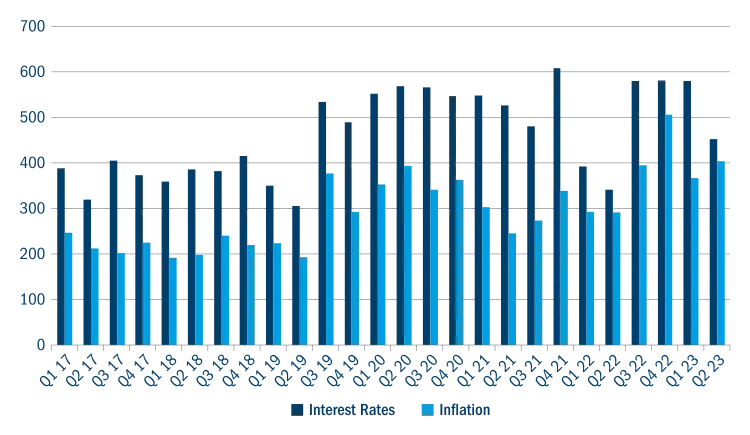

In the quarterly Columbia Threadneedle Investments LDI Survey we poll investment bank trading desks on the volumes of quarterly hedging transactions

Chart 1: Index of UK pension liability hedging activity (based on £ per 0.01% change in interest rates or RPI inflation expectations i.e., in risk terms)

Market Outlook

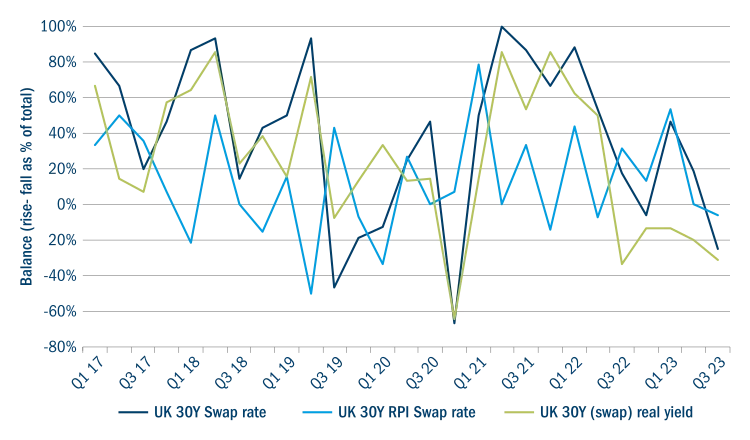

Chart 2: Change in swap rates over the next quarter.

Important information

For professional investors. For marketing purposes. Your capital is at risk. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. Not all services, products and strategies are offered by all entities of the group. Awards or ratings may not apply to all entities of the group.

This material should not be considered as an offer, solicitation, advice, or an investment recommendation. This communication is valid at the date of publication and may be subject to change without notice. Information from external sources is considered reliable but there is no guarantee as to its accuracy or completeness. Actual investment parameters are agreed and set out in the prospectus or formal investment management agreement.

In the UK: Issued by Threadneedle Asset Management Limited, No. 573204 and/or Columbia Threadneedle Management Limited, No. 517895, both registered in England and Wales and authorised and regulated in the UK by the Financial Conduct Authority.