Macro Matters provides a concise, comprehensive look at macroeconomic themes that matter to clients.

Key takeaways

- U.S. growth has continued weakening, especially in manufacturing. Outside the U.S., the U.K./European economies are slowing more meaningfully and China’s growth is weak.

- The U.S. is gyrating toward target inflation; Europe is already there. With inflation falling, the Federal Reserve (Fed) can focus more on growth concerns.

- The Fed will likely follow its September cut with two more cuts in 2024. The European Central Bank (ECB) and the Bank of England (BoE) appear to remain more careful.

Growth: Can central banks stabilize growth?

Elevated rates and slower global growth plus a weaker U.S. labor market weighed on U.S. consumers in September. The overall level of growth indicates a soft landing, though, at around 2–3% real economic growth (growth adjusted for inflation). The Fed’s aggressive September cut of 50 basis points (bps; 100 bps = 1.00%) led the equity market to rally back to its previous all-time highs. More cuts are needed, though, to engineer a gradual slowdown as consumers become more cautious. U.S. 30-year mortgage rates have dropped from 2023’s 8.0% high to around 6.6% in late September. Both presidential candidates will likely extend current federal tax cuts set to expire in 2025.

Internationally, the growth picture looks worse—Germany and France slowed more meaningfully lately. Germany has probably entered a recession. While China’s growth remains weak, the latest monetary and fiscal measures are a significant step in the right direction, although it remains to be seen if consumer confidence improves.

Inflation: Has it become a non-issue, or could it possibly resurge?

The latest U.S. inflation reading confirmed our predicted downward inflation trend, with headline inflation at 2.4% and core inflation a bit higher at 3.3%. The market expects a total of 50 bps in additional Fed rate cuts this year. With September’s 50-bp cut, we’ve seen the expectation for inflation rising, though from very low levels—but this is something to watch for as the rate-cutting cycle progresses.

Internationally, Europe and U.K. data point to further inflation moderation driven by weaker growth and cautious consumers. Germany’s inflation dropped below the ECB’s 2% target while the U.K.’s stabilized at 2.2% year over year. China’s inflation remains close to 0% while the country’s producer prices remain negative.

Rates: Global central banks need to keep pace with the Fed.

Fed Chair Powell’s Jackson Hole speech mentioned little tolerance of further weakening in employment data. The market has priced in an additional 50 bps in cuts by year-end. Beyond 2024, a big focus will be on what terminal rate the Fed believes will stabilize growth without raising inflation.

Outside the U.S., growth and inflation remained weaker and more rate cuts are expected. While the BoE’s and the ECB’s rhetoric remain cautious, the latest inflation numbers suggest a more aggressive approach is warranted to support growth. The current approach—dependence on mainly backward-looking wage and service price data—risks falling behind the curve. The rates market has moved to price a 90% probability the ECB will cut rates in October while the probability the BoE will cut twice more in 2024 has increased to 55%.

Implications for fixed income

Conditions for fixed income generally remain very favorable. Also, higher-yielding bonds should remain supported by economies that avoid recession. Inflation’s decline allows global central banks to now focus more on supporting economic growth. Interest rates should continue falling on the short end of the curve, and the longer end will also be supported by the rate cuts. A recovery in inflation expectations, though, could mean longer-maturity bonds continue underperforming shortand medium-term bonds, leading to further steepening of the yield curve in the U.S. and other developed regions, like the eurozone and the U.K. Over the short term, we expect volatility to remain elevated. Since aggressive rate cuts are already priced in, stronger-than-expected U.S. growth data could lead to some profit-taking in the bond market. Nevertheless, the longer-term picture remains positive. We continue favoring U.S. bonds with lower-to-medium-term durations and higher quality in the U.S. that should benefit from further rate cuts.

International bonds remain supported by lower growth and inflation, and real yields have continued improving with falling inflation. We believe emerging market bonds should also benefit from a weaker U.S. dollar.

Implications for equities

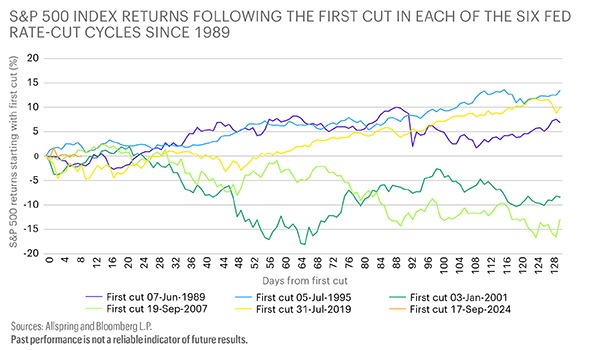

We remain constructive on equities for the remainder of 2024. Earnings have been mixed but generally have surprised on the upside. While a slowing economy could lead to earnings disappointments, the equity market overall should remain supported by the lower-rate outlook as long as a recession can be avoided, as seen in the chart above. Equity volatility is likely to increase, and we might see more rotation into cheaper parts of the U.S. and international equity markets. However, absolute performance will likely remain supported by the prospects of monetary easing and the U.S. economic outlook.

We expect the equity rally to continue and to broaden beyond U.S. mega caps into U.S. small caps and international equities, including emerging markets. The latest monetary and fiscal stimuli announced by the Chinese authorities are powerful enough to move short-term sentiment positive. Cheaper valuations, lower real rates, and weaker currencies all support the potential for outperformance by emerging market equities. We believe focusing on quality and valuation remains a prudent approach.

Implications for multi-asset portfolios

We continue to like both bonds and equities over inflation-sensitive assets like commodities. Both equities and bonds showed positive performance in September, driven by the outlook of further monetary easing. Commodities showed a strong rebound, partly driven by the bad weather and partly driven by geopolitical risk and China’s latest easing measures. That said, the commodity rally is unlikely to last as external demand and global growth remain weaker. We continue to prefer the U.S. and Europe within equities. Within bonds, we still prefer shorter maturities over longer ones because we expect the yield curve to steepen. The U.S. dollar has weakened more meaningfully lately, and in our view, any further weakening would strengthen the case for emerging market exposure.

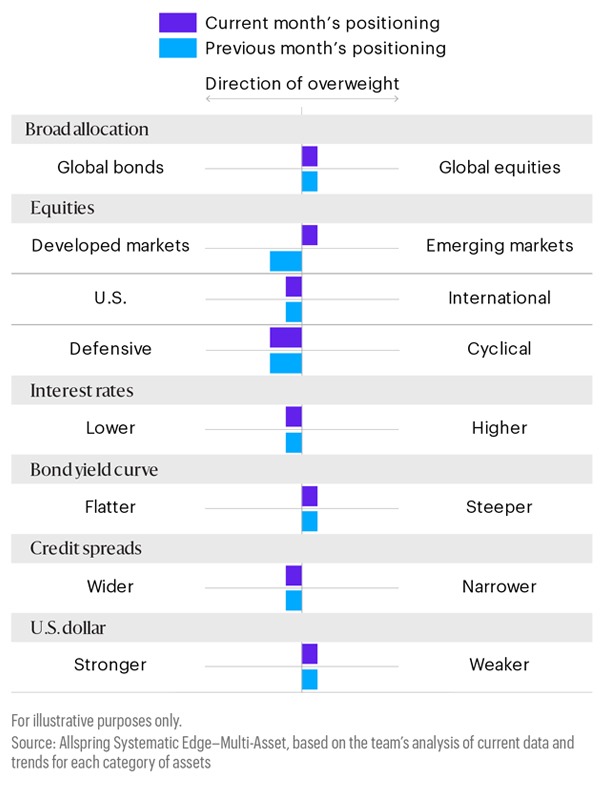

Potential allocations based on today’s environment

The table below depicts our views on short-term trends. These perspectives are developed using quantitative analysis of data over the past 30 years overlaid with qualitative analysis by Allspring investment professionals. The positioning of each bar in the table shows the direction and magnitude of an overweight.