After three negative quarters, 2022 closed with a bang. Equities around the world delivered very strong returns in both October and November on the back of relatively good news on the inflation front. Therefore, despite a negative December, developed market equities gained 9.8% in Q4, and emerging market equities gained 9.7%.

This instalment of the WisdomTree Quarterly Equity Factor Review aims to shed some light on how equity factors behaved in this rebound and how this may have impacted investors’ portfolios.

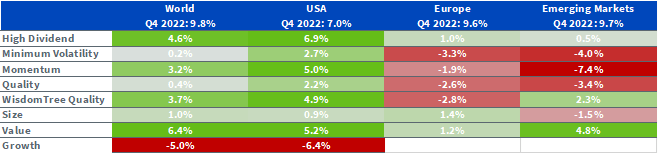

- Overall factors performed strongly for Global and US investors. Only Growth delivered an underperformance in Q4.

- Value, High Dividend and High Quality dividend payers delivered the strongest performance in both regions.

- In Europe, Small Cap stocks performed the best, followed by Value and High Dividend stocks.

- In emerging markets, Value and High Quality dividend payers delivered the strongest outperformance.

Looking forward to 2023, the same issues that drove markets in 2022 remain. While inflation has shown signs of easing, we expect central banks to remain hawkish around the globe as inflation is still very meaningfully above target. In an environment where interest rates and inflation remain high, and volatility of both equities and interest rates is increasing, we continue to tilt toward High Dividend, Value and High Quality dividend payers.

Performance in focus: High Dividend and Value finish strong

In the fourth quarter of 2022, equity markets posted their first positive quarter of the year across regions. In October and November, markets benefitted from positive inflation numbers and increased hopes for a Fed Pivot or at least a pause in rate hikes leading to a sharp rebound. MSCI World gained 7.2% and 7% in those two months, respectively. However, hopes of such a pivot were dashed quickly, with the Federal Reserve Chair making clear in the December Federal Open Market Committee (FOMC) meeting that he wanted to see “substantially” more progress on inflation before the hiking would stop. This led the MSCI World to lose -4.3% in December.

Overall, factors performed strongly for Global and US investors:

- Only Growth delivered an underperformance in Q4 in US and global equities

- Value, High Dividend and High Quality dividend payers delivered the best performance across regions but mostly in the US.

- In Europe, factors had a more difficult time. Small Cap stocks performed the best, followed by Value and High Dividend stocks but Quality, Momentum and Min Volatility delivered underperformance.

- In emerging markets, Value and High Quality dividend payers delivered the strongest outperformance. In this market, Quality, Momentum and Min Volatility also delivered underperformance.

- In Q4, the market environment continued to discriminate strongly between Quality stocks. The definition of Quality and the criteria used have hugely impacted the result. Quality, left unattended, tends to tilt toward growth (investors pay for Quality, after all) and would have suffered from that tilt, as illustrated with MSCI Quality (‘Quality’ in Figures 1 and 2). Highly profitable companies and dividend growers have fared better this quarter, as illustrated by WisdomTree Quality.

Figure 1: Equity factor outperformance in Q4 2022 across regions

Source: WisdomTree, Bloomberg. 30 September 2022 to 31 December 2022. Calculated in US Dollars for all regions except Europe where calculations are in EUR.

Historical performance is not an indication of future performance and any investments may go down in Value.

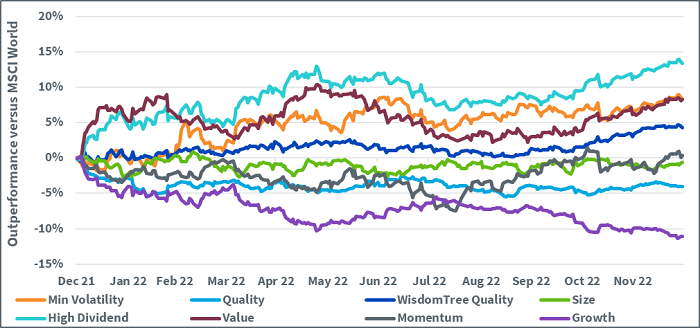

2022, the year of the dividends

Looking back at the whole year, High Dividend has dominated the factor space consistently across the year. It delivered a 13.4% outperformance to the MSCI World and a 15.2% outperformance versus the MSCI USA. In Global equities, Value and Min Volatility completed the podium with 8.3% of outperformance. In the US, the podium is a bit different, with WisdomTree Quality (that is, High Quality dividend payers) finishing second (+11.4%) and Min Volatility and Value coming third and fourth. In both regions, Growth and Quality (with its growth tilt) were the only factors to deliver underperformance. In Europe, High Dividend and Value also dominated the field.

Figure 2: Year to date outperformance of equity factors in developed markets

Source: WisdomTree, Bloomberg. 31 December 2021 to 31 December 2022.

Historical performance is not an indication of future performance and any investments may go down in Value.

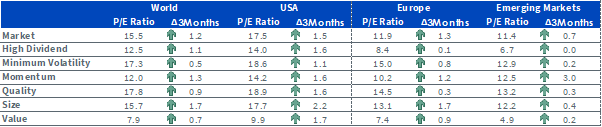

Valuations rebounded in Q4

In Q4 2022, valuations rebounded across the board on the back of markets’ positive performance. Small Caps saw the largest increases with +1.7 in Global and European equities and +2.2 in US equities. European and Emerging markets remain quite cheap, leading to factors being cheap as well. Emerging market value is currently priced at a 4.9 P/E Ratio.

Figure 3: Historical evolution of price to earnings ratios of equity factors

Source: WisdomTree, Bloomberg. As of 31 December 2022.

Historical performance is not an indication of future performance and any investments may go down in Value.

Looking forward to 2023, recession risk is continuing to rise. The International Monetary Fund (IMF) is warning of a recession in the US, a deep slowdown in Europe, and a drawn-out recession in the United Kingdom. While inflation has shown signs of easing, we expect central banks to remain hawkish around the globe as inflation is still very meaningfully above targets. The Federal Reserve made clear in its December meeting that ‘substantially’ more progress will need to happen on the inflation front before hiking stops. The European Central Bank (ECB) projections show inflation is unlikely to reach the 2% target until late 2025, leading to a hawkish turn there as well. The Bank of Japan also surprised markets in December with its own hawkish move. Overall, as we transition to 2023, three questions still remain unanswered from 2022: 1) how sticky will the underlying inflation be 2) how intense will the recession be 3) will we find a solution to Europe’s energy crisis?

With markets facing the same issues in 2023 that they faced in the second half of 2022, we continue to tilt toward the strategies that delivered for investors in 2022, that is, High Dividend, Value and High Quality dividend payers.

World is proxied by MSCI World net TR Index. US is proxied by MSCI USA net TR Index. Europe is proxied by MSCI Europe net TR Index. Emerging Markets is proxied by MSCI Emerging Markets net TR Index. Minimum volatility is proxied by the relevant MSCI Min Volatility net total return index. Quality is proxied by the relevant MSCI Quality net total return index.

Momentum is proxied by the relevant MSCI Momentum net total return index. High Dividend is proxied by the relevant MSCI High Dividend net total return index. Size is proxied by the relevant MSCI Small Cap net total return index. Value is proxied by the relevant MSCI Enhanced Value net total return index. WisdomTree Quality is proxied by the relevant WisdomTree Quality Dividend Growth Index.