Overall, we expect a shallower, more short-lived economic slowdown for North America than for Europe.

- We downgraded equities to a small underweight because the risks of a recession have increased while earnings expectations have not properly repriced the more challenging growth outlook into 2023. Europe remains the most vulnerable region because of its precarious energy supplies. Overall, we expect a shallower, more short-lived economic slowdown for North America than for Europe. Canada is better positioned because of its energy exports.

- Central-bank tightening should continue to firm up to lean against excessive inflationary pressures. Rising rates should weigh on the growth outlook and equity valuation, leaving few places for investors to hide.

- On a regional basis, we raised Emerging Market (EM) equities to neutral as we think the worst is over for China. Canada is our sole equity overweight as we expect energy prices to stay elevated and support both the Canadian economy and its equity market. We remain underweight to Europe, Australasia, and the Far East (EAFE) and we have a currency hedge against the U.S. Dollar.

- On a sector basis, we initiated an overweight to the U.S. healthcare sector. We remain overweight to technology, financials, and energy, but we closed out our exposure to international travel and trimmed our U.S. small caps.

“There will be bear markets about twice every 10 years and recessions about twice every 10 or 12 years but nobody has been able to predict them reliably. So, the best thing to do is to buy when shares are thoroughly depressed and that means when other people are selling.” — John Templeton

Recession on the Radar: Stranger Things

Recessions traditionally surprise investors as a parade of denials usually occurs until economic activity suddenly contracts, sentiment sours, and a wave of layoffs and distress hits the economy on the chin. But this time, a strange and unusual consensus is fast emerging around an upcoming recession scenario where the main question is not if, but when the recession will strike over the next eighteen months. The reason for this is simple: near double-digit inflation is forcing central banks to aggressively tighten the stance of monetary policy such that breaking the back of inflation will requires the proverbial soft-landing of the economy.

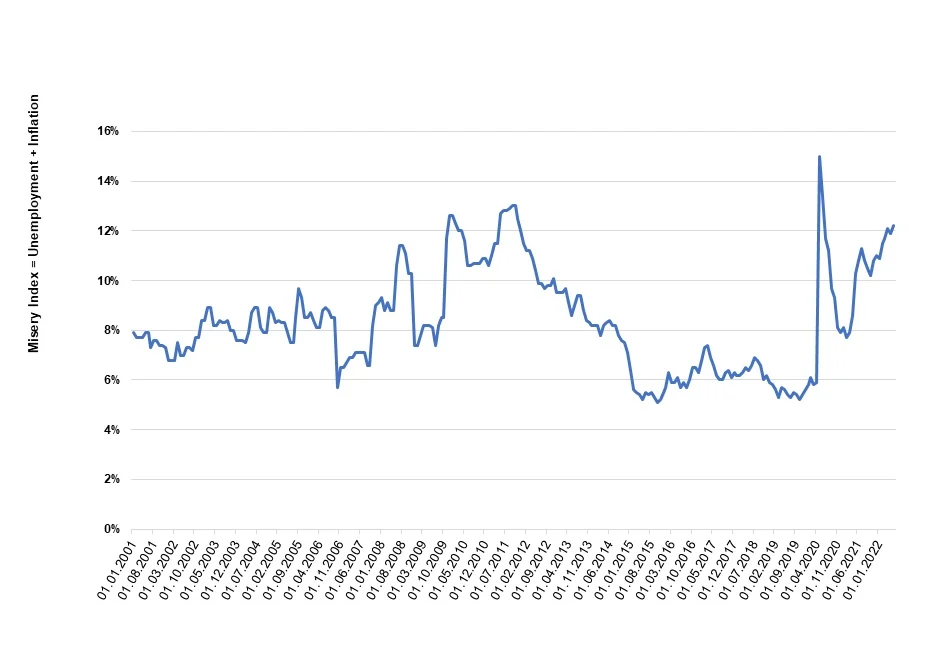

In our view, Europe is the most vulnerable region as concerns over energy supplies will likely worsen into 2023. The U.S. economy has already materially slowed and likely contracted during the first half of 2022 as consumers are starting to feel miserable under the rising burden of inflation (Chart 1).

Chart 1: U.S. consumers feeling the misery* of high inflation

Consumer sentiment is likely to deteriorate with the fast-cooling housing market as spiking mortgage rates are pushing buyers to the sidelines. For Canada, the outlook into 2023 is not too dissimilar, the housing chill is underway (Source: Bloomberg), but elevated energy prices should continue to support Canada’s economic and equity outlook. If a region can pull off a soft landing, we think it could be Canada.

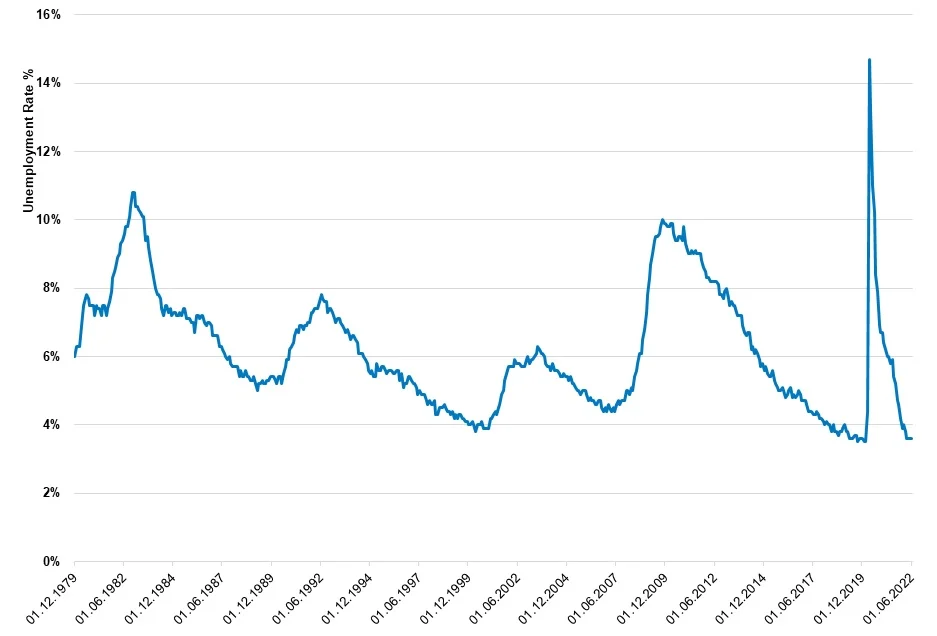

Finally, we reiterate that a key differentiating factor that may minimize the potential economic hardship of the next recession is the tightness of the labour market and the severe labour shortages. While we expect the unemployment rate to rise into 2023, we think it’s possible to see a shallower, more short-lived recession scenario where the unemployment rises modestly by no more than a couple percentage points, like the 1990-92 and 2001-02 downturns where the unemployment rate marginally rose, unlike 2008 (Chart 2). Such scenario would qualify as a mild recession, at least for North America, and would suggest the birth of a new equity bull cycle could come by mid-2023 rather than 2024. Until then, we expect equity markets to remain volatile, with possible bear-market rallies, but drift lower as the economic outlook continues to cool. On the fundamental side, a pivot by the Fed could re-ignite risk appetite, but that might only come sometimes next year once inflation is on track to cool sharply.

Chart 2: Labour Shortages to Keep a Lid on the U.S. Unemployment Rate?,

Global Markets in June: Recessionary vibes feeds the bears

Global equities (MSCI ACWI, -8.4%) registered a sharp drop in June as expectations for a global recession are moving fast because central banks have little choice but to seek to break the back of inflation. Most major developed markets were down heavily and within a narrow range for a second consecutive month, especially after accounting for currency fluctuations. In the U.S., the S&P 500 fell 8.3% and was roughly matched by small-caps (Russell 2000, -8.2%) and the tech-heavy Nasdaq 100 (-8.9%). Similar performance was recorded in Europe (Euro Stoxx 50, -8.7%) and Canada’s TSX (-8.7%) while the overall Europe, Austral-Asian, and Far-East (MSCI EAFE) complex was down 9.3%. Emerging markets (MSCI EM, -6.6%) outperformed slightly, led by a solid rebound of Chinese shares (MSCI China, +6.7%) as growth has finally shown encouraging signs of bottoming out.

One of the most impressive trends of 2022 continued in June as bond yields rose across the yield curves of most major developed economies. In Canada, the yield on the 10yr Federal bond rose from 2.89% to 3.22% as inflation expectations crept up. Oil prices gave back their May gains and fell to $105.76/bbl from $114.67/bbl on increasing concerns over an imminent recession, which could finally bring some demand destruction. Another powerful trend of 2022 continued with the rise of the Greenback (DXY Dollar Index, +2.9%), which gained 9.5% year-to-date. Between the broad buying of the safe-haven USD and the drop in oil prices, the loonie lost 1.8% in June. Although risk sentiment deteriorated alongside the drop in asset prices, the VIX volatility index largely remained immune to sharp, sudden spikes and barely budged in June, ending the month at 28.7%.

Equity Valuation: Are P/E priced for a recession?

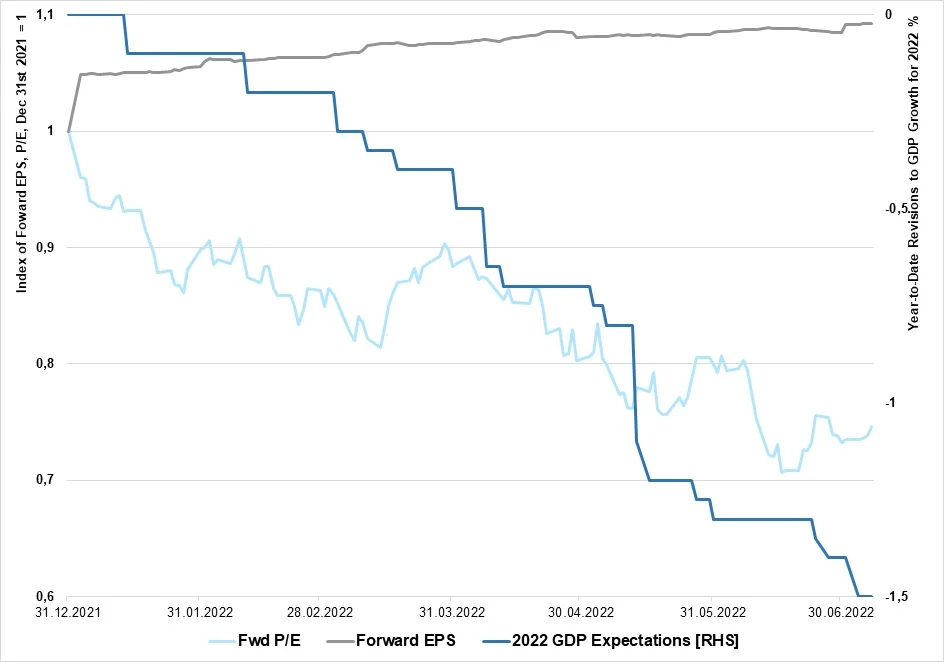

Price-to-earnings metrics have fallen sharply this year as surging rates have forced investors to aggressively reprice equity multiples (e.g., the price-to-earnings ratio, P/E) lower. While some derating could also be attributed to early recession fear, we think little recession risk is priced into equities as earning expectations remain on an uptrend, in sharp contrast to the deteriorating economic outlook (Chart 3). We therefore believe the bulk of the equity derating could be attributed to a higher discount rate and we think that the rosy earnings expectations are potentially mispriced, which would suggest more equity downside.

Chart 3: S&P Earning Estimates Have Yet to Catch Up with Slowing 2022 Growth Expectations for the U.S.

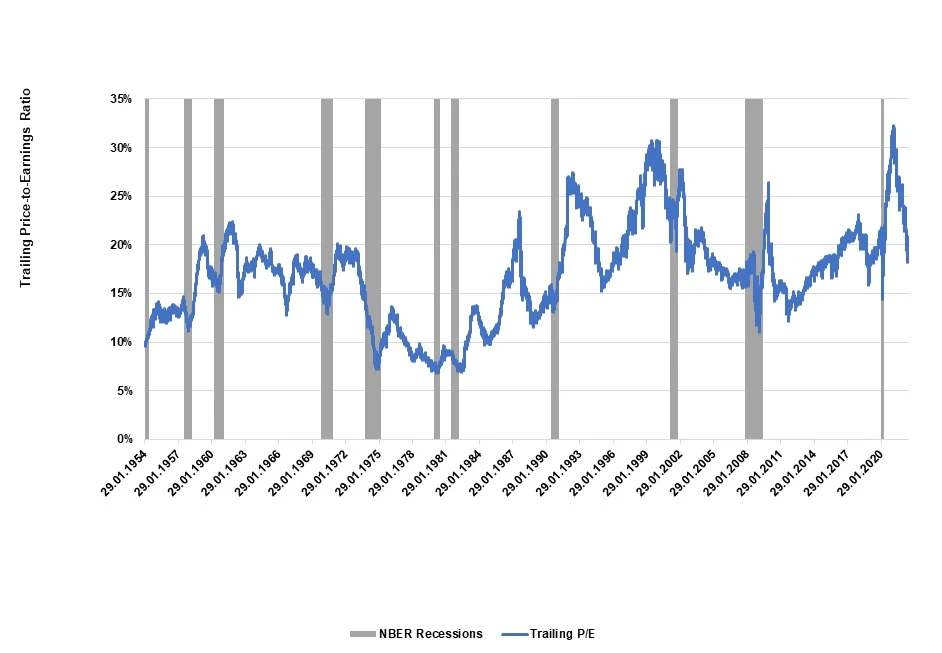

Looking beyond earnings, we also think that equity multiples could trade lower over coming months, both from slower economic growth and from rising rates. Looking at the history of trailing P/E for the S&P 500 since 1954, we see that most recessions sent the P/E well below fifteen at the bottom of the cycle. For investors who are expecting a recession but are seeking technical goalposts to buy equities, it would seem premature to buy until the P/E of the S&P 500 drops below fifteen. Although the recession is only a risk for now, long-term investors should keep in mind that equities are generally quick to rerate once the economic cycle bottoms out. The P/E could easily rise by five to ten points a year after the cycle bottoms.

Chart 4: Hard to Think a P/E of 18 Could be the Bottom for the S&P 500 Ahead of a Recession

Outlook and Positioning: Time to lower the landing gears

As the Fed and major central banks are attempting the difficult task of soft-landing the economy, we are taking additional measures to de-risk our portfolios. We are lowering our asset mix to a small underweight of equities, alongside an underweight to fixed income, thereby further increasing our allocation to cash in this challenging stagflationary backdrop. We remain overweight of Canadian equities as we think Canada is the least likely to suffer a recession over the next twelve months while we remain neutral on U.S. equities and underweight to the EAFE block, which is the most vulnerable to the ongoing macro backdrop, in our view. We upgraded EM equites to neutral as we think the worse is over for China.

On a sector basis within the U.S market, we initiated an overweight to the healthcare sector while we closed our position in the international travel sectors as surprisingly intense supply constraints are preventing the sector to fully monetize the strong pent-up demand for travel. We also trimmed our exposure to U.S. small caps. We remain overweight of financials because of rising rates and view that the recession will be milder than expected. We also remain overweight of the energy sector as we continue to expect tight supply conditions to persist into 2023 despite elevated risks of a recession. Finally, we are maintaining a currency hedge against the U.S. Dollar.

Disclaimer:

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Forward-Looking Statements

Certain statements included in this news release constitute forward-looking statements, including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions. The forward-looking statements are not historical facts but reflect BMO AM’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although BMO AM believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. BMO AM undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.