Concerns about rising interest rates – and their likely impact on borrowing costs and economic growth – have once again been to the fore this week, pushing stock markets in Europe and the US lower.

The European Central Bank (ECB) confirmed on Thursday that it would raise rates for the first time in 11 years when it meets next month as it attempts to bring rampant eurozone inflation under control. The ECB is also planning to bring its asset-purchase programme to a halt. This has raised fears that some heavily indebted European Union member states such as Italy, Spain and Greece could see their borrowing costs rise more rapidly than in, say, Germany or France. This disparity could act as an additional brake on eurozone growth while also making monetary policy more challenging to formulate.

There were few signs this week that inflationary pressures are likely to ease in the weeks ahead: the price of oil, for example, remains stubbornly high thanks in part to an easing of Covid-19 restrictions in China and the likelihood that the country’s industrial production will start to ramp up in the coming weeks. The World Bank cited sharp price rises as the main reason for it downgrading its global growth forecast for 2022, which was cut to 2.9% from 4.1%. The organisation added that rising interest rates coupled with soaring prices were likely to create a significant risk of stagflation.

US markets

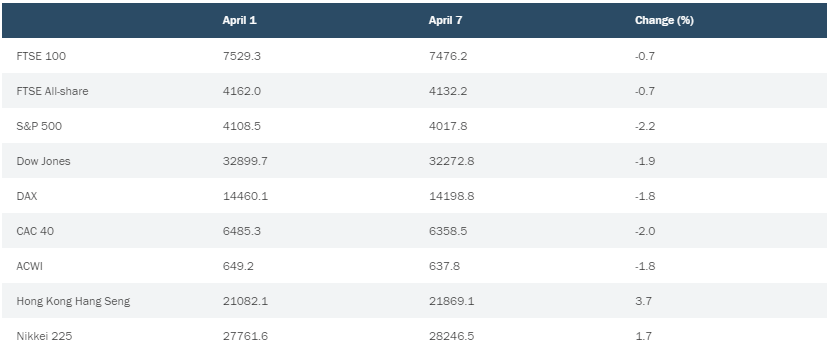

On Wall Street, the Dow Jones Industrial Average ended trading on Thursday 9 June 1.9% down for the week so far, with the S&P 500 losing 2.2%. Following gains at the start of the week, share prices in the US fell on Wednesday and Thursday as investors anticipated yet more worrying inflation data at the end of the week.

Europe

Asia

Note: all market data contained within the article is sourced from Bloomberg unless stated otherwise, as at 9 June 2022.

2 Oil giant Shell to take £3.8bn hit by leaving Russia, bbc.co.uk, 7/4/2022.