Last month we noted that there had been a change in leadership in the equity market, with Europe taking on the baton of strength from the US, and a shift in the key themes that are driving the market. For the US, the support of the index from the ‘Magnificent Seven[i]’ technology companies has waned, albeit with some very recent recovery, meaning negative returns for the year so far. Europe however has soared, with equities as measured by the MSCI Europe Index up by over +10% in sterling[ii] and more in US dollars as the dollar has weakened. The narrative has been about the defence sector’s stellar returns on the back of clear governmental commitment to increasing spending as the security umbrella offered by the US appears to seep away, but in fact the biggest sector contributor to the European index’s return has been Financials. Banks have found a lot of favour in the market as the prospect of fiscal stimulus, the effects of tariffs, and geopolitical uncertainty affecting the cost of commodities are thought to lead to higher inflation and thus interest rates over time. However, within the Industrials sector it is certainly defence and related companies that have shone from a market perspective, with companies like Rheinmetall, Thales and Dassault Aviation spiking upward so far in 2025.

The Evenlode Global Income fund has charted a course between the two extremes of market returns on either side of the Atlantic so far this year. If there is a consistent narrative for the fund, then it is a prosaic one of delivering dividend growth through time. As we passed the end of the fund’s financial year last month we delivered on that growth ambition, with the distribution for the year growing +15% in sterling.[iii] This is above what we would normally expect from the fund and is in part driven by portfolio changes, but the steady growth that the portfolio has delivered since the onset of the covid pandemic five years ago is encouraging to see. It likely in part explains the total return experience this year – it’s a relatively defensive equity strategy so we expect some downside protection and equally do not expect to keep up with every narrative that pushes the market upward. ‘Consistent dividend growth’ is a headline that is unlikely to grab attention in the financial press, and that means that there is often a valuation opportunity in companies that churn out cash for the benefit of shareholders consistently. In a sense it’s the under-the-radar nature performance of companies that can chug along like this that creates the long-term opportunity over time, as the market often under-values persistent cash generation.

Valuation, growth and some cash today

To explain a little about how we approach the delivery of our dividend growth aim in practice, we can look at our opportunity set through the lens of another of the core parts of our philosophy, namely that managing valuation risk and opportunity in the market is prudent over time. Even the best business can be a bad investment if bought at an inflated valuation, and conversely good companies with near-term challenges can sometimes be bought at knock-down prices in the market. Our approach is not a ‘deep value’ one though, and so we do not just invest in companies that look the cheapest. Rather we look for the combination that can deliver yield today and growth in that yield, whilst managing valuation risk for our clients.

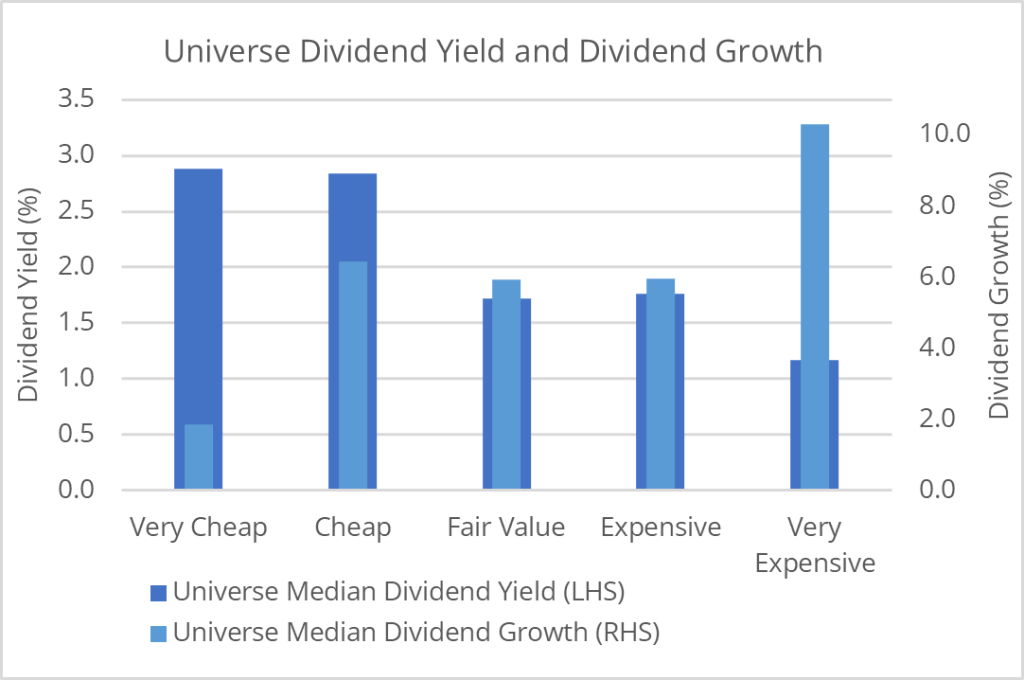

To illustrate this, we can take a look at our investable universe of companies, on which we have done our research, and have concluded that they have the characteristics we seek and

we could invest in on our clients’ behalf if the price makes sense. For each of these businesses we make an estimate of its valuation, and by splitting the universe into five buckets from the cheapest to the most expensive we can see some dividend-related trends[iv].

The chart above shows that the companies that we estimate to be ‘cheap’ or ‘very cheap’ have the most attractive yields. That makes intuitive sense, as all other things being equal lower prices mean higher yields. However, the very cheap companies also have the lowest recent dividend growth on average. This is one reason why we don’t just invest in the very cheapest companies – while there can be a valuation opportunity, something could be sacrificed depending on the market conditions. At the moment that something is dividend growth.

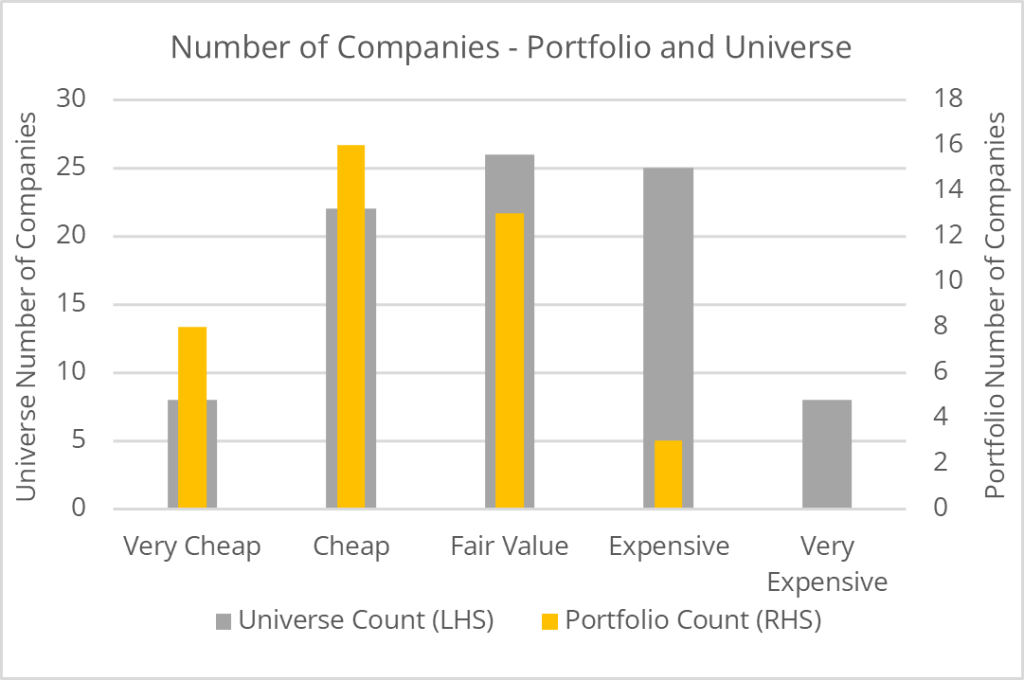

As we move toward the more expensive valuations in our investable universe not much changes until we get to the most expensive companies, where dividend growth is higher, but yields are much lower. These aren’t the only considerations that we use to guide portfolio construction, but they are instructive. The following chart shows the distribution of companies in the portfolio compared to our investable universe across the valuation spectrum[v].

At the very cheap end we have some companies in the portfolio as there is a valuation opportunity and we get some high yields, but lower growth. We expect these companies to grow but not at a fast rate, so there are a smaller number of them.

At the other extreme we don’t have any exposure to companies that are, in our estimation, trading at a very expensive valuation in the market. This is something of a characteristic of the market at the moment, which despite declines in certain areas is still valuing growth very highly. There are higher dividend growth rates available, but the price tag is high too.

In between is where the bulk of the portfolio sits; companies that are trading in line with our estimate of their valuation or a bit better. This is really the sweet spot for our strategy; mid-to-high single digit dividend growth can be captured if we are selective in this part of the market, at valuations that don’t present too many risks. That’s why we don’t expect the double-digit percentage dividend increase we experienced last year to be the norm. It’s not actually what we see in our universe, but we do see revenue, profit and cash flow growth that can consistently support an attractive rate of growth through time.

EssilorLuxottica - Narrative clearly seen?

At the level of individual company holdings our recent disposal of eyewear giant EssilorLuxottica is a good illustration of this positioning in action. We think EssilorLuxottica is a great business, and we hope we get the chance to invest in it again, but at a valuation that better reflects the risks as well as the opportunities the company faces.

EssilorLuxottica is the global market leader in eyewear, across lenses, frames, retail and insurance, sunglasses and prescriptions. Eyewear market growth is driven by deteriorating eyesight in developed markets and increasing eyecare coverage by healthcare systems elsewhere. This has been reflected in EssilorLuxottica’s financial performance with organic revenue growth at 6-7% over the past three years, a good rate that is in line with what we would expect for the company.

Recent share price performance has been very strong. This move has propelled the company’s valuation towards the ‘very expensive’ end of the charts above, which has made other positions more attractive to us on a risk-reward basis. As a sense check, EssilorLuxottica’s price/earnings ratio[vi] increased to about 50x at the peak in February, which rationally would imply very strong future growth prospects if investors are willing to put up 50 years of current earnings to buy the stock. Whilst growth should be solid with some tailwinds, this is still a very high valuation.

This is perhaps where market narrative has played its part. An opportunity that the market is getting excited about and perhaps captures the techno zeitgeist more than corrective lenses, is EssilorLuxottica’s partnership with Meta in smart glasses. This could be the next great consumer computing platform with EssilorLuxottica occupying a similar competitive position as in their core business. But questions remain on consumer adoption and competition. Ray-Ban’s branding and the ability to flex the technology across different styles of glasses are an advantage for EssilorLuxottica, but companies like Apple, who are looking for ways to diversify away from the iPhone, will be paying close attention should the category succeed, and have a decent track record at defining the next era of consumer technology in a stylish package.

Like with all the market drivers noted above there is a genuine real-world opportunity for EssilorLuxottica. For a long time, its opportunities were being reasonably valued by the market; for now, thanks to the appeal of the technology narrative, the market price looks high compared to solid but not spectacular growth.

Narratives in the market are nothing new and new ones will doubtless emerge. Our valuation framework alongside fundamental analysis of businesses gives us a view as to whether those narratives shift the risks associated with market prices for shares in a company beyond what is acceptable, or toward a margin of safety. As the US market dwarfs the European market from a market capitalisation point of view it is the move downward that has dominated global equity market returns more recently. But Europe’s spirited showing demonstrates that each part of the market can have its day if the wind is behind it.

Ben P., Ben A., Chris, Phoebe, Rob and the Evenlode team

28 March 2025

Evenlode has developed a Glossary to assist investors to better understand commonly used terms.

Please note, these views represent the opinions of the Evenlode Team as of 28 March 2025 and do not constitute investment advice. Where opinions are expressed, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice. This document is not intended as a recommendation to invest in any particular asset class, security, or strategy. The information provided is for illustrative purposes only and should not be relied upon as a recommendation to buy or sell securities. For full information on fund risks and costs and charges, please refer to the Key Investor Information Documents, Annual & Interim Reports and the Prospectus, which are available on the Evenlode Investment Management website (https://evenlodeinvestment.com). Recent performance information is also shown on factsheets, also available on the website. Past performance is not a guide to future returns. The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Fund performance figures are shown inclusive of reinvested income and net of the ongoing charges and portfolio transaction costs unless otherwise stated. The figures do not reflect any entry charge paid by individual investors. Current forecasts provided for transparency purposes, are subject to change and are not guaranteed. Source: Evenlode Investment Management Limited, authorised and regulated by the Financial Conduct Authority, No. 767844.

Market data is from S&P CapIQ, Bloomberg and FE Analytics unless otherwise stated.

[i]The Magnificent Seven refers to seven dominant US tech companies—Apple, Microsoft, Amazon, Alphabet, Meta, Nvidia, and Tesla—that played a crucial role in driving market growth over recent years.

[ii]31 December 2024 – 25 March 2025 total return basis.

[iii] B Inc GBP share class.

[iv]Source: Evenlode, S&P CapIQ, 19 March 2025. Dividend growth is latest fiscal year percentage change compared to the previous. Dividend Yield – A measure of income from an investment over a 12-month period. Calculated by dividing the dividend per share by the current share price.

[v]Source: Evenlode, 19 March 2025.

[vi]The price/earnings ratio is the company’s share price divided by its earnings per share, a commonly used valuation metric.