In the quarterly Columbia Threadneedle Investments LDI Survey we poll investment bank trading desks on the volumes of quarterly hedging transactions. In the UK the true meaning of political risk took centre stage, with 30-year real yields moving c.2.30% trough to peak and consigning negative real yields to history (for now). Inflation hedging activity rose 35% from the previous quarter, and interest rate hedging jumped by 70% quarter-on-quarter (note that this includes activity in both directions).

From a global perspective the third quarter was a continuation of the second quarter; geopolitical tension with Russia, the energy and cost-of-living crisis continued to build momentum and central banks committed to their monetary tightening paths in order to tackle the persistent inflation pressures. In the UK we experienced a calm summer, perhaps due to the hiatus of political leadership whilst Rishi Sunak and Liz Truss conducted hustings and made promises (some extravagant) to attract the votes of the tiny core of Conservative party members who were trusted with this important decision. The Bank of England (BoE) meanwhile continued its rate hike path as inflation topped 12.6% in September – whilst announcing the imminent commencement of their quantitative tightening (QT) programme. As Liz Truss reached the pinnacle of power her plans were put on hold whilst the world mourned the passing of the second Elizabethan age. Almost immediately afterwards, and with apparently no time to involve key agencies such as the Office of Budget Responsibility, Liz Truss’ and Kwasi Kwarteng’s Growth Plan exploded onto the market.

Whilst the concept of stimulating growth certainly has merit, the combination of tax cuts and spending hikes with no costing plans whatsoever unsurprisingly panicked the markets. This year has been tricky for liquidity generally; as volatility has risen particularly in short end rates and inflation so those risk budget metrics which rely upon VAR (Value at Risk) have diminished in appetite; making for a more volatile market going forwards. The so-called Growth Plan was announced on the 23rd September, and yields rose at unprecedented speeds peaking at 11am on the 28th September when the BoE stepped in with a temporary bond buying programme to calm the extremely disorderly markets. The rapid rise in yields was a consequence of a vicious cycle that is inherent in the use of leverage. A rise in yields decreases a pension scheme’s liability cost; with the use of hedging the portfolio moves in line with the liabilities, i.e. decreases as yields increase. Typically, this would prompt a call for collateral in order to top up the assets backing the hedging portfolio which was the case during the market volatility. If, however, it was not possible to raise assets to back the hedging portfolio within the accelerated time frame required then the next action would be to reduce the hedging position – it is this that exacerbated the moves in the market. The Government quickly rowed back on one after another of its pledges, yet their credibility was in tatters and the only solution was another leadership change, to a far more fiscally austere approach.

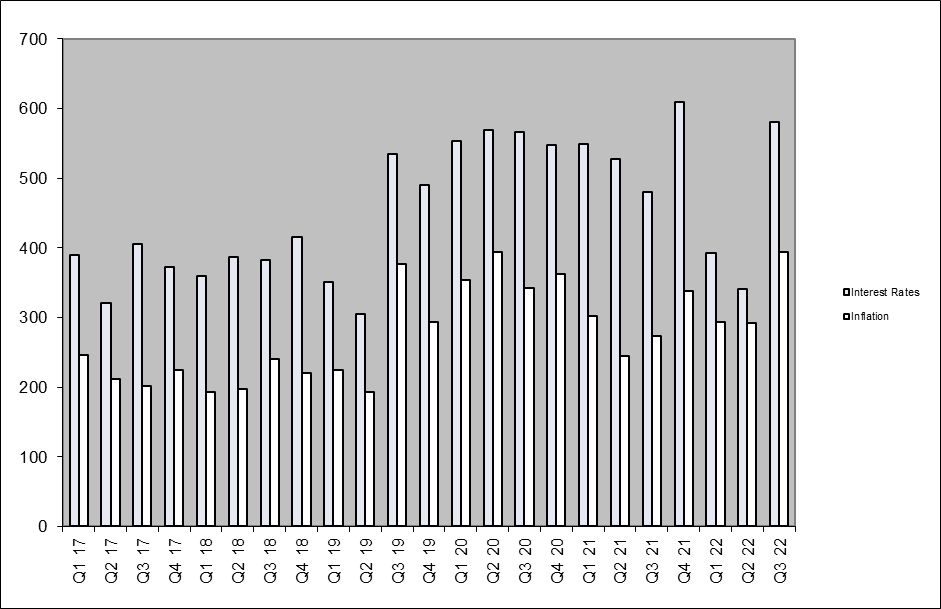

Total interest rate liability hedging activity ballooned to £44.3 billion, an increase of 70% from the previous quarter, inflation hedging also grew to £39.7 billion an increase of 35% and a new high watermark for inflation activity. These numbers are primarily outright hedging activity in both directions with a heavy weighting towards the end of the quarter. Switching activity also provided interest as the market prepared for the signposted start of the QT programme.

The chart below describes hedging transactions as an index based on risk. Note that transactions include switches from one hedging instrument into another. It should be noted that as the index is constructed by using the rate of change of risk traded by each counterparty per quarter, it allows the introduction of additional counterparties to the survey.

Chart 1: Index of UK pension liability hedging activity (based on £ per 0.01% change in interest rates or RPI inflation expectations i.e. in risk terms)

The funding ratio index run by the Pension Protection Fund showed further improvement quarter-on-quarter (134.8% at end September vs 120.1% at end June), driven by rising real yields. As pension funds will likely have significantly reduced their allocation to growth assets this then puts a move to buy-out even higher up the agenda. This is also helped by the more attractive spreads in the high-quality corporate bond market, which are a component of buy-out pricing.

Market Outlook

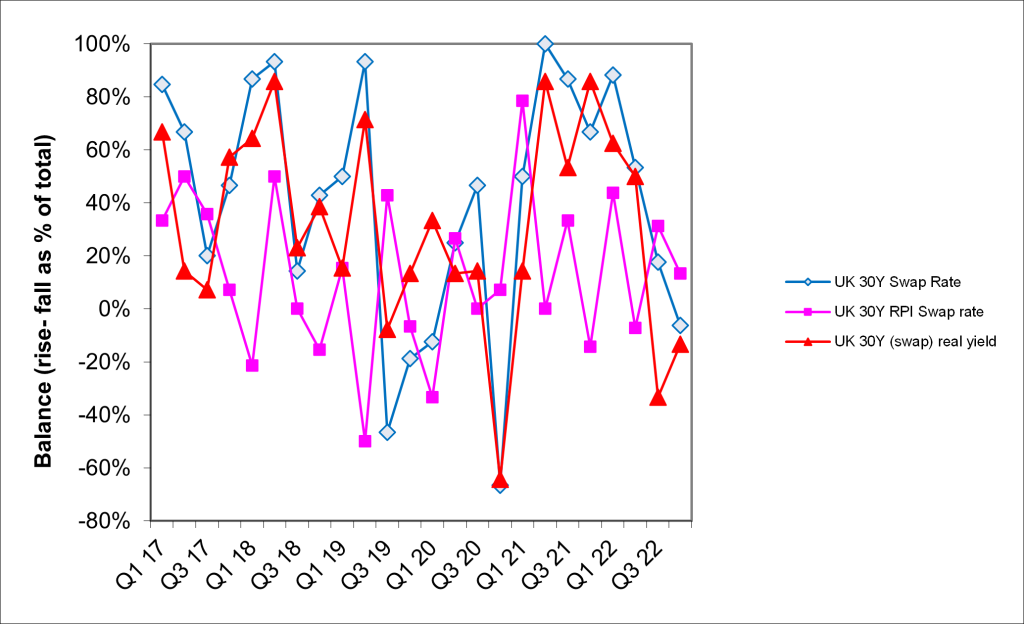

The Columbia Threadneedle Investments LDI Survey also asks investment bank derivatives trading desks for their opinions on the likely direction of key rates for pension scheme liability hedging. The aim is to get information from those closest to the market to aid trustees in their decision-making.

The results are shown below as the number of those predicting a rise less those predicting a fall, as a percentage of the number of responses. The larger the balance, the more responses predict a rise. The more negative the balance, the more responses predict a fall.

Chart 2: Change in swap rates over the next quarter

Our counterparties correctly called an increase in inflation costs and interest rates (albeit with low conviction) but had believed that inflation would outstrip the increase in interest rates thus lowering real yields. Regular readers will know that at the end of June the terminal base rate in the UK was priced in the market to be 3.25% however many felt this was overdone and estimates coalesced around 2.5%. We are now in a new paradigm with the market pricing a peak around 4.70%; and yes, many do feel this is still higher than it should be, aided by comments to that effect from the BoE.

For the final quarter of 2022 unsurprisingly, there is little agreement on the future path of yields. On average there is a bias towards lower longer term interest rates, lower real yields and slightly higher inflation. For those in favour of higher yields they cite the QT programme, the new DMO remit and the November index-linked gilt syndication. On the other hand, there is the spectre of end of year de-risking and the expected fiscal tightening through higher taxation and lower spending to be announced in the November 17th Budget. If this is significant it could affect the additional bond issuance required in the short term, with the understanding that it will do little to impact the forward issuance requirements particularly as support for domestic energy users is still in play. The BoE has tweaked its QT allocation to target shorter dated bonds which will bring back much needed supply of these scarce bonds and will also reduce the impact on longer dated yields. However, an announcement is also to be made soon on the unwind of the emergency bond-buying programme from end September to mid-October – with the expectation that the BoE is keen to divest yet they will need calm markets as they are conscious of the risk of selling if market conditions remain delicate and volatile.

Important information

For professional investors. For marketing purposes. Your capital is at risk. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. Not all services, products and strategies are offered by all entities of the group. Awards or ratings may not apply to all entities of the group.

This material should not be considered as an offer, solicitation, advice, or an investment recommendation. This communication is valid at the date of publication and may be subject to change without notice. Information from external sources is considered reliable but there is no guarantee as to its accuracy or completeness. Actual investment parameters are agreed and set out in the prospectus or formal investment management agreement.

In the UK: Issued by Threadneedle Asset Management Limited, No. 573204 and/or Columbia Threadneedle Management Limited, No. 517895, both registered in England and Wales and authorised and regulated in the UK by the Financial Conduct Authority.

In the EEA: Issued by Threadneedle Management Luxembourg S.A., registered with the Registre de Commerce et des Sociétés (Luxembourg), No. B 110242 and/or Columbia Threadneedle Netherlands B.V., regulated by the Dutch Authority for the Financial Markets (AFM), registered No. 08068841.

In Switzerland: Issued by Threadneedle Portfolio Services AG, an unregulated Swiss firm or Columbia Threadneedle Management (Swiss) GmbH, acting as representative office of Columbia Threadneedle Management Limited, authorised and regulated by the Swiss Financial Market Supervisory Authority (FINMA).

In the Middle East: This document is distributed by Columbia Threadneedle Investments (ME) Limited, which is regulated by the Dubai Financial Services Authority (DFSA). For Distributors: This document is intended to provide distributors with information about Group products and services and is not for further distribution. For Institutional Clients: The information in this document is not intended as financial advice and is only intended for persons with appropriate investment knowledge and who meet the regulatory criteria to be classified as a Professional Client or Market Counterparties and no other Person should act upon it.