The impact of geopolitical events on equity markets tends to be short-lived; inflation is likely to be the more enduring theme for markets going forward. We see the need to be more tactical in 2022 and while we moved to a neutral stance on equities at the start of the year, we continue to look for opportunities in beaten down areas of the markets, with the expectation that Emerging Markets are likely to fare better over the course of the year.

Equity markets have been volatile in recent weeks as investor sentiment dampened, oscillating between hopes for a diplomatic resolution to the Russia-Ukraine situation and fears of an armed conflict. At the point of writing, tensions have escalated with Putin declaring commencement of military operations in Ukraine on February 24th.

A number of conflicting dynamics come into play when assessing the impact of Russia’s recent actions in Ukraine:

- Complete annexation of Ukraine proves quite challenging, given its population of 44 million, and considering 90% of Ukrainians had voted to leave the Soviet Union in 1991.

- The extent and effectiveness of the sanctions imposed by the US, UK and the EU. On February 22nd, the US, UK and the EU implemented a first wave of sanctions, which included restricting the sale of Russian sovereign debt, and freezing the assets of Russian oligarchs and their children, banks and parliamentarians. Germany also paused the certification of Nord Stream 2, an undersea pipeline intended to carry more gas from Russia to Germany.

- The potential retaliation from Russia, a major nuclear power and global supplier of critical materials. Russia is the world’s largest exporter of fertiliser and accounts for 43% of the world production of palladium, which is used in catalytic converters in cars. There is also increased risk of cyber-attacks, which have already started in Ukraine.

- Europe’s dependence on Russian energy imports, in particular gas. Russia accounts for about one third of the gas burned in Europe and slightly more than 50% of Germany’s gas imports.

- The ability of Russia to better defend itself against potential sanctions given the current high oil price, low debt levels (government debt to GDP estimated to be 17.9% as at 20221) and high level of foreign exchange reserves (~USD 630 bn).

- Russia’s role as an energy provider to the world and the implications of the Russia-Ukraine tensions on already high oil prices, which have surged to seven-year highs.

Short-lived impact

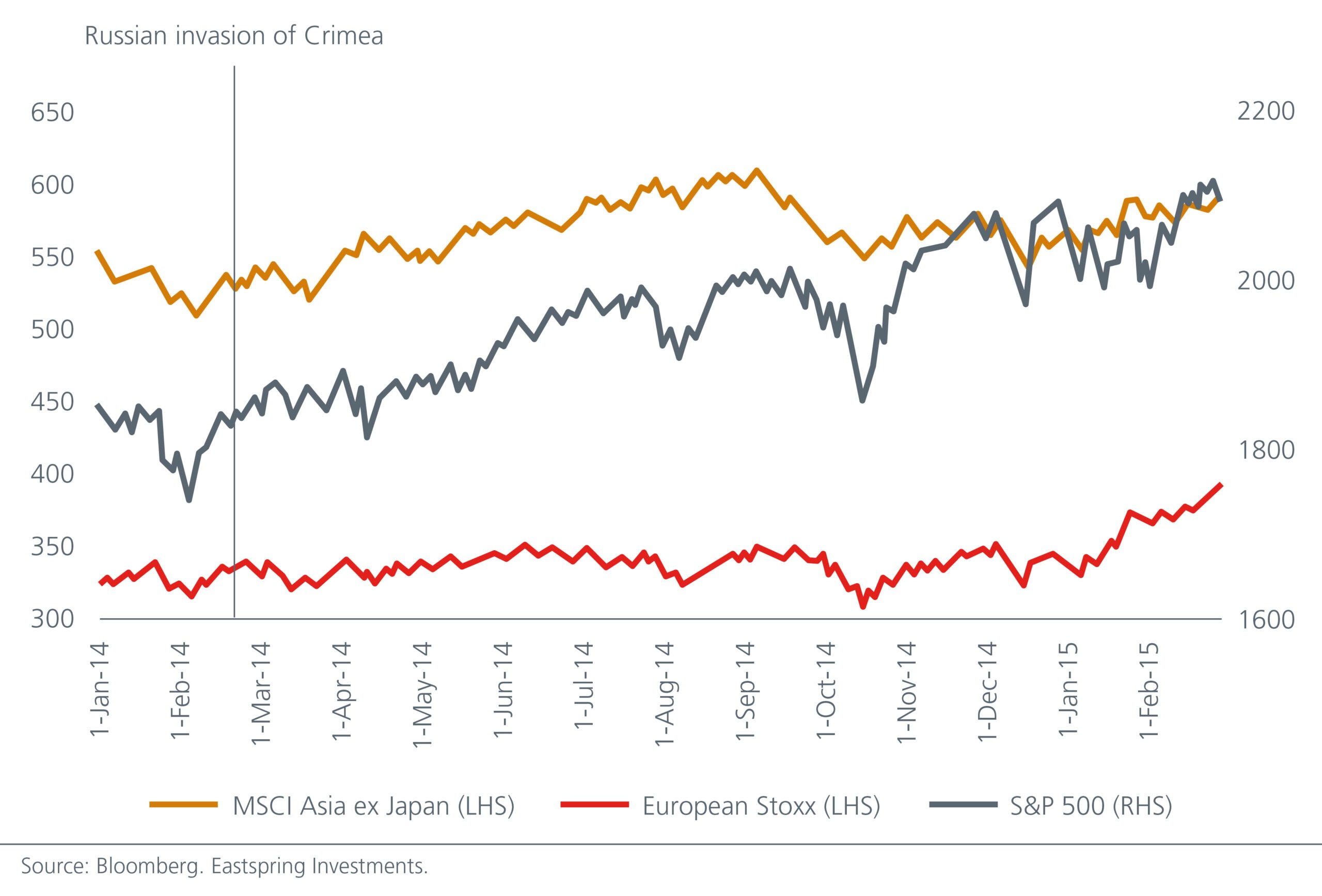

Encouragingly, lessons from history suggest that the impact of geopolitical events on equity markets tend to be short-lived. The closest example we can refer to may be the Russian annexation of Crimea in February 2014. While oil prices peaked around the event, there was no lasting impact on asset prices. The S&P 500 experienced volatility in the three weeks leading into the incursion, but the recovery was relatively swift. The impact on Asian equities was relatively muted. Higher oil prices arising from 2014’s sanctions provided a tailwind for Europe’s oil and gas sector, lending a boost to the European equity market. Fig. 1.

Fig. 1. Selected market performances pre and post annexation of Crimea

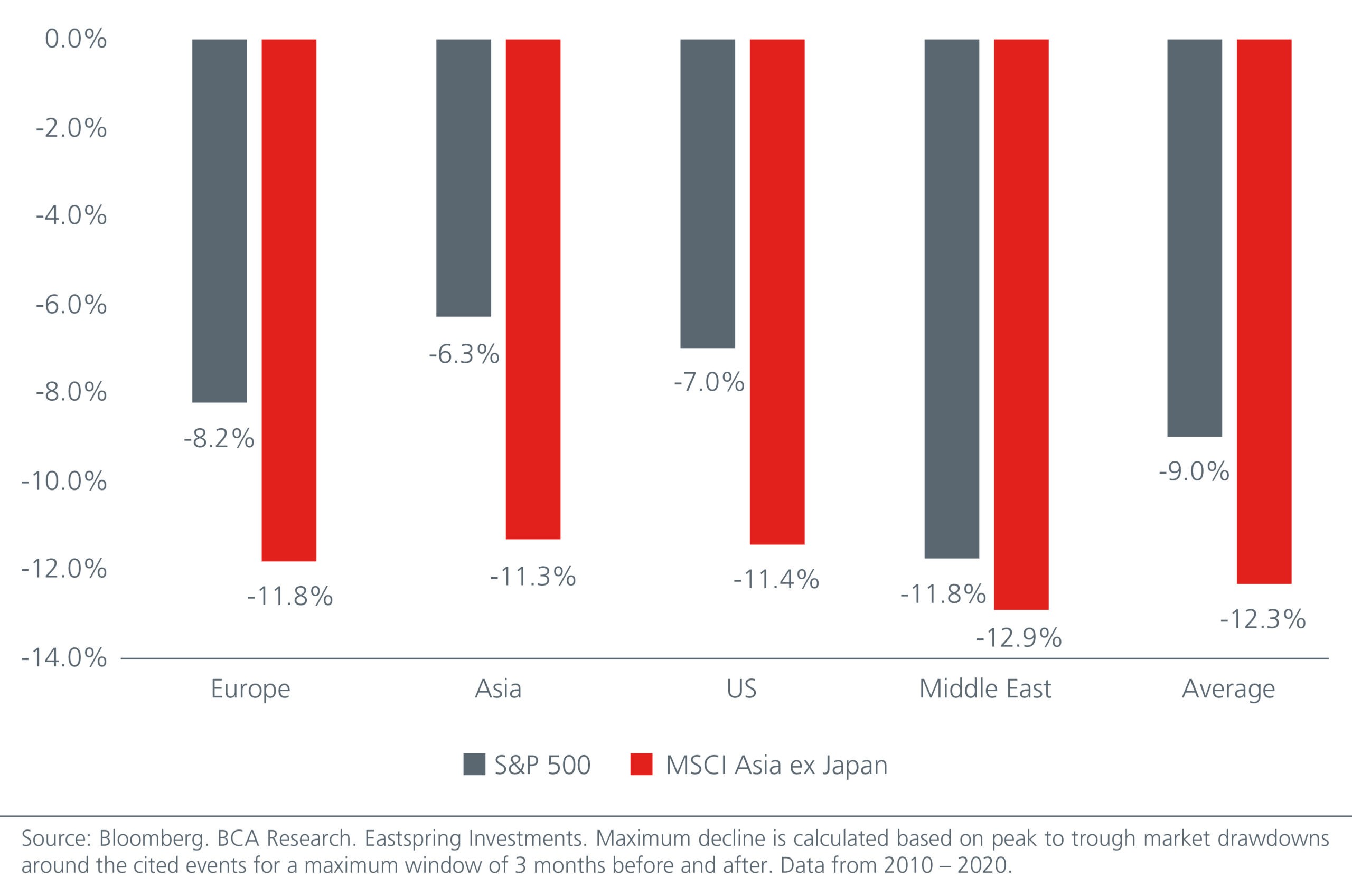

Broadening our analysis to include geopolitical events from 2010 to 2020, we note that the average maximum declines2 for the S&P 500 and MSCI Asia ex Japan indices arising from geopolitical events were 9.0% and 12.3%, respectively. Fig. 2. Interestingly, the maximum declines for the S&P 500 and MSCI Asia ex Japan Indices appear to be the largest for geopolitical events that take place in the Middle East. While markets may experience more volatility as the uncertainty persists, we note that any de-escalation of tensions could potentially result in a sharp snapback in equity markets.

Fig. 2. Maximum declines according to location of geopolitical events

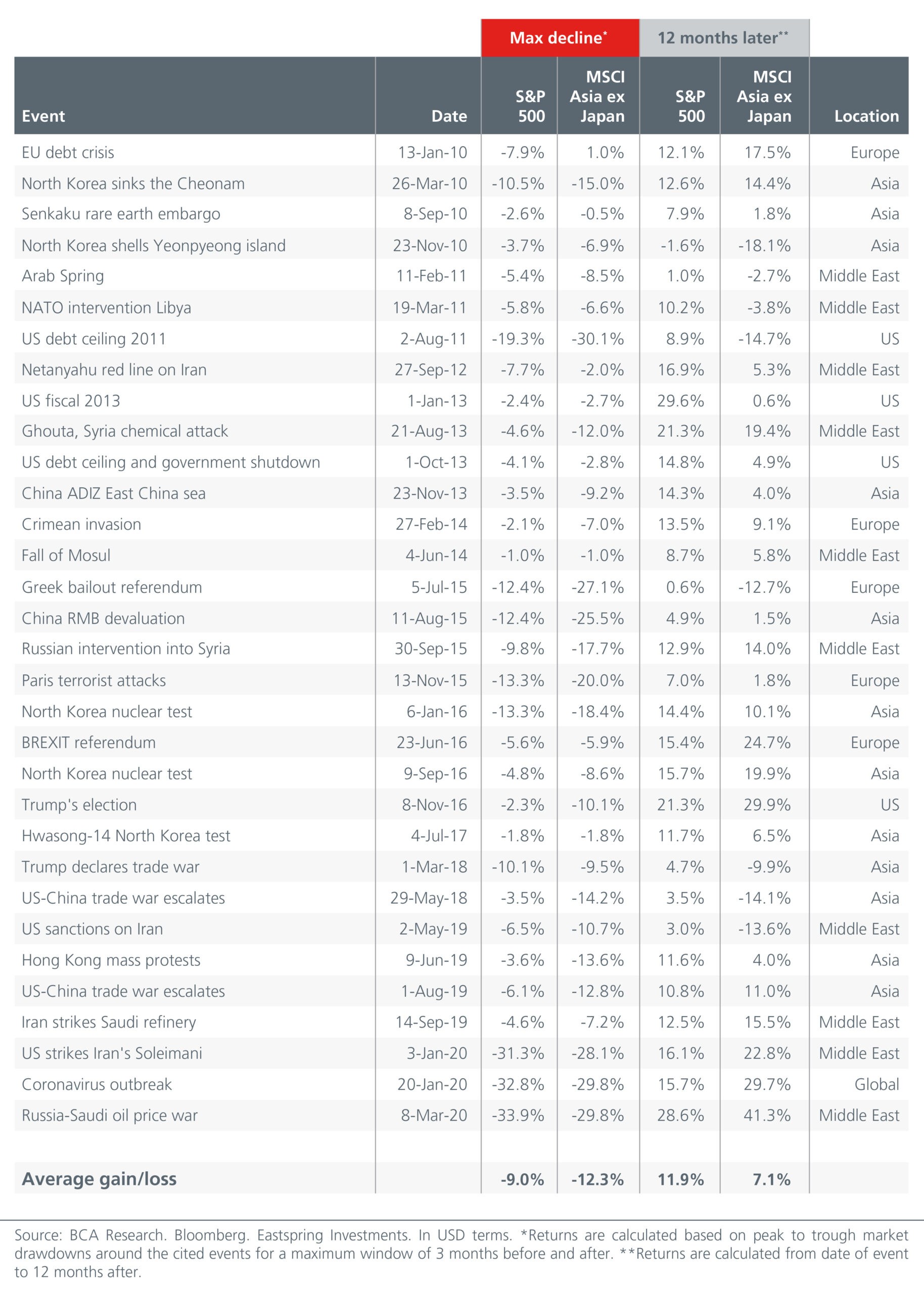

Importantly, 12 months following the cited geopolitical events, the average returns for the S&P 500 and MSCI Asia ex Japan indices have been positive at 11.9% and 7.1% respectively. History shows that geopolitics have been largely responsible for market pullbacks, but not bear markets. See Fig. 3.

Fig. 3. Geopolitical events and impact on US and Asian equity markets

While geopolitical risks are currently very much in focus, inflation is likely to be the more enduring theme for markets going forward and have a longer lasting impact on portfolio returns. Most investors have since accepted that inflationary pressures are here to stay. In the US, the Consumer Price Index (CPI) is likely to remain on an uptrend in 2022 while continued supply bottlenecks will feed into the core Personal Consumption Expenditures (PCE) Price Index.

Portfolio actions

Eastspring Investment’s multi asset solutions team, also known as Eastspring Portfolio Advisors (EPA), has locked in the gains from our overweight equity stance in 2021 and turned neutral on equities at the start of 2022. While we remain moderately bullish on equities in 2022, the less supportive monetary and fiscal policy backdrop as well as currently elevated equity valuations especially in the US, means that there is a need to be more tactical.

We implemented a long position on gold miners in early February. This has added value to our portfolios as market volatility rose. Meanwhile, we are looking for opportunities to turn more positive on the Emerging Markets – exports continue to be on an uptrend and economic data are beating expectations, especially in Asia and CEEMEA3. The recovery story in China remains intact as Chinese policymakers have started to ease both monetary and fiscal policies, although the domestic COVID situation could be a potential headwind in the near term.

Footnotes

Sources:

1 Statista.

2 Returns are calculated based on peak to trough market drawdowns around the cited events for a maximum window of 3 months before and after.