Key takeaways:

- Copper has very high electrical conductivity, making it a key metal enabler of decarbonisation and electrification.

- Companies are developing new techniques to enhance the efficiency and productivity of copper mining and manufacturing, while at the same time reducing its carbon footprint.

- New investment is driving interesting investment opportunities as Europe develops a domestic supply chain of raw materials to enable the clean energy transition.

On a visit to Spain, Portfolio Manager Tal Lomnitzer experiences the innovative approaches used in the mining and production of copper, a key metal enabling the shift to decarbonisation.

The JH Explorer series follows our investment teams across the globe and shares their on-the-ground research at a country and company level.

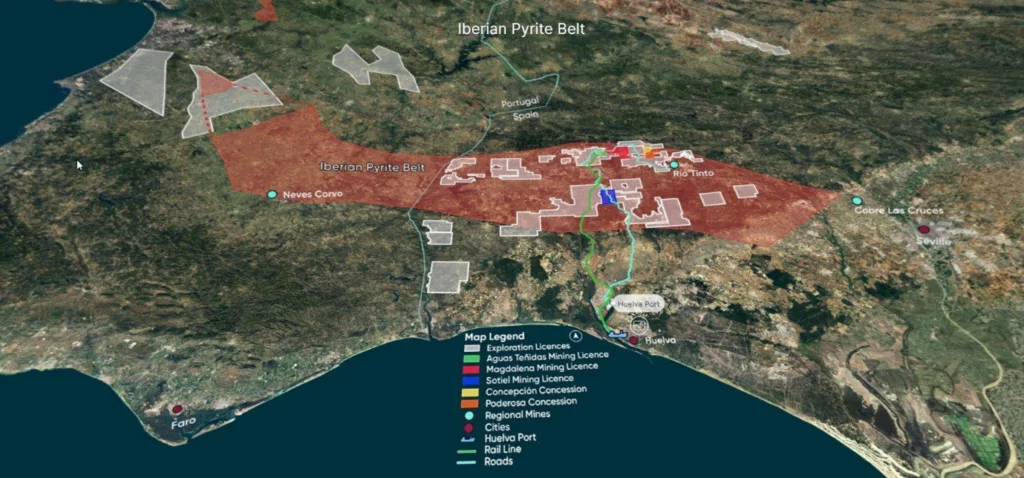

Recently, I visited three mines in the Iberian Pyrite Belt to better understand the opportunities for investment as Spanish mining mounts a Barcelona-style ‘remontada’ (or comeback for those that are unfamiliar with football).

Andalusia’s beautiful countryside is dotted with gnarled, ancient oak trees whose ‘bellota’ (acorns) are savoured by Ibérico black pigs whose exquisite, cured meat, ‘jamón ibérico’ is enjoyed all over the world. The origin of the Iberico pig goes back millennia, to the time of cavemen who decorated local caves with their art. What is far less well known is that the mining history of this area also goes back millennia.

The Iberian Pyrite Belt is a geological feature stretching through southern Spain and Portugal, which has evidence of mining activity going back to 800BC and is estimated to have produced over two billion tons of ore, with more than 400 million tons left to produce. The focus of ancient Roman activity was to produce gold and silver from the polymetallic ore, which also includes copper, tin, lead, zinc, and iron. Today, it is the copper and zinc that are treasured and the area is being rejuvenated by new investment as Europe develops a domestic supply chain of raw materials to facilitate the clean energy transition.

Technology and efficiency are driving higher profitability

It’s been said that mines are like snowflakes – no two are the same – and that was certainly the case with the mines I visited. Although similar rock is mined, they are all going about it in different ways. Sandfire Resources recently acquired the MATSA mining complex. This is a bulk mining, underground operation, with remote drilling and loading operated from surface.

Sandfire is bringing a new approach to the geologic understanding of the area. The discovery of more resources close to existing workings will extend the life of the mine or bring higher-grade, more profitable material into the production profile. This company sells its copper/zinc concentrate to traders who blend it at the port facility of Huelva and then send it to smelters in Europe or China. The pure copper ultimately ends up as wires to transmit electrons or copper foil for batteries to store electricity.

Innovation is reducing the carbon footprint of copper production

Las Cruces was the second mine I visited. Here, the oxidised portion of an ore body is mined close to surface using an electrowinning process to make pure copper on site.

The owner of this operation is First Quantum Minerals. Having depleted the open pit, the company now has to decide whether to mine the primary sulphide rock by going underground. This will entail a new hydrometallurgical process that the company has pioneered to recover the copper and avoid the need to make a bulk concentrate that would need to be shipped to smelters. By alleviating the need to ship 20-30% copper concentrate elsewhere by making the 99.99999% copper on site, the overall carbon footprint of the end product can be significantly reduced, while keeping the value added in Spain. This is a win for the company, a win for the country and a win for the copper consumer.

The third mine I visited was the Rio Tinto mine, which was restarted in 2015 by Atalaya Mining. This has been a mine site for around two millennia, with excavations uncovering evidence of Roman smelting activity. The prolific ore body was previously owned by mining giant Rio Tinto (or Red River), which took its name from the local river whose rich iron content makes the waters appear red. In a way, the Rio Tinto mining operation is a fusion of the first two mines. It is an open pit (like Las Cruces was) that takes low-grade material and produces a bulk concentrate (like the MATSA mine).

Atalaya is highly innovative and has made the economics of a low-grade deposit work by applying economies of scale. Like First Quantum, Atalaya realises that there are benefits to avoiding selling a bulk concentrate, so it is trialling a new electrochemical process to produce pure copper. I met the founder of the innovative company who invented this electrochemical approach, and she is deeply impressive. Watch this space – this is an incredibly exciting development if it can work at scale and could unlock hitherto uneconomic copper in Andalusia.

Each of the three mines I visited has its idiosyncratic pros and cons, but as a long-term investor, I could not help but imagine how combining these operations would create an extremely impressive and globally significant 200,000 ton per year copper producer, using innovative hydrometallurgical and electrochemical techniques to maximise value.

This whole area became immensely wealthy by bringing to Europe innovative goods from the Americas, including potatoes, tobacco, corn and tomatoes. A new era of wealth creation is being driven by applying new technologies to a very old set of rocks. Christopher Colombus, whose explorations were funded by the mineral wealth in this area said, “Gold is a treasure, and he who possesses it does all he wishes to in this world.” What he did not know is that copper has higher electrical conductivity than gold, which in terms of decarbonisation and electrification arguably makes it even more precious today.

ESG integration at JHI: Thoughtful, practical, research-driven and forward-looking

Definitions:

Electrowinning process: used to recover metals from concentrated solutions by applying a voltage across electrodes immersed in a concentrated solution.

Hydrometallurgical process: extraction of metal from ore by preparing an aqueous solution of a salt of the metal and recovering the metal from the solution.

Electrochemical process: recovery of metals from metal ores. Reactions are carried out in separate anode and cathode tanks with the liquid product from the anode tank separated and purified before being returned to the cathode tank for metal deposition.

IMPORTANT INFORMATION

Natural resources industries can be significantly affected by changes in natural resource supply and demand, energy and commodity prices, political and economic developments, environmental incidents, energy conservation and exploration projects.

Sustainable or Environmental, Social and Governance (ESG) investing considers factors beyond traditional financial analysis. This may limit available investments and cause performance and exposures to differ from, and potentially be more concentrated in certain areas than the broader market.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. References made to individual securities do not constitute a recommendation to buy, sell or hold any security, investment strategy or market sector, and should not be assumed to be profitable. Janus Henderson Investors, its affiliated advisor, or its employees, may have a position in the securities mentioned.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.