There has been much focus on whether Trump could force the US trading partners into a so-called “Mar-a-Lago Accord” to weaken the dollar. Chief Strategist Lars Mouland reflects on what such a deal could entail.

The phrase “Mar-a-Lago Accord” was coined by US money market wizard and previous Credit Suisse Strategist Zoltan Poszar back in June 2024 on an idea that the US could force countries to accept a weaker dollar and lower interest rates on their US Treasury investments in order to still be protected by the US security umbrella. The phrase is a spin-off of the 1985 “Plaza Accord” where France, Japan, West Germany and the UK agreed with the US to jointly weaken the dollar. Replacing the Plaza Hotel in New York (which Trump owned from 1988 to 1995) with Trump’s Mar-a-Lago Club in Palm Beach, Florida, as the venue of a potential new deal seems fitting and makes for a catchy phrase.

The idea was picked up by then Hudson Capital’s strategist Stephen Miran and outlined in more detail in November. Miran’s paper did not really catch the market’s attention before he ascended to chairman of Trump’s Council of Economic Advisors. The paper provides a sort of intellectual framework for much of what Trump is currently doing with security and trade policies.

The rationale

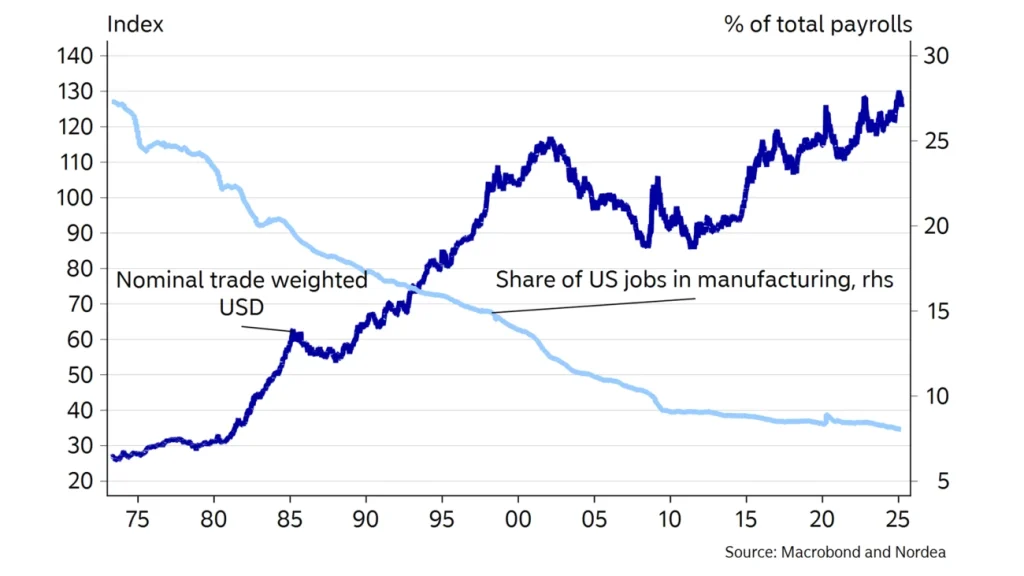

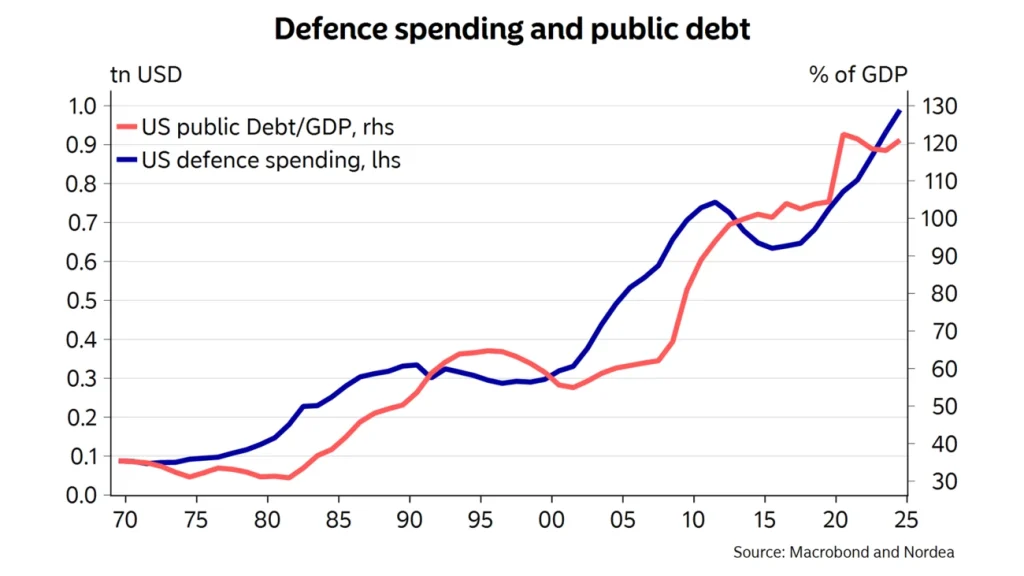

In Trump’s opinion, the main reason for the demise of the American Dream is an artificially strong dollar, which has led to the dismantling of US manufacturing and loss of “well-paying blue collar jobs.” The strong dollar is a result of its status as reserve currency, which amplifies investments into the US. With local manufacturing uncompetitive, the US is then forced to increase imports, leaving it dependent on foreign countries for a number of goods. With other countries (China for instance) unfairly supporting their manufacturing sectors, the problem is amplified. Connected to this problem is also the US role of global police, leaving it with a large military cost burden, which again leads to public deficits and debts (easily financed because of the dollar’s reserve status).

Trump sees the stronger dollar as the main reason for the falling share of US industrial jobs

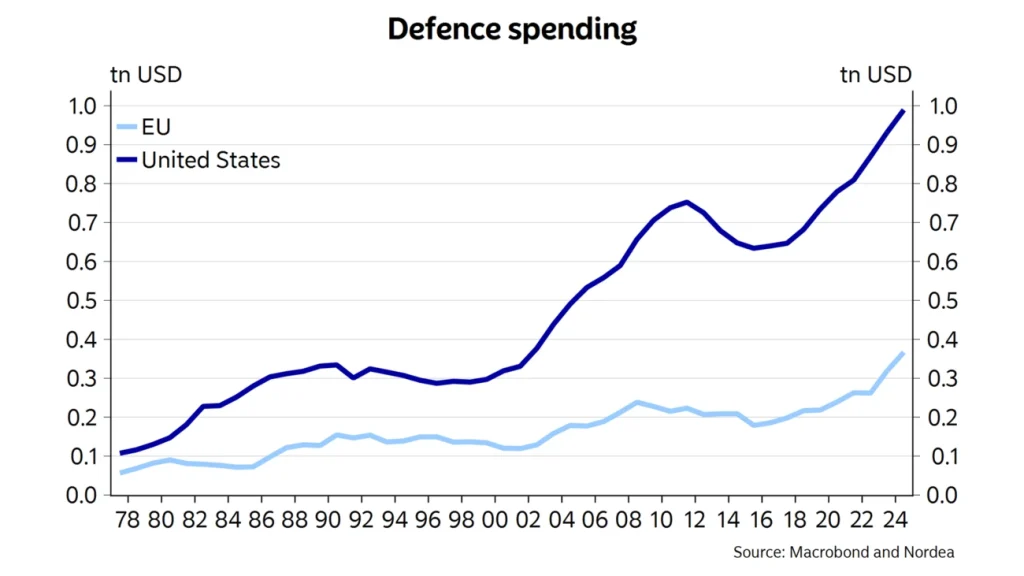

The thinking goes: In order to bring the system into a more “fair” balance, the US should demand a weaker dollar and disincentivise imports to rekindle domestic manufacturing. It should also make other countries pay a larger share of the defence bill themselves and accept a lower payout on their US treasuries for paydown of past security guarantees. Countries that do not agree to these terms should be left out in the cold.

The US is taking on a disproportionately large share of defense spending, leading to increasing public debt

Current actions

Tariffs are in this regard seen as an important instrument. One the one hand, raising tariffs will heavily incentivise foreign companies to move production capacity to the US, and this creates domestic jobs. Revenues from tariffs will help reduce the fiscal deficit and open up for tax cuts, which again makes it more attractive to invest in the US. The threat of tariffs is also seen as a bargaining tool to make other countries bend to the will of the US in terms of military spending, immigration, drug smuggling, etc.

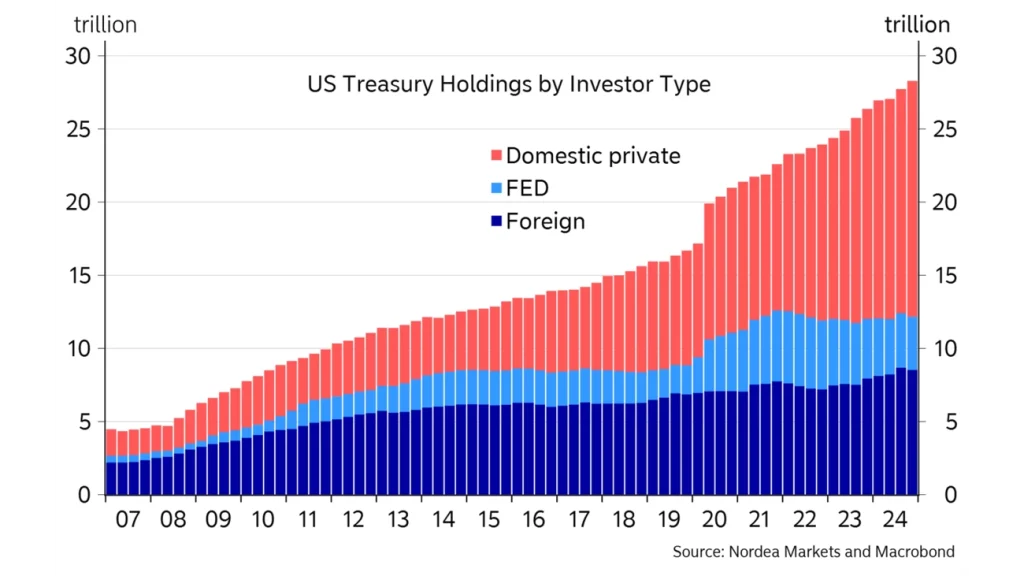

Trump himself has not openly advocated for the idea of an accord, but some of his policies could be seen as working in this direction. The threat of a US retreat from NATO and closer ties with Russia have led to a massive increase in European defense spending. Higher tariffs have led to several companies announcing large investment plans in the US. The dollar has also weakened, mostly as a result of global investors allocating away from American equities. So far, the more financially nuclear option of restructuring the outstanding US debt, either by applying a tax on coupons, lowering coupons or terming the debt out to 100 years has so far not been seriously discussed. US Treasuries are the backbone of large parts of the global financial system, and messing it up could have serious repercussions. Less than a third of US Treasury securities are held abroad, so in order to meaningfully reduce the overall public debt, you could not spare domestic investors.

Only restructuring the foreign-owned US Treasuries would still leave a lot of debt

While we already are seeing parts of Miran’s Mar-a-Lago Accord in action, we doubt that we will see a globally coordinated deal à la 1985’s Plaza Accord. Back then, most currencies were still administered by central banks, and the financial market had a much smaller role in the economies. Effectively controlling the level of the dollar would be much harder right now. Defaulting on the US Treasury debt would surely lead to a much weaker dollar, but it would come with a lot of unwanted side effects. If the Trump administration starts to float such an idea, it could lead to a marked selloff in the US bond market.

Regardless of a coordinated accord to weaken the dollar, we still expect the fallout of US policies to weaken the dollar over time. A more isolationist US should lead to less foreign investments and lower growth rates over time, as will a more restrictive fiscal policy. Higher European defense and infrastructure spending will increase growth and reduce the economic gap to the US while also opening up for investment opportunities outside of the US.

See the full analysis on Nordea Corporate, Macro & Markets: Mar-a-Lago accord?