Excerpted from the Aegon AM Long-term Outlook

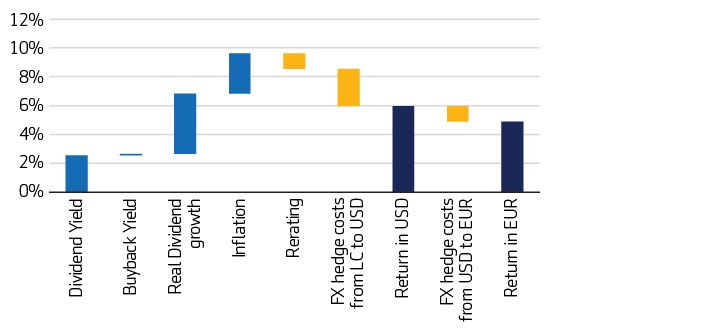

After the rapid and sharp decline in the first quarter of 2020, shares have generally recovered quickly and strongly. By the end of 2020, share prices had recovered from the shock that caused equities to fall by a third in February and March 2020. In 2021, prices gains have continued and although the increase has eased somewhat in the course of 2021, returns have been strong for 2021.

The strong recovery in equities is due to the supportive monetary and fiscal policies worldwide and the acceleration of trends such as online shopping and technological developments. Within equities, there are large differences in the degree of recovery. Tech companies in particular have benefited, while the energy sector has lagged far behind. In addition, small caps were hit hardest last year due to their higher sensitivity to economic growth, and lagged in the recovery until later in 2020. It was the large cap companies in particular that led the recovery, especially the large technology companies. Small caps have seen a sharp rise since the last quarter of 2020 after it became clear effective vaccines were available and the economy would recover.

Figure 1: Strong recovery for equities after Q1 2020

In the longer term, small caps are expected to show higher earnings per share growth compared to large caps and can be a good addition to global large cap equity portfolios. However, small caps have shared less in the returns of dominant tech companies in recent years. The last time small caps underperformed was in the years 2007-2009 with outperformance in the following years. Future relative performance in the shorter term will depend on the speed of economic recovery and developments at the major tech companies.

Are stocks expensive now?

The question most investors have is whether stocks are expensive right now.

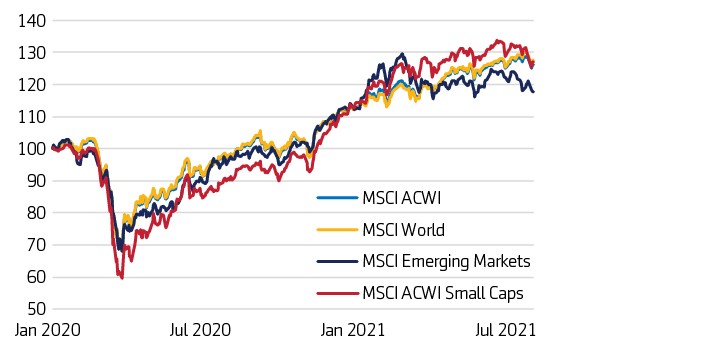

If we look at valuations, from a historical perspective, shares are priced expensively at the moment. One reason for this is that interest rates are low and spreads on many fixed income asset classes are also low as a result of the ‘search for yield’. The earnings yield on world equities (the inverse of the price-to-earnings ratio) is at the lowest levels in a long time. The difference between the earnings yield and the interest rate on government bonds gives an indication of the compensation for taking equity risk and this measure is also at historically low levels. So based on standard valuation metrics, stocks are indeed expensive.

Figure 2: Earnings yield on equities vs. government bond yields

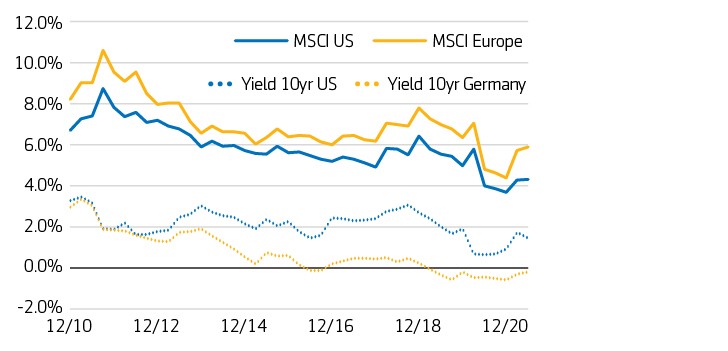

Sector differences cause valuations difference between the US and Europe

If we look at regions, US equities in particular are currently relatively expensive. This difference in valuation is largely explained by the sector composition. The US has a greater weight to the highly valued tech sector (see figure 3),while Europe has a higher weight in lower valued sectors (i.e. financials, energy, materials and utilities). When comparing valuations between similar sectors of both regions, they are much closer together, although the valuation in the US is generally still slightly higher. The higher sector valuation in the US can be explained by the higher profit margins and more shareholder focus, which makes companies better able to grow profits.

The high valuation of the tech sector is a result of the strong growth in this sector. Clearly, there has been a trend towards greater use and adoption of technology, which has been even further accelerated due to the pandemic. As an example, corporate profits in the tech sector have grown almost twice as fast as those of the broad index. Assuming the tech sector can sustain this rapid growth in to the future, this also justifies a higher valuation of this sector.

Figure 3: US sector composition is tilted toward technology

Another reason for the high valuations is the expected earnings growth. In 2020, there was a severe decline in reported profits due to the impact of Covid-19 on the global economy. Reported profits fell by a quarter globally though again, there were large differences in regions. For example, profits in emerging markets fell less than in developed markets, while in developed markets, profits in Europe fell much faster than in the US. In the course of 2021, it became clear that economies worldwide would recover quickly and corporate profits will grow back to new records in 2021. For 2021, we expect profits to grow about 30% compared to 2019. For the following years, we assume a flattening of the profit growth towards historical averages.

Taxation as a risk

For the coming years, we see a number of risks for stocks. One is an increase in corporate taxes which in recent decades have steadily declined. Countries have been competing against each other to offer companies lower tax rates to stimulate job creation, both at the companies themselves and within the supply chain. However, in the past decades governments debt has risen and the pandemic has caused many governments to set aside the budgetary rules, as a result, debts have risen sharply. These debts will eventually have to be reduced and the question is who will pay for them. Both in the US and in Europe, signals of a higher corporate tax rate are getting stronger. A recent example of this is that the world’s 20 largest economies have signed a plan for global reform with a minimum tax rate for multinationals. This should limit multinationals from moving their profits to tax-friendly countries. Also taxes on technology companies, seem to be gaining support in Europe. Ultimately, higher taxes for companies will have a negative impact on corporate profits and therefore also on equity returns.

Outlook

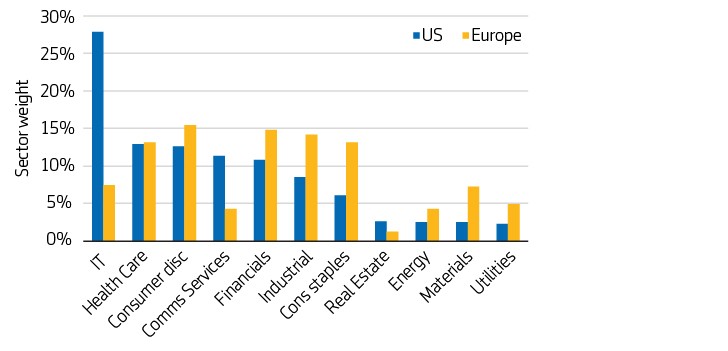

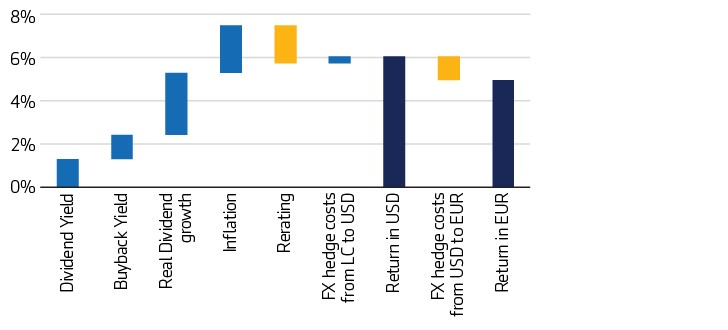

For developed markets, we expect a return of just under 6% annually in US dollar terms for the coming years. Our return assumption is based on factors that determine the return on equities. The dividend yield and return from share repurchase programs (buyback yield) by companies should be lower than in recent years due to higher valuations. We expect a dividend yield of approximately 1.6% and a buyback yield of approximately 1.0%.

An important component of long-term equity returns is profit growth. For the coming years, we expect corporate profits to rise further and as a result dividend and buyback growth will likely be higher than inflation. We are assuming 2.9% real dividend growth and 2.2% inflation.

The expected profit growth should be partly offset by a revaluation to slightly lower valuation levels. However, we expect equity valuations to remain above historical average due to low yields on fixed income assets. On balance, we expect a negative revaluation component of approximately 2%.

Hedging the return on equities to the US dollar currently shows a small positive benefit, as non-US short-term interest rates are on average slightly lower compared to short-term interest rates in the US. When hedging the return on equities to the euro, there is currently a negative effect, as euro interest rates are significantly lower. In euro terms, we expect a developed market return of approximately 5% per year.

Within developed markets, we are more positive about the US than Europe. This is mainly driven by the previously described sector composition of the regions in combination with the expectation that the accelerated trends towards digitization and automation will continue in the coming years. As a result, technology companies are also expected to grow faster than the more traditional sectors in the coming years. We therefore expect profit growth in Europe to lag behind the US.

Figure 4: Expected Returns – World Equities

ACWI (FX hedged to USD and to EUR) average annual returns until 2025

For emerging market equities, we expect returns close to developed markets. The dividend yield is higher with 2.5%, partly due to the more favorable valuations. Furthermore, the expected profit growth is significantly higher than in developed markets. We also expect a negative impact of the revaluation component. Hedging equity returns has a negative impact, because short-term interest rates in emerging markets are higher than in the US and Europe. Overall, we expect a return of approximately 6.0% annually in US dollar terms, and 4.9% in euro terms..

Figure 5: Expected Returns – Emerging Markets Equities

Emerging Markets (FX hedged to USD and to EUR) average annual returns until 2025