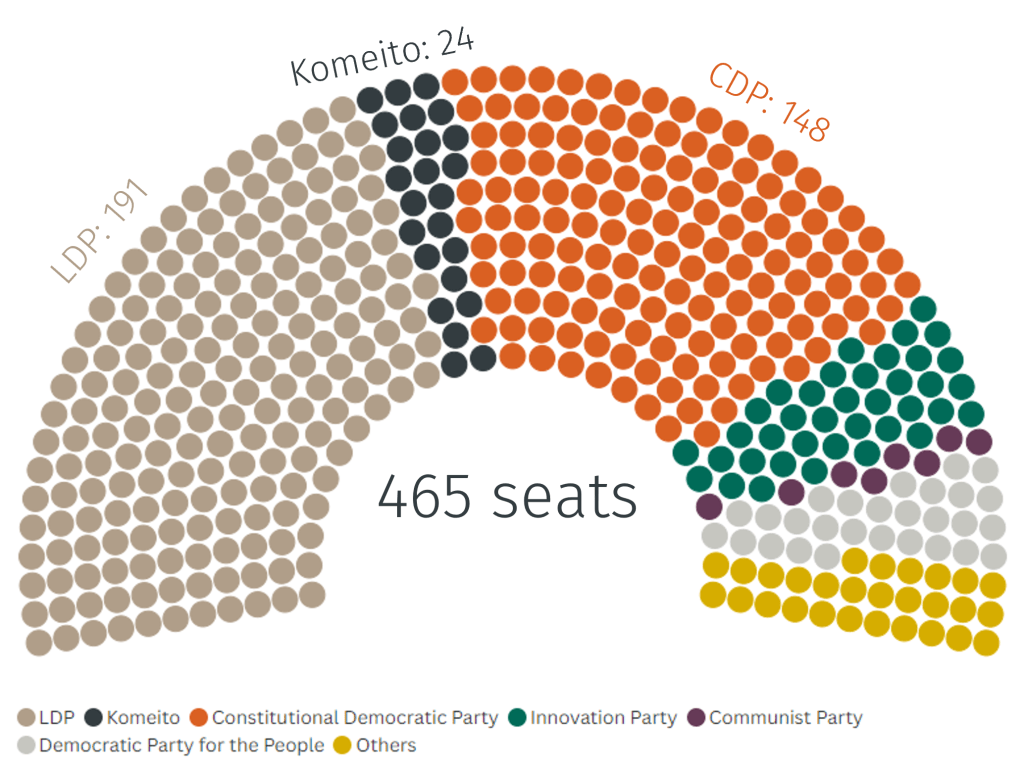

The LDP won 191 seats in October’s election, 67 less than it held heading into the vote (see Chart 1). In addition, its junior coalition partner, Komeito, won 24 seats, 12 less than it held before the election. This means the coalition is 18 seats short of the 233 required to have a majority in the lower house.

Chart 1. Japan’s lower house composition

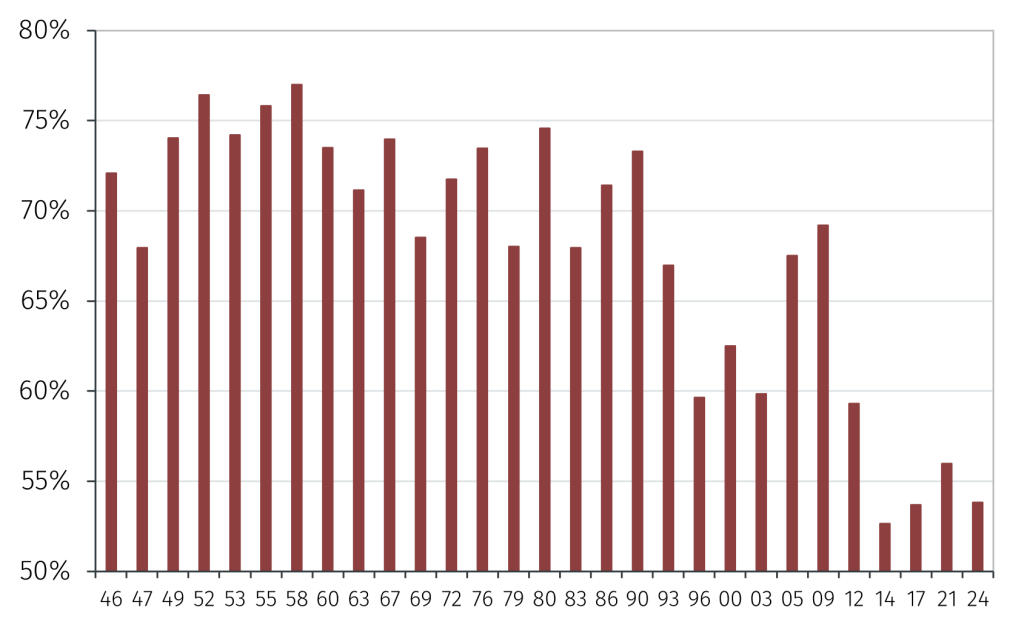

Voter turnout was the second lowest in the period since the Second World War, suggesting that this election was about punishing the LDP for its involvement in a slush fund scandal, rather than endorsing the opposition (see Chart 2).2

Chart 2. Voter turnout at Japanese general elections (%)

Political uncertainty

Even with the support of the fifteen independent members of the lower house, which is by no means guaranteed, the LDP would still need backing from another three members to pass legislation. The implication is that the LDP will need to invite a third party to join its coalition to form a government and get the necessary votes both to elect a Prime Minister and to pass policy.3

There is no clear sign yet as to which party this will be, so it is difficult to ascertain the exact impact. Whichever party becomes “kingmaker” will likely have a disproportionately greater role in policymaking than its number of seats would usually suggest.

The LDP sits on the more conservative end of the fiscal policy spectrum, yet in the run-up to the election Ishiba proposed a supplementary budget for the remainder of fiscal year 2024 greater than the JPY 13 trillion (USD 84.7 billion) supplementary budget in 2023.4 Last year’s fiscal package equates to roughly 2.1% of Japan’s GDP, making this a meaningful pledge.5 With a more fiscally liberal party now having a greater say in policy, it is likely that this budget is more expansive than Ishiba initially suggested. However, the details of the fiscal package are yet to be agreed and this is what will dictate its effectiveness.

In addition, it is possible a leadership race ensues within the LDP. Given the heavy losses at the general election, there is no guarantee that Ishiba is re-elected. Thus, we may see a third LDP President and Japanese Prime Minister in as many months and this could also have an impact on future policy direction.

Summary

In summary, given the diminished power the LDP now has in the lower house, it is unlikely that any contentious policies are pursued in the coming months. Thus, the short-term implications of the election result are that fiscal policy is likely to be slightly more expansive than would have been the case if the LDP had maintained its majority but beyond that, policy is expected to stagnate somewhat. This is likely to remain the case until the upper house elections which are scheduled for July 2025. In addition, it is possible there is a leadership challenge within the LDP which results in a new Party President and Prime Minister, keeping political uncertainty unusually high in the next few quarters.

1 See previous Macro Flash Note ‘Japan: the election going under the radar’. Available at https://www.efginternational.com/uk/insights/2024/japan–the-election-going-under-the-radar.html

2 Slush fund scandal: https://www.ft.com/content/24ca6ce5-8415-4523-ab49-7ea86615cf82

3 Following a lower house general election, a Special Diet Session is arranged to elect the new Prime Minister, with members of the lower house voting in favour of, or against, a proposed candidate. A Special Diet Session is scheduled for 7 November to elect the new Prime Minister but this could be postponed if a single candidate has not yet gained sufficient support.

4 https://www.reuters.com/world/japan/japan-premier-ishiba-vows-big-spending-drifts-away-fiscal-restraint-2024-10-16/

5 Calculation based on nominal GDP as at Q2 2024. Source: LSEG Workspace & Analytics and EFGAM calculations. Data as at 30 October 2024.