Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The Liontrust UK Micro Cap Fund returned 3.4%* in November. The FTSE Small Cap (excluding investment trusts) Index and the FTSE AIM All-Share Index comparator benchmarks both returned 6.6% and 5.5% respectively. The average return of funds in the IA UK Smaller Companies sector, also a comparator benchmark, was 6.9%.

Global equities recovered further in November, helped along by hopes that the pace of monetary policy tightening may be set to slow. The US Federal Reserve and Bank of England both implemented 75 basis point hikes in November, while the European Central Bank had lifted rates by the same amount at the end of October.

More important than the scale of this month’s moves were the comments regarding the future direction of policy. Minutes from the Federal Reserve’s rate-setting meeting and comments from its Chair, Jay Powell, noted that rates may need to peak higher than previously anticipated, but also suggested that future rate hikes may be smaller and slower, as the Fed waits to observe the cumulative impact of the policy measures already taken.

As investors weighed up whether this should be interpreted as a hawkish or dovish message, weaker-than-expected consumer price inflation tipped them towards the latter and added fuel to the recovery in risk asset prices. Inflation for October came in at 7.7% year-on-year, the lowest since January, down from June’s peak of 9.1%, and below forecasts of 7.9%.

With a number of companies updating on trading on the period to 30 September, it was a busy month for portfolio newsflow.

Tatton Asset Management (+32%) confirmed that – as announced in an October trading update – assets under management rose by £1.0bn to £12.3bn as at 30 September. The rise was a combination of organic growth, with over £900m of net inflows, and acquisitive expansion, after £1.0bn was added through Tatton’s purchase of a 50% stake in 8AM Global, partially offset by negative investment performance as markets fell.

Tatton also revealed that the recent recovery in market levels had helped push assets up to £12.9bn by 18 November. Tatton expects net inflows to slow in the next six months, but it is confident of progress towards its short-term target of £15.0bn in assets under management through a combination of net inflows and acquisitions.

Strong underlying growth and beneficial currency movements boosted revenue at Calnex Solutions (+25%) by 38% year-on-year in the six months to 30 September. Calnex supplies hardware solutions which enable customers in the telecommunications industry to test and validate the performance of critical network infrastructure equipment. Despite ongoing global semiconductor shortages and inflationary pressures, Calnex has been able to ship scheduled orders as planned while maintaining profit margins. It has reiterated its confidence in achieving a full-year result in line with market expectations.

CML Microsystems (+23%) is a developer of mixed-signal, RF and microwave semiconductors for global communications market. This year it has benefited from a recovery in its wireless voice and data communications end markets, with revenues in the six months to 30 September growing 22% year-on-year to over £10m. This outcome is ahead of management’s targets and, with a strong second half to the year anticipated, it is now expecting full-year trading to be ahead of market expectations.

Record (+20%), the asset manager specialising in currency strategies, registered 35% year-on-year revenue growth to £22m in the six months to 30 September. Record manages currency hedging on assets equivalent to over $80bn, and it experienced significant growth in the fees it generates off this base: management fees increased 18% while performance fees rose almost fivefold. The company is targeting growth to annual revenues of £60m by March 2025. These targets, if met, will require analysts to upgrade given consensus revenue forecasts for FY25 are currently just over £43m.

Yourgene Health (-40%) dropped as it warned on cost pressures in the six months to 30 September. As expected, the molecular diagnostics group saw a fall in revenues, down from £17.5m to £9.6m, as Covid-19 related sales fell away. Although sales are still on track to meet its full year guidance (with a 60:40 weighting to the second six months), it commented that margins have been eroded by inflationary pressures.

In October, Inspiration Healthcare Group (-25%) had flagged that ordering patterns were likely to lead to an abnormally large second-half weighting this financial year (ending 31 January 2022). In November, it issued another update as it became clear these orders aren’t going to feed through in sufficient scale to meet its forecasts. The medical technology company blamed Covid-19 measures in China as a particularly large drag on customer orders.

Having rallied 40% last month on acquisition news and an interim trading update, Intercede (-11%) gave back some ground following the release of half-year results. The cybersecurity specialist recorded a 24% increase in revenue to £6.1m and says its outlook for the second half of the year is unchanged.

A new position was initiated in On The Beach, an existing holding in the Liontrust UK Smaller Companies Fund which, following two years of significant business disruption from the pandemic, has now also dropped into the UK Micro Cap Fund’s investment universe. While recent trading conditions have been very difficult, the fund managers believe the company possesses strong intangible assets in several areas including distribution, IP and brand, while also having a strong owner manager culture.

The position in energy procurement management company Inspired was sold due to ongoing concerns over the low conversion of profits into cash and the level of debt in the business. In recent trading periods the company had seen more cash consumed by working capital as a result of overdue debtor balances from specific customers, as well as the more working capital intensive shift towards “energy optimisation” services, where payment terms are skewed in favour of end customers. This dynamic, in addition to a significant current contingent consideration liability, caused concerns over the level of balance sheet stretch into the coming financial year.

Positive contributors included:

Tatton Asset Management (+32), Calnex Solutions (+25%), CML Microsystems (+23%), Instem (+21%) and Record (+20%).

Negative contributors included:

Yourgene Health (-40%), Inspiration Healthcare Group (-25%), Inspired (-24%), Tribal Group (-16%) and Intercede (-11%).

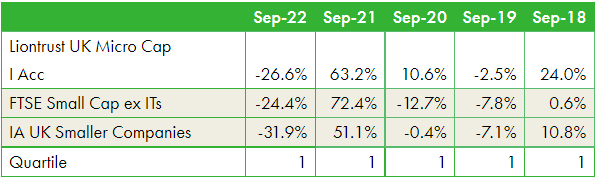

Discrete years’ performance** (%), to previous quarter-end:

Past performance does not predict future returns

**Source: Financial Express, as at 30.09.22, total return (net of fees and income reinvested), bid-to-bid, institutional class.

KEY RISKS

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Some of the Funds managed by the Economic Advantage team invest primarily in smaller companies and companies traded on the Alternative Investment Market. These stocks may be less liquid and the price swings greater than those in, for example, larger companies.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust.