A calibrated, progressive approach of implementing virtual accounts can be highly beneficial to corporates, even in a diverse region like APAC.

The digital revolution in treasury management has given corporates better visibility and control of their transactions and cash positions. Treasurers are now able to pay, collect and reconcile transactions more efficiently. Yet, cash still sits in numerous bank accounts of business units, often across countries, and needs to be actively monitored and managed for optimal utilisation.

As companies continuously strive for treasury centralisation and automation, virtual account management (VAM) is a game changer that helps reduce the number of physical accounts, and enable real-time cash and liquidity management. It gives corporates self-service capabilities to create distinct sub-ledgers, or virtual accounts, within a physical account. Besides rationalising account structures, VAM centralises transaction processing and gives treasurers an instant overview of the company’s cash across businesses while managing accounts in multiple currencies and businesses through a virtual ledger.

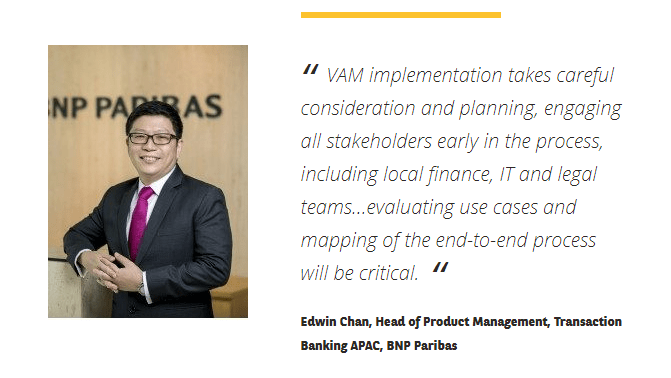

“Though VAM has gained popularity over the past decade in Europe, where regulatory and accounting regimes are relatively homogenous, the more diverse landscape across Asia Pacific (APAC) calls for a calibrated approach,” says Edwin Chan, Head of Product Management, Transaction Banking APAC, BNP Paribas. At this year’s BNP Paribas APAC Treasury Board meeting, the majority of participants expressed varying degrees of familiarity with VAM, but many felt that regulatory restrictions would make region-wide implementation challenging. Even so, “Singapore, Hong Kong, Australia, and Japan have conducive regulatory frameworks and house regional headquarters of many large corporates, making them ideal starting points to launch VAM in APAC,” explained Chan

Implementing VAM in APAC: the way forward

Some of the key accounting and regulatory considerations in implementing VAM in APAC are similar to those faced in deploying regional liquidity management structures. As subsidiaries no longer need to maintain their own bank accounts, the virtual account becomes an intercompany ledger, aggregating cash positions, as well as the underlying transactions of various entities. Therefore, it is also important to review internal policies and processes before embarking on the virtual account journey:

Treasury’s role and responsibilities: Internal policies governing the role and responsibilities of the treasury department towards the corporate’s business entities may need to be amended to ensure KPIs and legal working relationships are agreed upon within the organisation before switching from a bank managed account structure to a self-service account management process under VAM. This may require establishing accounting policies and legal agreements between business units and the centralised treasury.

Legal segregation of money: Since VAM consolidates cash from various business entities into a single physical account, it is imperative to legally ring-fence the money attributable to each entity for accounting and regulatory purposes as well as to protect the interests of the corporate from claims or disputes pertaining to one or more units. Since VAM’s centrally managed accounting ledger takes the major step of combining payments and collections on behalf of the units (POBO and COBO), accounting functions and liquidity management objectives into one overarching process, ring fencing the legal right of money and ownership of funds of the business entities becomes a complex centralisation exercise. Any enhancement to existing FX policies may also add to these complexities.

Regulatory challenges and the role of banks: Unlike in Europe, corporates and banks in APAC need to navigate diverse regulatory regimes. Rules on accounting consolidation — such as POBO/COBO, liquidity management and FX repatriation — also vary widely. Hence, banks will need to take the advisory route in helping corporates figure out the areas where VAM schemes can work and the efficiency of such structures. Banks and corporates would also need to work with regulators to allay their concerns and make the case for establishing regulatory frameworks to make region-wide VAM structures a reality.

Aligning corporate ERP and internal systems: To implement a self-service account management process via VAM, treasurers will need to ensure their current ERP systems can pair up and synchronise with the segregation and administration of virtual account ledger assignment to the business entities. Once VAM is implemented, the treasurer would need to figure out the best way of synchronisation between the bank and corporate structures.

Single or multi-bank VAM system: While implementing a single-bank VAM would be straightforward, corporates will typically want to work with more than one bank. A multi-bank VAM would involve the use of third-party software to build a consolidated virtual ledger. There are also third-party VAM systems in the market that add on to corporate ERP systems, and some software companies also offer VAM solutions to banks to accelerate the time to market. However, establishing a multibank VAM will be an intricate process requiring a trial-and-error approach as banks may offer different levels of VAM services.

Embracing a virtual future

While it’s still early days in the evolution of VAM, especially in APAC, the solution is undoubtedly a powerful treasury management tool and the strategic enabler of treasury transformation.

“VAM implementation takes careful consideration and planning, engaging all stakeholders early in the process, including local finance, IT and legal teams”, notes Chan. “Examining the underlying objectives and requirements, evaluating use cases and mapping of the end-to-end process will be critical.” Corporates thinking about implementing VAM would need to consider engaging a trusted bank partner or a system provider to co-journey with them in this important centralisation exercise.