Expectations for Fed and Bank of Canada (BoC) tightening continue to firm up as monetary stimulus is getting removed at a quick pace to lean against excessive inflationary pressures. Rising rates should weigh on the growth outlook and equity valuation, but we do not expect a recession over the next 6 to 9 months

- Commodities are experiencing a perfect storm that has yet to show signs of peaking, which should support the outlook for global inflation. Canada remains well positioned to benefit (equities and currency) from the commodity cycle as its exports are booming on rising prices.

- Expectations for Fed and Bank of Canada (BoC) tightening continue to firm up as monetary stimulus is getting removed at a quick pace to lean against excessive inflationary pressures. Rising rates should weigh on the growth outlook and equity valuation, but we do not expect a recession over the next 6 to 9 months.

- We remain neutral on equities, underweight to fixed income, and overweight to cash. We hope to soon redeploy capital as uncertainty over Fed policy comes down. On a regional basis, we took U.S. equities back to neutral after their short-squeeze rally in May. We think the earnings outlook could prove more challenging. We remain overweight of Canadian equities and underweight to Europe, Australasia, and the Far East (EAFE) and Emerging Markets (EM) equities, alongside having a currency hedge against the U.S. Dollar.

- On a sector basis, we remain overweight to technology, financials, energy, and international travel.

“Why is patience so important? Because it makes us pay attention.” ― Paulo Coelho

The Economy to Face Increasing Chill, not a Hurricane

J.P. Morgan CEO Jamie Dimon fueled the recession narrative by telling a crowd of investors that an economic “hurricane” is coming (Source: CNN). While there is no doubt the pace of global economic growth is slowing, we think it’s premature to expect that a recession is around the corner. While the pace and magnitude of upcoming rate hikes by the U.S. Federal Reserve (the “Fed”) and BoC will likely drive economic growth to a pace of below 2% into 2023, we think the path for delivering this soft-landing scenario is narrowing as inflationary pressures diminish but remain too elevated. Our tactical view on the markets remains about being cautious and patient regarding global equities. On the one hand, equity markets have properly reflected the impact of rising rates by crushing valuation multiples such as the price-to-earnings ratio, but on the other hand earnings expectations and profit margins could be on the high side if inflationary pressures remain sticky and rates drift upward further. The elevated uncertainty around the inflation outlook will likely persist over coming months, which should leave market volatility higher than normal and thereby offer more short-term and nimble investment opportunities, in our view.

Global Markets in May: Bargain hunters and hope for Fed pause save the month with relief rally

Global equities (MSCI ACWI, +0.3%) ended the month of May flat, but only after experiencing a solid rally from mid-month on as fear of Fed over-tightening abated. Interestingly, there was little differentiation across major regional equity markets as they performed within a narrow range. One notable laggard was the Nasdaq 100 (-1.5%) as some big-tech names continued to suffer. Meanwhile, European equities outperformed (Euro Stoxx 50, +1.3%). Every other market performed slightly positive within a tight range. While the resulting month-end performance was near flat, the intra-month market volatility was significant as the S&P 500 experienced 5.5% maximum drawdown, before rallying to end the month flat (+0.2%).

After surging so far in 2022, the yield on Canada’s 10yr bond was relatively stable in May, barely rising from 2.87% to 2.89%. Meanwhile, oil prices surged in May, from $104.69/bbl to $114.67/bbl as the oil market faces a perfect storm, notably because of the sanctions against Russia. The U.S. Dollar (DXY Dollar Index, -1.2%) fell for the first time in 2022 as the Fed’s leadership took a pause. The loonie benefited from hawkish expectations regarding BoC policy and gained 1.7% versus the greenback. Finally, despite large daily swings on the S&P 500, the VIX volatility index hovered at relatively benign levels in May, ending the month at 26.2% while peaking below 35% earlier in the month. Although it was a high level, it nevertheless failed to clearly signal investor capitulation, which in our view required a +40% VIX.

Bank of Canada Outlook: Cooling inflation via the housing market

Canadian money markets are expecting the BoC overnight policy rate to reach 3.25% by December, from a low of 0.25% for the BoC’s policy rate at the start of the year. Monetary-policy tightening will undoubtedly have an impact on Canada’s housing market, a key driver of domestic inflation. Sales activity has already begun cooling and we expect potential buyers to remain on the sidelines. Buyers must reevaluate their purchasing power as borrowing costs surged alongside the sharp rise of the yield on Canada’s 5-year Federal debt

(Chart 1).

Chart 1: Housing Resales Activity Will Cool Throughout the Summer as Borrowing Rates Drift Higher*

Source: Bloomberg, BMO Global Asset Management, as of May 2022 data. *Note: excludes February, March, and April 2021 because of the severe distorting base effects of the 2020 lockdown.

Cooling of the housing market is part of the recipe for the BoC to bring down inflation. With the resumption of strong immigration flows into Canada and the severe labour shortages that should cushion the labour market against slower economic growth, underlying housing demand should remain robust and provide a floor to national housing prices. However, we expect the hottest regions (Greater Toronto, Montreal, and Vancouver) to see some pullback in prices over the year. Overall, assuming Canada’s level for the neutral interest rate lies in the vicinity of 2.5%, future policy rates rising above 3% will undoubtedly weigh on rates-sensitive areas of the economy such as housing activity.

Oil Outlook: Elevated energy prices is the new normal?

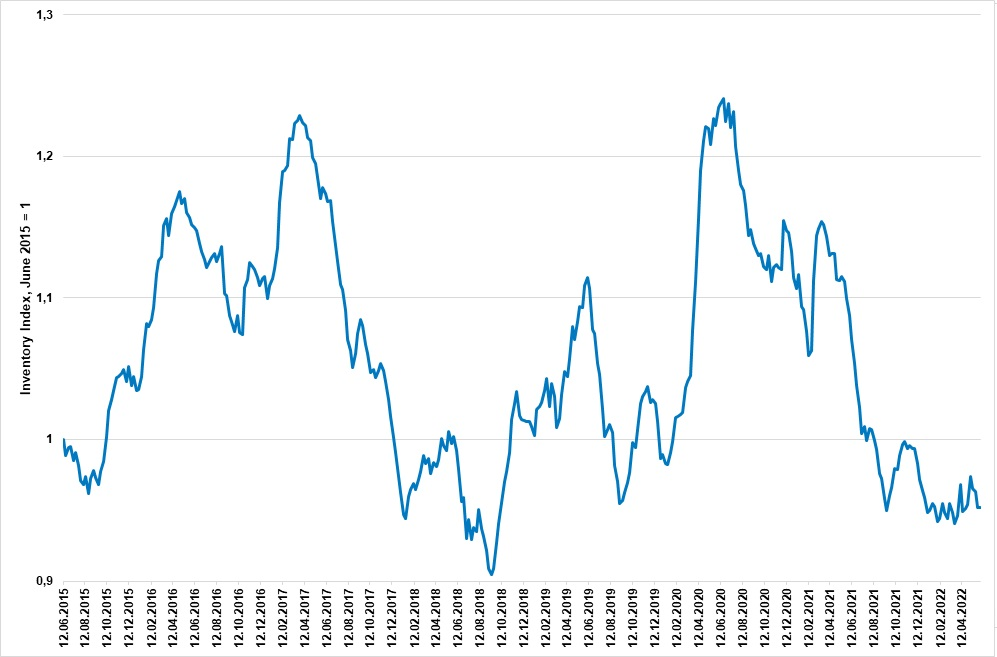

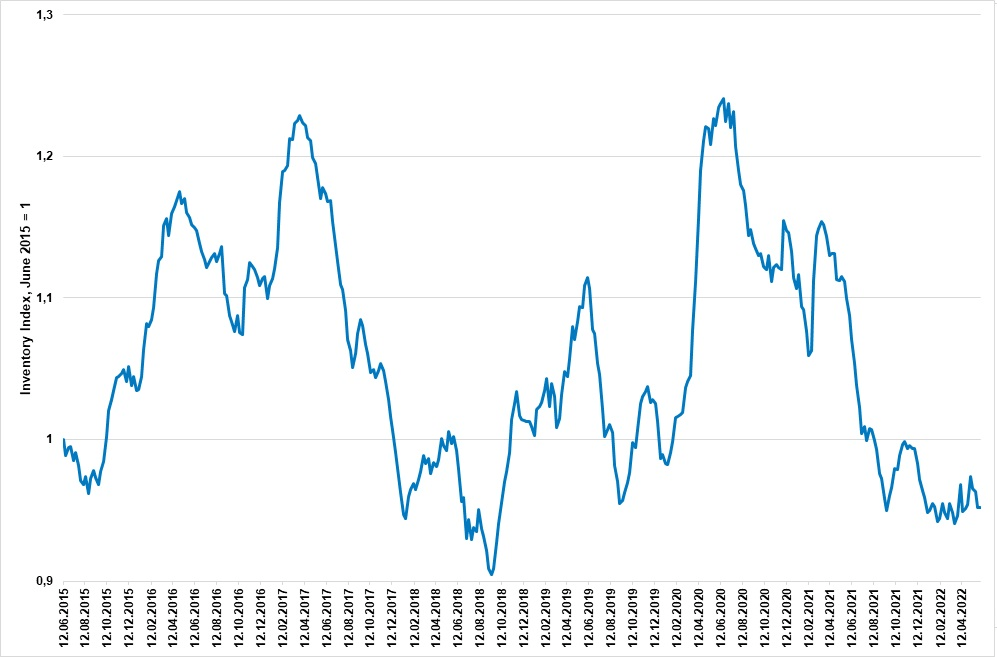

A common saying is that the cure to high prices is high prices. For energy and gasoline prices, however, the recent spike of prices has not bitten much into demand yet as consumers are eager to enjoy the road and fly after two years of pandemic and restrictions. Although the conflict in Ukraine and the sanctions against Russia have further tightened the oil and energy markets, we have been concerned about rising demand-vs-supply imbalances several months before the conflict began. Unlike previous energy cycles, oil production has been lagging the price recovery, which caused a steady decline of inventories during the past couple years (Chart 2). Taxing the energy sector (source CBC) will probably amplify the cycle, unfortunately. With oil demand approaching pre-COVID levels, the combination of sanctions against Russia, and oil production that is set to lag demand, we see upside risks to the oil outlook into 2023 and we are maintaining our overweight to the energy sector.

Chart 2: U.S. Oil Inventories Falling Fast and Could Deplete Further this Summer

Source: Bloomberg, BMO Global Asset Management, as of June 6, 2022.

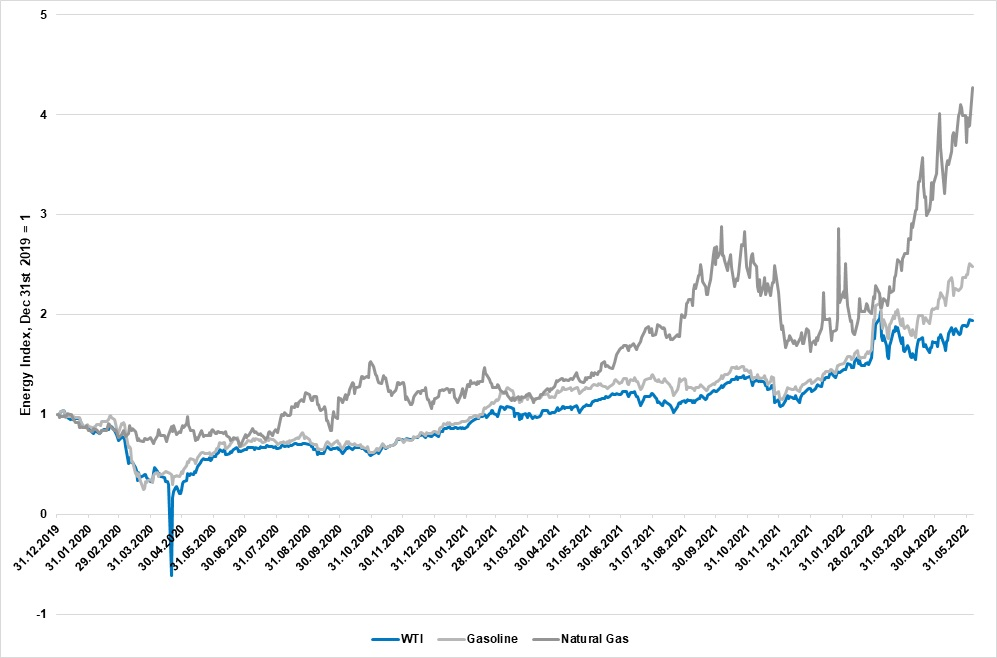

For drivers, the price shock is even worse as refined products such as a gasoline and diesel fuel are seeing an even more worrisome depletion of inventories, which may even pose supply risks into the summer (source EIA). Within the energy complex, the rise of natural gas prices, used mostly for heating and manufacturing activity, have seen the most spectacular surge, jumping more than four folds compared to pre-COVID levels, meanwhile wholesale gasoline prices have risen 250% whereas crude oil (WTI) have doubled (Chart 3). For Europe, the energy-supply situation is likely to worsen as we approach heating season. It’s possible that the low energy supplies will negatively impact economic activity in Europe and weigh on the growth outlook of the region.

Chart 3: Energy Prices Well Above Pre-COVID Levels, More Pain Ahead at the Pump for Drivers this Summer

Source: Bloomberg, BMO Global Asset Management, as of June 6, 2022.

Outlook and Positioning: Caution rules while macro divergence continues

Rate-hike expectations by the BoC and the Fed continue to firm up, which will weigh on the outlook for economic growth. We think the path for a soft-landing is narrowing as expectations for policy rates drift higher and will likely peak beyond neutral territory to break the back of inflation. U.S. consumers have been resilient to surging inflation and we continue to think the near-term (6 months) economic outlook will prove better than feared as the job market remains exceptionally tight.

Because of this challenging backdrop and elevated Fed uncertainty, we remain neutral on equities in our asset mix. For bonds, we are slightly underweight as we expect rate-hike expectations to firm up a bit more. As we wait for greater clarity on the rates and equity outlook, our preferred asset is cash, and we hope to see opportunities to redeploy it over coming months.

Regionally, we dialed down U.S. equities back to neutral after a solid short-squeeze rally in May. We also expect the outlook for U.S. earnings to prove more challenging in the quarters to come as economic growth cools to a trend-like pace of 2%. Our conviction on Canadian equities is intact as the commodity cycle is benefiting from a perfect storm. Against that steady bullish view on Canada, we remain underweight on EAFE and EM equities. On a sector basis within the U.S market, we are overweight of financials, energy, international travel sectors, and large-cap technology. Finally, we initiated a currency hedge against the U.S. Dollar at about $0.775 with the view that Canada’ terms of trade (i.e., commodity exports) and a hawkish BoC could push the loonie up in the vicinity of $0.83 by year end.

Disclaimer:

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Forward-Looking Statements

Certain statements included in this news release constitute forward-looking statements, including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions. The forward-looking statements are not historical facts but reflect BMO AM’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although BMO AM believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. BMO AM undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.