For the past six years Bessemer Venture Partners, along with Forbes and Salesforce Ventures, have released the Cloud 100 List, the definitive ranking of the top 100 private cloud companies. This provides participants deep insights into the growth and innovation in the private side of the cloud computing market.

Below we detail some of the key takeaways from this year’s event, but we highly recommend watching or reading through the entire event on Bessemer’s site here:

2021 Cloud 100 - A List of Unicorns

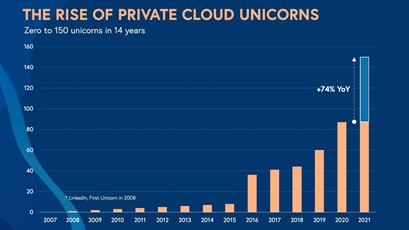

- In 2021 every company on the Cloud 100 list has at least a $1bn valuation, companies meeting this threshold are referred to affectionately as “unicorns”. For reference, 87% of last year’s list consisted of unicorns. This is evidence that the appetite for strong cloud computing businesses continues to grow.

- The cumulative value of Cloud 100 is $518bn, increasing 94% year-over-year from $267bn. For reference, that aggregate valuation is greater than the individual gross domestic product of 87% of countries on the planet! The average company on the list is valued at $5.2bn, which is more than double the 2020 average of $2.5bn.

- Since the first Cloud 100 list in 2016 the value of the list has increased 5x over. The average Cloud 100 valuation has grown by $4.1 billion at a +38% Compound Annual Growth Rate (CAGR) since 2016, from $1.1 billion in 2016 to $5.2 billion today.

The Cloud Industry’s Accelerating Growth

- The average revenue growth rate on the list was 90% year-over-year, which compares to 80% in 2020. The top quartile of companies on the list grew 110% year-over-year, which is faster than ever before according to Bessemer.

The Public Cloud Market and IPOs since the 2020 Cloud 100

- 19 of last year’s Cloud 100 list are now, or in the process of becoming, publicly traded companies.

Evaluating Bessemer’s 2020 Predictions

- At last year’s event Bessemer predicted that 1) public cloud markets would surpass $2tn in cumulative market capitalization 2) the entire Cloud 100 would consist of companies with at least a $1bn valuation

- Prediction 1: As of July 2021, the public cloud market reached $2.3tn, not only achieving but well surpassing Bessemer’s prediction.

- Prediction 2: As mentioned above, the entire Cloud 100 list consists of unicorns with at least $1bn in valuation

Cloud Globalization

- International representation on the list continue to expand to nearly 30%. Ireland, Germany, Israel, and Australia are a few of the regions on this year’s list. Bessemer also continues to see cloud leaders rising out of the Asia Pacific, India, and other international markets.

- In Bessemer’s view, the cloud industry will have a sizeable impact on global GDP over the coming years.

Cloud Job Growth

- According to Bessemer, Cloud 100 companies increased their number of employees by an average of 26% since January 2021, equating to a total of more than 17,000 new hires. The Fintech industry created the greatest number of new jobs year-to-date.

Top Cloud 100 Sub Sectors

- Fintech companies on the list experienced the strongest growth, increasing 461% in value since the 2019 list. This subsector totals a cumulative $146bn valuation, which is more than a quarter of the list’s total value.

- According to Bessemer, cloud companies within the Fintech subsectors are helping modernize the infrastructure that the financial services industry relies on. Many of today’s cloud companies embed financial services and payments within their software solutions. For example, Cloud 100 constituent Toast offers an all-in-one point-of-sale and restaurant management platform for restaurants. In Bessemer’s view, cloud companies like Toast are often able to process payments and payroll more efficiently than many traditional banks.

- Data and Infrastructure businesses also had more representation, increasing 70% in value from the 2019 list. Today this subsector makes up $63bn of the list’s value.

- There is certainly some valuation concentration at the top of the list. The top 10 companies on the list amounts to approximately $200bn, or 38% of the list’s cumulative value

New Market Leaders – MT SAAS vs. FAANG

- Last year Bessemer introduced a competitor for the well-known FAANG basket (Facebook, Amazon, Apple, Netflix, Google) with the cloud giants encompassed by their MT SAAS basket (Microsoft, Twilio, Salesforce, Amazon, Adobe, Shopify).

- According to Bessemer, MT SAAS performance represents the power of the cloud and how it will continue to drive technology and innovation in the future. In 2020, MT SAAS outperformed FAANG by over 100%.

Our Final Thoughts

Bessemer Venture Partners has one of the largest cloud portfolios in venture capital and we believe the unique insights they provide in the Cloud 100 and other published research is an excellent resource to gauge the status of the broader cloud economy.

We exit the Cloud 100 event with reinforced confidence in the potential growth trajectory of the cloud industry based on three key takeaways: 1) cloud technology is a necessity for businesses to survive and compete in today’s economy 2) the cloud industry is a meaningful contributor to global GDP and employment growth 3) revenue growth rates in the private cloud market continue to accelerate and provide evidence that we remain firmly in a historic period for cloud technology adoption.

All figures referenced are sourced from Bessemer Venture Partners as of 10 August 2021