Since the global financial crisis, growth equities have been the overall best performing asset class. High yield bonds have also done very well, especially relative to the volatility of returns. Market dips have been bought and shocks have not had a long-lasting negative impact on returns. Going forward this may remain the case. However, uncertainty around US President-elect Donald Trump’s potential policies could upset the growth and inflation outlook, which in turn may cause market returns to sharply deviate. As always, investors need to balance the strategic with the tactical.

Not crystal clear

If you are not already inundated with 2025 market and economic outlooks you will be soon. Spoiler: no-one knows what is going to happen next year. The reason? Trump of course, and his policies, and the unknown global responses to them. The consensus seems to be that in the US we will see higher growth, inflation and government borrowing, which might be a problem for the Federal Reserve (Fed) and the bond market. For the rest of the world, it looks like mostly bad news. Tariffs will hurt – China will struggle to boost its economy amid ongoing weakness in the property sector, and Europe is tightening fiscal policy.

For the moment though, the markets are collectively shrugging. US Treasury yields have fallen since the election, so have inflation break-even spreads, while the S&P 500 keeps achieving new highs and credit spreads are steadfastly tight. European equities have underperformed since the election but that is nothing new. There will be more meaningful market moves next year but for now it is all quite calm. Happy holidays!

Strategy…

From an investment point of view the uncertainty around Trump is certainly an issue. This makes it hard to set out an investment roadmap for the coming couple of years. One approach would be to go with what has worked already – be exposed to US equities and the dollar and have some credit for income with US high yield being the most attractive credit asset class in our view – or for European investors who hedge the currency risk, European high yield. A second approach is tactical – dynamically adjusting portfolios to navigate the materialisation of any risks and the emergence of any clear value opportunities. Of course, this approach is at the mercy of market timing but there could be some opportunities created by volatility or the need to reduce risk. European fixed income markets currently provide some relative value trades that may turn out to be profitable – buying French government bonds versus swaps, holding other government bonds such as Italy and Spain and looking for spread dispersion opportunities in corporate credit. The fall of Michel Barnier’s government in France seems to have been priced in. Spreads on French government bonds narrowed a little following the no-confidence vote, reflecting the view that the budget will be somewhat fiscally restrictive.

For the slightly more medium term, taking a view on duration in the US, or on inflation protection, means betting on a particular macroeconomic outcome to manifest over the next year. That is not easy. Most bond investors are likely to play the range in US Treasuries and the volatility will, for now, mostly be driven by expectations on how much the Fed can cut rates before the bulk of Trump’s agenda hits the economy.

Or strategic

The third approach is to set out a strategic asset allocation based on long-term performance metrics of different asset classes, and then act tactically, when and if things start to go wrong, or new opportunities present themselves. Precisely how this is achieved depends on an investor’s time horizon and risk tolerance. If we assume past performance is some guide to future returns (a cardinal sin), setting a strategic allocation based on history is not a bad approach as investors can choose, broadly, where they sit on the risk curve depending on the implied return and volatility which is somewhat inherent in the behaviour of publicly-traded financial assets.

Long-term pointers

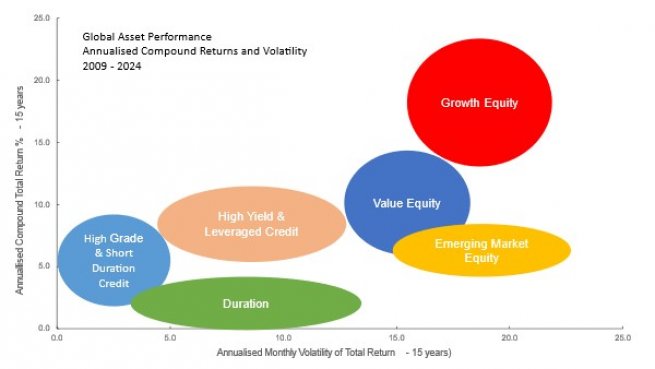

This week I looked at total returns for several assets across fixed income and equity markets over the last 15 years. Plotting the returns against the realised annualised volatility of monthly total returns generates some bunching of asset class performance. I put them into six categories (seven if I include cash) – growth equities, value equities, emerging market equities, high yield and leveraged credit, high grade credit, and duration.

The chart below is a stylised version of the more detailed chart. There are some interesting messages. Investors have done well by being exposed to growth equities and high yield over the last decade and a half. They have both delivered the best risk-adjusted returns and, outside of recessionary periods, should continue to do so. Growth equities represent technological innovation and the manufacturing supply chain which has allowed the scaling up of generative artificial intelligence, robotics, the metaverse and other technologies. It has been, and is likely, to continue to be very US-centric. Returns have been in the 15% to 25% range and include sectors (via indices) such as the S&P 500 Information Technology sector, the Nasdaq 100, specific growth indices, the Indian and Taiwan stock markets and, although less obviously and with more volatility, US small caps.