Global stock markets have managed to hold on to last week’s gains despite another central bank interest-rate increase, gloomy economic data and growing political tension between the United States and China.

Tensions over Taiwan

The visit by US House of Representatives Speaker Nancy Pelosi to Taiwan – which China considers to be a breakaway province – prompted Beijing to retaliate by planning a series of live-fire naval exercises. This led to heavy losses on equity indexes in mainland China as well as in the US at the start of the week.

Economic news has been largely negative, with high commodity and energy prices in recent months prompting a slowdown in global factory output in July: most notably, factory production fell in China, while electronics powerhouses South Korean and Taiwan both recorded their first dip since 2020.

Bank of England raises interest rates

The Bank of England (BoE) ratcheted up the pace of monetary-policy tightening, raising the bank rate by 50 basis points to 1.75% – its highest level since 2009 – as officials struggle to bring surging prices under control.

A fall in the oil price at the end of the week – despite President Biden’s unsuccessful attempt to persuade Organization of Petroleum Exporting Countries (OPEC) members to significantly boost production – raised hopes that inflationary pressures could start to recede in the weeks ahead.

Earnings boost sentiment in the US

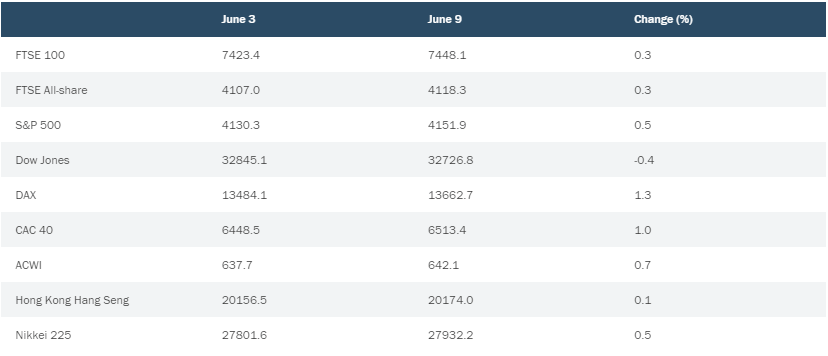

On Wall Street, the Dow Jones Industrial Average ended trading on Thursday 0.4% down for the week so far, with the S&P 500 gaining 0.5%. New figures showed the US economy remained weak last month following its second-quarter contraction, but investors appear to be in a largely positive mood given the relatively strong earnings season and the fact there will be no further interest-rate increases until the next Federal Reserve meeting in September.

In the UK, the FTSE 100 closed on Thursday 0.3% up for the week, with sterling weakness helping to underpin the index. The exceptionally downbeat picture painted by the BoE at its August meeting suggested UK inflation could hit 13% in the autumn – largely because of the energy crisis created by Russia’s invasion of Ukraine in February.

While a recession in Britain seems now to be priced in by investors, the Bank predicted inflation could return to near its long-term 2% target by 2024.

In Frankfurt, the DAX index ended Thursday’s session up 1.3% for the week, while France’s CAC 40 gained 1%. Strong second-quarter company earnings and a surprise upswing in factory orders in June helped German stocks continue their recent rebound. Meanwhile, lawmakers in Paris approved a relief package to help French households deal with soaring energy bills and consumer prices.

Asia recovers from early losses

In Asia, the Hang Seng index in Hong Kong had edged ahead 0.1% for the week by Thursday’s close. Early losses prompted by US-China tensions on Monday and Tuesday were clawed back towards the end of the week by expectations of strong earnings for major technology companies.

Japan’s Nikkei 225 index of leading shares finished 0.5% ahead with the weakening yen again helping to boost the domestic value of shares in multinational companies.

Note: all market data contained within the article is sourced from Bloomberg unless stated otherwise, as at 5 August 2022.

2 Oil giant Shell to take £3.8bn hit by leaving Russia, bbc.co.uk, 7/4/2022.

Important information

For marketing purposes.

This document is intended for informational purposes only and should not be considered representative of any particular investment. This should not be considered an offer or solicitation to buy or sell any securities or other financial instruments, or to provide investment advice or services. Investing involves risk including the risk of loss of principal. Your capital is at risk. Market risk may affect a single issuer, sector of the economy, industry or the market as a whole. The value of investments is not guaranteed, and therefore an investor may not get back the amount invested. International investing involves certain risks and volatility due to potential political, economic or currency fluctuations and different financial and accounting standards. The securities included herein are for illustrative purposes only, subject to change and should not be construed as a recommendation to buy or sell. Securities discussed may or may not prove profitable. The views expressed are as of the date given, may change as market or other conditions change and may differ from views expressed by other Columbia Threadneedle Investments (Columbia Threadneedle) associates or affiliates. Actual investments or investment decisions made by Columbia Threadneedle and its affiliates, whether for its own account or on behalf of clients, may not necessarily reflect the views expressed. This information is not intended to provide investment advice and does not take into consideration individual investor circumstances. Investment decisions should always be made based on an investor’s specific financial needs, objectives, goals, time horizon and risk tolerance. Asset classes described may not be suitable for all investors. Past performance does not guarantee future results, and no forecast should be considered a guarantee either. Information and opinions provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed. This document and its contents have not been reviewed by any regulatory authority.

In the UK: issued by Threadneedle Asset Management Limited, registered in England and Wales, No. 573204. Registered Office: Cannon Place, 78 Cannon Street, London EC4N 6AG. Authorised and regulated in the UK by the Financial Conduct Authority.

In Singapore: Issued by Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapore 239519, which is regulated in Singapore by the Monetary Authority of Singapore under the Securities and Futures Act (Chapter 289). Registration number: 201101559W. This advertisement has not been reviewed by the Monetary Authority of Singapore.

In Hong Kong: Issued by Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司. Unit 3004, Two Exchange Square, 8 Cownnaught Place, Hong Kong, which is licensed by the Securities and Futures Commission (“SFC”) to conduct Type 1 regulated activities (CE:AQA779). Registered in Hong Kong under the Companies Ordinance (Chapter 622), No. 1173058.

Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies.