Recurrent waves of COVID-19 have impacted the ASEAN economies in varying degrees in recent months, forcing many countries to reimpose restrictions. As a result, the region’s 2021 growth forecast has been downgraded by the Asian Development Board (ADB) from 4.4% to 4.0%. Unsurprisingly the short-term investor sentiment towards ASEAN has turned negative. Still this shadow cast by the pandemic should not detract one from the region’s long-term fundamentals which remain intact and compelling.

The ten countries in ASEAN form an economic powerhouse with a combined GDP of USD 2.6trillion1, currently making it the seventh-largest economy in the world. By 2030, the region is expected to become the fourth largest single market in the world2, behind the US, China and the European Union. Favourable demographics is another plus point. ASEAN’s population of approx. 660 million3 makes it the 3rd most populous market after China and India. More importantly, the region’s median age in 2040 is expected to be 35 years versus China’s 47 and Japan’s 504, aided by a growing working population.

Macroeconomic indicators remain supportive

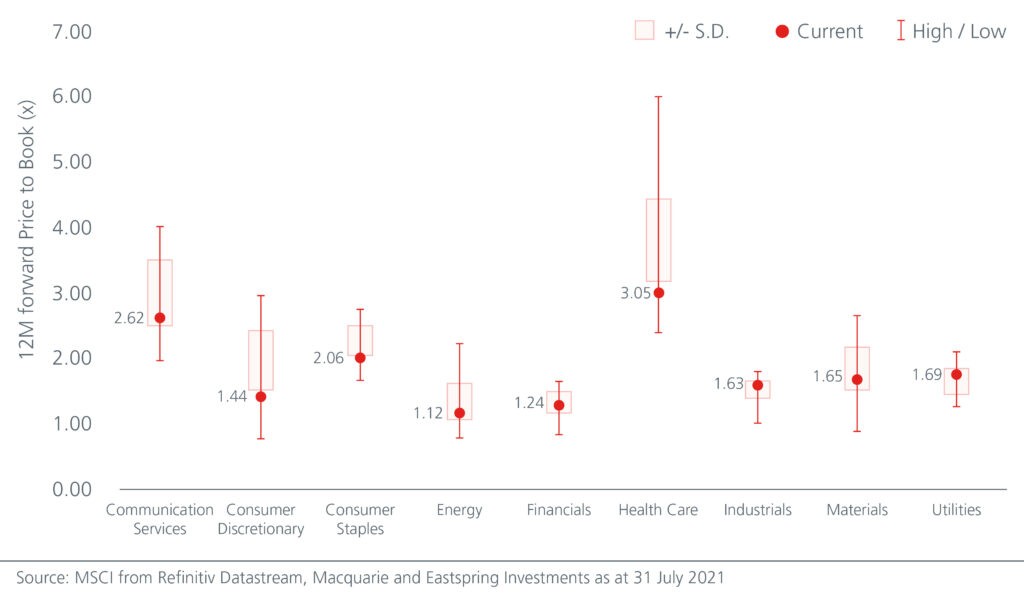

ADB forecasts the region’s growth to recover to 5.2% in 2022 at current vaccination rates. Growth aside, other macro factors across the region seem encouraging. Inflation, for example, has been relatively benign; both headline and core inflation have been trending lower. See Fig 1. The rebound in commodity prices has not translated into a broad-based increase in consumer price inflation. With inflation largely expected to remain within the ASEAN central banks’ targets, it is likely that policymakers will maintain an accommodative policy stance to support their economic recoveries. Some even have room to cut rates further should the need arise.

Fig 1: Headline inflation remains benign

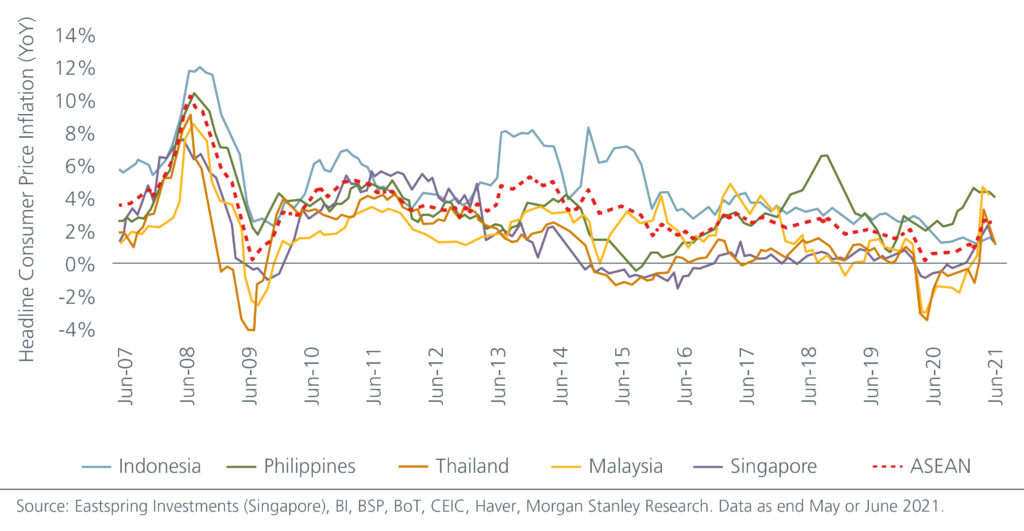

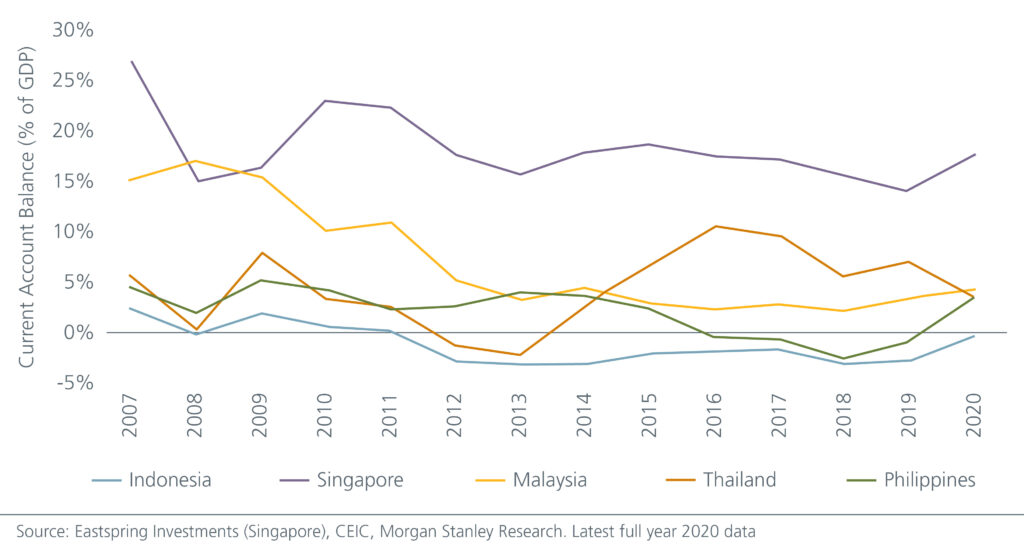

Another closely monitored indicator is a country’s external balance. Here too the numbers seem healthy; within the ASEAN-5 (Singapore, Malaysia, Indonesia, Philippines and Thailand), all except Indonesia boast positive current account balances as a % of GDP. See Fig 2. Meanwhile fiscal deficits are coming off the highs seen in 2020 but are unlikely to come down to pre-pandemic levels in the near term given the fact that many governments have pledged higher spending in 2021 to tackle the COVID-19 challenges. See Fig 3.

Fig 2: Majority boast healthy external balances

Fig 3: Fiscal deficits coming off the highs

Recovery being driven by trade for now

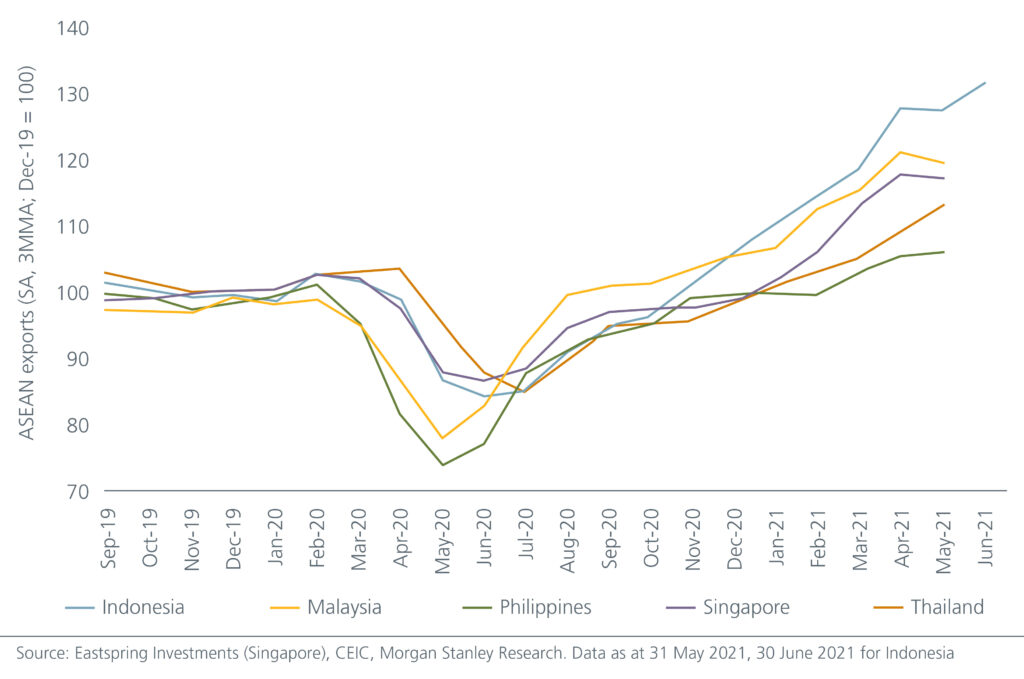

The region’s strategic location has enabled it to become a major global hub of manufacturing and trade flows. As such, the recovery in global trade with the reopening of the developed markets is a huge tailwind for the region. Based on data from the ASEAN-5, exports have recovered and are back to pre-COVID-19 levels. See Fig 4. Stronger US demand will also be particularly beneficial given that the US accounts for more than 12% of goods’ exports.

Fig 4: ASEAN-5 exports have recovered to pre-COVID levels

Meanwhile the region’s manufacturing sector which was showing steady signs of improvement since the start of the year fell into contraction territory5 in June and slipped further in July due to the stricter COVID-19 restrictions imposed by several countries. Nevertheless, once these measures are relaxed, activity levels should edge up above the healthy 50 mark. Manufacturing is expected to play an important role; individual ASEAN countries possess their own core competency and thus offer varied investment opportunities. Similarly, domestic consumption, a major driver of GDP in many ASEAN markets, will likely only see outperformance when a full domestic reopening takes place.

Longer term there are three areas that we think should facilitate robust growth in the region, i.e. greater regional integration, faster digital adoption and an increasing focus on sustainability.

Regional integration spurs growth

The COVID-19 pandemic catalysed ASEAN to push ahead with its integration agenda which will lead to enhanced connectivity and improved competitiveness. Fortunately, the drive for stronger trade ties were unhampered as countries resorted to online negotiations even as the pandemic raged. Free trade agreements (FTAs) such as the mega trade deal, the Regional Comprehensive Economic Partnership (RCEP), was signed after eight years of negotiations in November 2020. The RCEP is important as it unifies existing FTAs between ASEAN and existing partners and will be the world’s largest FTA measured by GDP, even bigger than the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), the EU, the MERCOSUR trade bloc in South America, and the United States–Mexico–Canada Free Trade Agreement.

Separately the move to reduce the reliance on the Chinese supply chain ecosystem is expected to benefit ASEAN member states’ growth and job creation potential. Multinational corporations will likely establish a regional manufacturing hub which can easily integrate into ASEAN’s regional supply chain ecosystem. ASEAN is an ideal relocation strategy due to a) low manufacturing wages in some ASEAN member states; b) ASEAN’s proximity to China, where many supply chains will still remain; c) ASEAN’s commitment towards establishing a single market and production base; and d) RCEP will account for approximately 40% of world trade.6

Digitalisation to hasten integration

Internet usage in the region continues to multiply. With access to goods, food, healthcare, education, and entertainment, just a click away, going digital has almost become a necessity in people’s daily lives. And this transformation, accelerated by COVID-19, is impacting both businesses and consumers. ASEAN member states are working together to help businesses capture opportunities generated by this digital boom.

Repeated COVID-19 lockdowns have sparked new online habits which in turn has propelled e-commerce. Online platforms have gained massive popularity and are the fastest growing pillar of ASEAN’s internet economy. In fact, ASEAN countries are in discussions over a potential ASEAN Agreement on e-commerce to establish trade rules and lower operating barriers to entry. The knock-on benefits extend to physical infrastructure such as distribution warehouses and data centres to ensure a seamless digital journey for customers.

The internet economy will remain resilient; 94% of new digital service consumers in a survey intend to continue with their digital journey post-pandemic. Investments in technology will thus remain strong, with higher focus on fintech, healthtech and edtech. ASEAN’s digital economy is projected to be worth more than USD300 billion by 2025, a threefold increase from 2020’s USD100 billion.7

Sustainable infrastructure becoming a priority

Investments in infrastructure are crucial to boost economic activity and create jobs. Whilst COVID-19 highlighted the conspicuous infrastructure gaps in healthcare, telecommunications and logistics which ASEAN governments sought to fill on an urgent basis, there are also other areas that need to be improved and upgraded. According to Asian Development Board, ASEAN needs to invest USD210 billion yearly to keep up with the region’s development goals and challenges posed by climate change.

Across the region, infrastructure development, such as renewable energy, logistics and transport, public health and info-communication technology are being prioritised. ASEAN has the potential to become a hub for green infrastructure. To meet the Paris Agreement’s climate target, the region would need to raise the current renewable energy target of 27 per cent of the energy mix to 52 per cent by 2030, at an additional cost of USD70 billion.8 There is a huge need for private sector to complement and fill the public sector financing shortfalls.

Opportunities for discerning investors

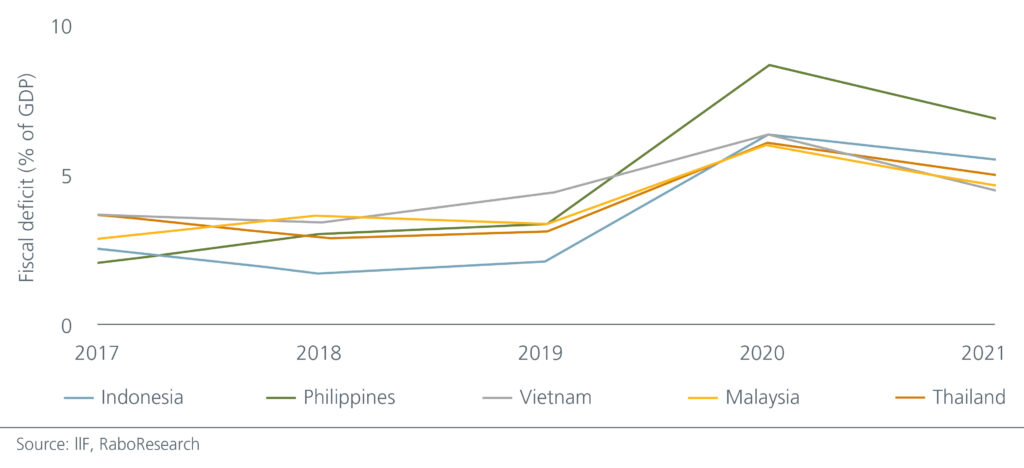

COVID-19 has cast a big shadow on ASEAN economies and corporate earnings in the near term. Nonetheless the region’s long-term fundamentals remain intact. Furthermore, many companies are poised to benefit from ASEAN’s post pandemic recovery. Investors may wish to consider the price-to-book valuation measure at this juncture; on this basis, valuation across most sectors look attractive.

Fig 5 : Price-to-book ratio (sectors) versus the 10-year historical range