Key Takeaways

- Growth, Momentum and Quality continued to do well in Developed Markets in the second quarter

- The weight in the ‘Magnificent Seven’ was the main driver in the outperformance or underperformance of the different factors

- The S&P 500 outperformance over the S&P 500 Equal Weighted accelerated, highlighting the dominance of mega caps on the markets

- Related ProductsWisdomTree US Quality Dividend Growth UCITS ETF – USD Acc, WisdomTree Global Quality Dividend Growth UCITS ETF – USD Acc, WisdomTree Eurozone Quality Dividend Growth UCITS ETF – EUR Acc, WisdomTree UK Quality Dividend Growth UCITS ETF, WisdomTree US Quality Dividend Growth UCITS ETF – USD, WisdomTree Global Quality Dividend Growth UCITS ETF – USD, WisdomTree Eurozone Quality Dividend Growth UCITS ETF – EUR, WisdomTree US Quality Dividend Growth UCITS ETF – GBP Hedged, WisdomTree US Quality Dividend Growth UCITS ETF – EUR Hedged Acc, WisdomTree Global Quality Dividend Growth UCITS ETF – GBP Hedged, WisdomTree Global Quality Dividend Growth UCITS ETF – EUR Hedged AccFind out more

After a strong start to the year, markets entered the second quarter, weighted by increasing inflation worries. With expectations of the number of Federal Reserve cuts melting in the sun, the MSCI World posted a negative 3.7% return in April. However, the inflation print improved over the rest of the quarter, leading to a more hopeful tone in May and June. While cuts remain elusive, the new expected date for cuts to begin is now September; as such markets have restarted their march upward. Artificial Intelligence and Semiconductor-related stocks continued to lead, though a broadening of the market remains elusive.

This instalment of the WisdomTree quarterly equity factor review aims to shed some light on how equity factors behaved during the second quarter and how this may have impacted investors’ portfolios.

Performance in focus: More of the same in May and June

In Q2, the MSCI World (+2.6%) and the MSCI USA (+3.9%) continued to perform quite well. After a slight inflation scare at the end of Q1 and the start of Q2, markets veered back to known territory, with large Tech Megacaps and Semiconductors leading the way. The US continues to lead despite the continuous postponement of rate cuts, thanks to a robust economy and inflation firmly on a downward path. Emerging Markets ended up performing the strongest during the quarter with the MSCI EM gaining 5%.

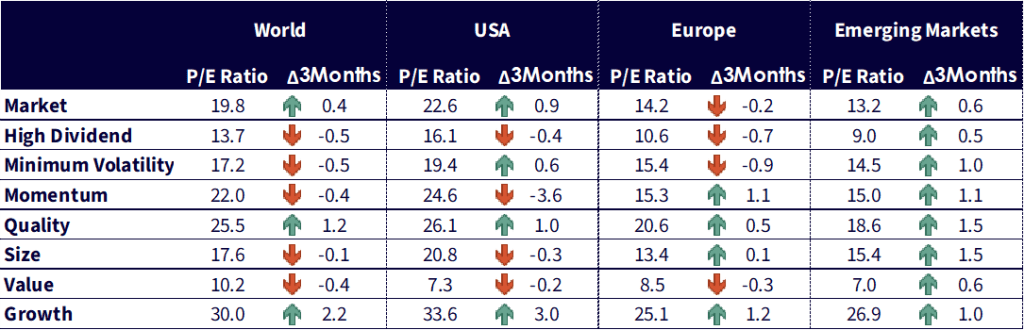

Factor performance also highlights this form of consistency from the markets:

- Overall Growth, Momentum and Quality continued to do well in Developed Markets with Growth taking the lead.

- In the US, Small Cap and Value suffered from the continuing postponement of rate cuts. They posted the deepest underperformance in Q2.

- In Europe, Growth stocks did not lead the way. Momentum and Quality posted the strongest returns followed by Minimum Volatility.

- In Emerging Markets, Momentum was the strongest, while Growth faded away after a strong Q1. Value, however, rebounded strongly, followed by High Dividend Stocks.

Figure 1: Equity factor outperformance in Q2 2024 across regions

Source: WisdomTree, Bloomberg. 31 March 2024 to 30 June 2024. Calculated in US Dollars for all regions except Europe, where calculations are in EUR. Historical performance is not an indication of future performance and any investments may go down in Value.

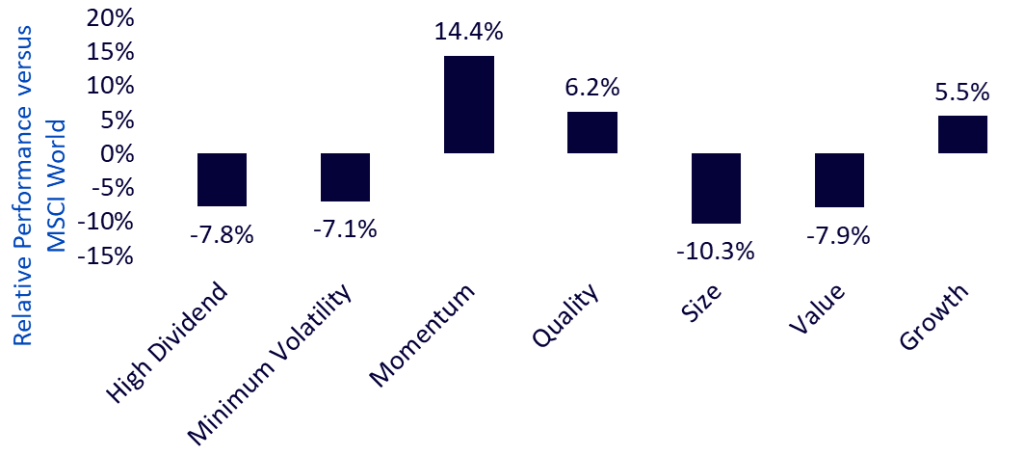

YTD factor performance: More of the same in May and June

Year to date, the MSCI World is up 11.7% and the leading factors are Momentum, Quality and Growth. All other factors are underperforming. In the first six months of the year, it is clear that the success of a given factor is intimately linked to its investment in the ‘Magnificent Seven’. All three factors that have outperformed are overweighted ‘Magnificent Seven’. Growth is the most overweighted, but Momentum also exhibited 5.7% more of the ‘Magnificent Seven’ than the benchmark, and Quality was overweighted 2.4%. The remaining factors, that underperformed, were all underweighted, from High Dividend with an underweight of -13% to Value or Small Cap that do not invest at all in the ‘Magnificent Seven’.

Figure 2: Equity factor outperformance in 2024

Source: WisdomTree, Bloomberg. 31 December 2023 to 30 June 2024. Calculated in US Dollars for all regions except Europe, where calculations are in EUR. Historical performance is not an indication of future performance and any investments may go down in Value.

This dominance of large caps and large cap tech is particularly evident when comparing the relative performance of the S&P 500 and the S&P 500 Equal Weighted. After a short period of dominance in 2022, the S&P 500 Equal Weighted has been crushed by its market cap equivalent. In 2024, we observed a slight pause at the beginning of Q2, but in May and June, the S&P 500 accelerated even further, outperforming the S&P 500 Equal Weighted by 2.1% over the two-month period.

Figure 3: Relative performance of the S&P 500 Equal Weighted vs S&P 500

Source: WisdomTree, Bloomberg. 31 December 2021 to 30 June 2024. Calculated in US Dollars for all regions except Europe, where calculations are in EUR. Historical performance is not an indication of future performance and any investments may go down in Value.

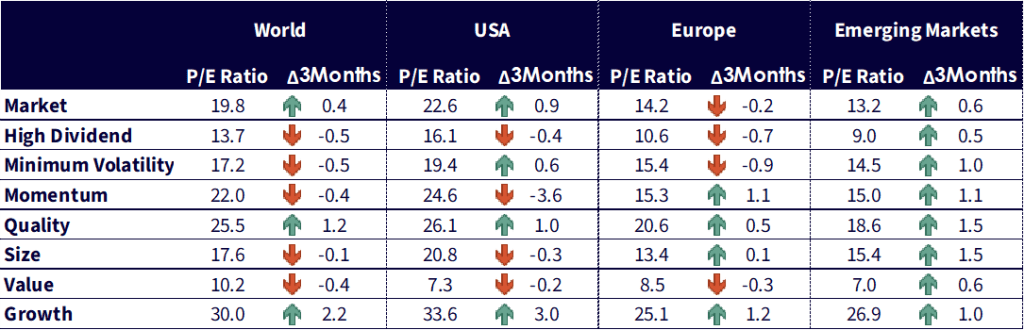

Valuations decreased in the US in Q2

In Q2 2024, developed markets became slightly more expensive. But again, the impact of large cap tech was overwhelming. Those stocks became more expensive leading factors like Growth and Quality to also become more expensive. On the contrary, the valuation of the rest of the market declined, leading to very attractive levels for a large portion of US equities. Europe’s valuations moved down on average. Emerging Markets, however, became more expensive across the board with Small Caps and Quality stocks leading the way.

Figure 4: Historical evolution of price to earnings ratios of equity factors

Source: WisdomTree, Bloomberg. As of 30 June 2024. Historical performance is not an indication of future performance and any investments may go down in Value.

Looking forward to Q3 2024

As we look forward to the second half of the year, we note three potential catalysts for the long-awaited broadening of the market and, with it, some form of small-cap and value revival. First, the Federal Reserve is finally moving toward its first cut, which is widely anticipated to happen in September. Such a cut would benefit less profitable companies that form a large part of the small cap universe and would boost further this market segment. Second, the gap in earnings growth expectation between the ‘Magnificent Seven’ and the rest of the market is closing toward the end of the year. This should create opportunities for stocks outside those seven mega caps to captivate investors’ attention. Finally, the US presidential election creates significant uncertainty that weighs on the market. Historically, it shows that once the election’s results are known, whichever the results, uncertainty lifts, and this very often creates a late-year rally as well as a small-cap rally. A balanced approach allowing for investment outside of large-cap mega caps could allow investors to benefit from such a broadening.

World is proxied by MSCI World net TR Index. US is proxied by MSCI USA net TR Index. Europe is proxied by MSCI Europe net TR Index. Emerging Markets is proxied by MSCI Emerging Markets net TR Index. Minimum volatility is proxied by the relevant MSCI Min Volatility net total return index. Quality is proxied by the relevant MSCI Quality net total return index.

Momentum is proxied by the relevant MSCI Momentum net total return index. High Dividend is proxied by the relevant MSCI High Dividend net total return index. Size is proxied by the relevant MSCI Small Cap net total return index. Value is proxied by the relevant MSCI Enhanced Value net total return index. WisdomTree Quality is proxied by the relevant WisdomTree Quality Dividend Growth Index.