Past performance is not a guide to future performance. Do remember that the value of an investment and the income generated from them can fall as well as rise.

Over the first quarter, the Liontrust India Fund returned -2.1%, versus the MSCI India Index’s 1.0% and the IA India return of -3.4%*^.

In what was an extremely turbulent quarter for global equities, the Indian market was comparatively resilient and returned 1.0%, a significant outperformance against wider emerging market equities (-4.3%) and developed market equities (-2.4%). The most significant event of the quarter was the Russian invasion of Ukraine, which had significantly negative implications for Russia itself and numerous knock-on effects for all asset classes, especially commodities.

The oil price rose steadily throughout the quarter to over $100 per barrel, briefly moving as high as $139 in the immediate aftermath of the military incursion, making the India market’s resilience all the more impressive given that its assets generally respond negatively to higher oil prices (in particular those caused by a supply shock rather than strong demand). One of the key supporting factors for India in the first quarter was the ongoing robust policy environment that continues to drive its idiosyncratic growth story. This policy environment was given further support when the ruling BJP retained power in all four of the states they defended in regional elections in early March, including bellwether state Uttar Pradesh.

The victory affirms policy continuity and assuages concerns that populist steps would need to be enacted to defend the BJP’s electoral base ahead of the 2024 general elections. Sound policy decisions in preceding years has also helped to reduce traditional concerns over higher oil prices, including removing key energy subsidies. Moreover, India’s oil consumption relative to GDP has been declining steadily since 2014, incrementally shielding the economy from the effects of higher prices.

Given the strength in commodities, it was unsurprising that the best-performing sector during the quarter was energy, with index heavyweight Reliance Industries performing strongly, alongside pure-play upstream oil and gas producers. On the flipside, rising input costs have continued to put pressure on margins in sectors such as consumer staples, especially at a time when rural incomes have been under pressure. Consumption remains somewhat muted, with the investment side of the economy offering the most attractive opportunities. That said, the strong monsoon outlook, which follows several years of heavy rainfall and rising agricultural prices, has given some recent support to rural spending.

During the quarter, the Liontrust India Fund returned -2.1%, which was below the benchmark but followed very strong performance over the preceding 12 months. The most significant drags on the Fund’s performance over the quarter came from the utilities sector, where gas distributor Gujarat Gas was impacted negatively by the significant spike in gas prices following the events in Ukraine. The related increase in input costs also had an outsized impact on the chemicals sector, where holdings in the chemical chain were adversely affected. This was somewhat mitigated, however, by the strong performance of Hindalco Industries, which saw its earnings supported by soaring aluminium prices (again driven in large part by the aftershocks of the Russian invasion). In the consumer sector, online food and restaurant platform Zomato endured a tough quarter, selling off heavily alongside global technology shares, largely due to the rapid increase in global interest rate expectations driven by the US Federal Reserve. The Fund’s performance was also supported by low exposure to the consumer staples sector, which continued to underperform due to the reasons stated above.

During the quarter, we responded to the reality of higher oil price expectations by adding both Oil & Natural Gas Corp and Oil India to increase the Fund’s exposure to upstream energy earnings, given that domestic gas prices are set to rise significantly in the coming months. A position was also initiated in utility NTPC, which offers exciting exposure to India’s energy transition towards renewables. The company is building a sizeable renewables business while improving its thermal power business with respect to ESG metrics. In terms of Fund divestments, positions were exited in Navine Fluorine, for which the valuations offered less compelling upside after strong performance in the previous year, and profits were taken in similarly strong performer, Indian Energy Exchange.

In our view, India’s impressively resilient performance in what was a very challenging quarter indicates the reality of the robust macro position engineered through several years of prudent policy-making and reforms, which are now bearing fruit. India is a transformed economy from the one that suffered so heavily during the ‘Taper Tantrum’ of 2013. Policy-making remains strongly focussed on reviving the domestic investment climate. As such, we continue to believe that India presents one of the most attractive long-term investments within emerging markets.

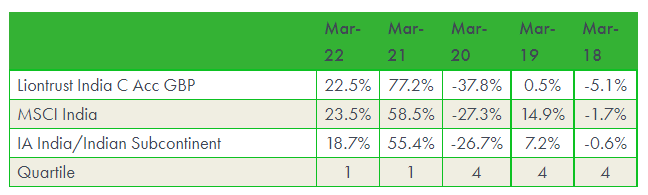

Discrete years’ performance (%)**, to previous quarter-end:

*Source: FE Analytics as at 31.03.22

**Source: FE Analytics as at 31.03.22. Quartiles were generated on 05.04.22

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested. The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term. Investment in funds managed by the Global Equity (GE) team may involve investment in smaller companies – these stocks may be less liquid and the price swings greater than those in, for example, larger companies. Investment in funds managed by the GE team may involve foreign currencies and may be subject to fluctuations in value due to movements in exchange rates.The team may invest in emerging markets/soft currencies or in financial derivative instruments, both of which may have the effect of increasing volatility. Some of the funds managed by the GE team hold a concentrated portfolio of stocks, meaning that if the price of one of these stocks should move significantly, this may have a notable effect on the value of that portfolio.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.