For investors seeking predictable returns and income, the one place where they can be found is emerging market corporate bonds. It’s an asset class that provides higher yields than its developed market peers, and where, in our view, the risk-reward payoff is compelling.

The emerging markets make up a substantial chunk of the globe, offering a vast pool of choice. As most investors know, diversification is an effective way to mitigate risk and emerging market corporate bonds exhibit a lower level of volatility than generally perceived. Therefore, it is an asset class where it is possible to build a well-diversified portfolio.

In order to provide an effective way to allocate to emerging market corporate bonds and benefit from the yields on offer, we are launching a fixed maturity fund that gives investors a clear idea of the yield they will receive, the Vontobel Fund II – Fixed Maturity Emerging Market Bonds 2026. The portfolio of bonds will be setup at launch, aiming to provide an annual yield of around 4.7% (in USD) over the coming five years.

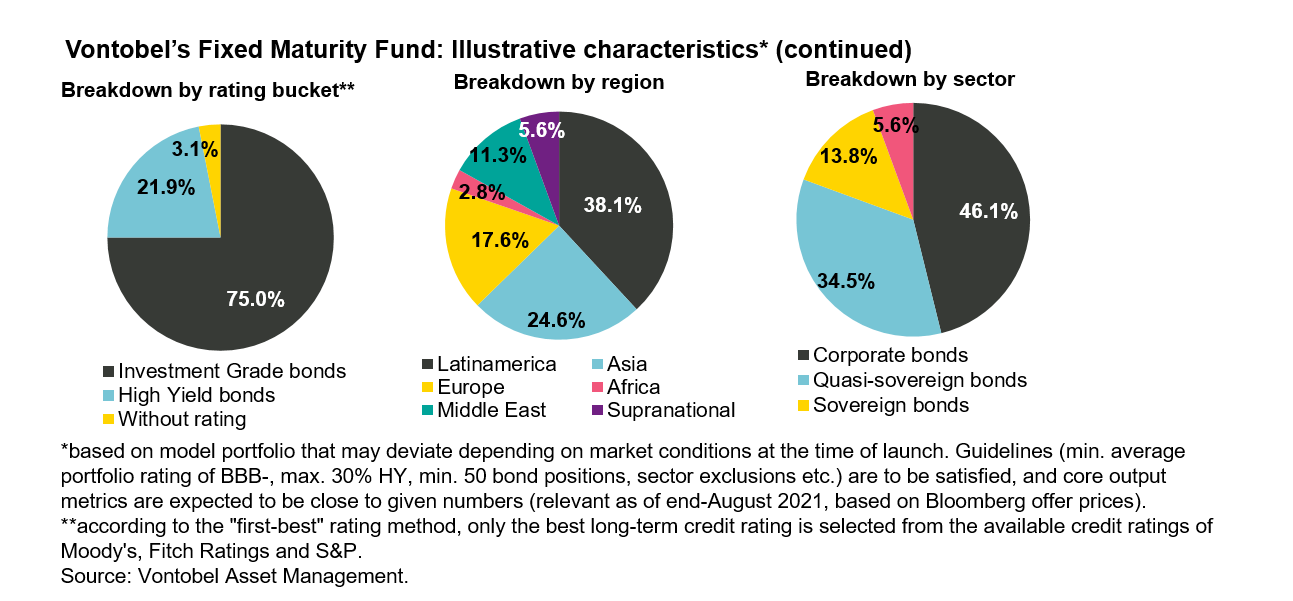

Built on a portfolio of mainly high-quality bonds, is well diversified across regions and sectors.

It’s all about consistent returns

Emerging market corporate bonds shows higher spreads (and lower duration) than their developed market equivalents. Spread is the extra return a bond offers compared to a risk-free alternative of similar maturity.

Historically, the higher the starting yield, the higher the long-term annualized return. While history is no guarantee of future performance, it suggests that these higher yields should feed into higher future returns.

Given the ongoing low-rate environment globally, it is a challenge to glean returns from rates. As long as rates remain low, spreads are where future returns should come from.

So, how do we go about creating a portfolio with a fixed maturity for five years capable of taking advantage of the higher spreads and generating yield for investors? We do this with two core building blocks: high-quality and diversification.

Diversification and quality

Emerging markets are a broad and diverse asset class. For active investors, the world is literally their oyster with opportunities on offer in Asia, Latin America, the Middle East, Europe, and Africa. The portfolio for the Fixed Maturity 2026 fund aims to diversify its holdings to take advantage of all emerging market regions (see chart below).

Recent events in China and ensuing market volatility over the summer of 2021 have illustrated, yet again, the importance of diversification. Skillful and well-informed bottom-up issuer selection as well as maximum diversification are key to minimizing overall risk over time.

Diversification alone is not sufficient to create a solid portfolio. With emerging market corporate bonds providing wider spreads for a similar credit rating compared to their developed market peers, investors can stock up on high-quality bonds while still benefiting from ample yields. For the Fixed Maturity 2026 fund, a minimum of 70% of the portfolio will be invested in investment-grade rated bonds.

To generate additional yield, the portfolio managers of the Emerging Market Bond team will seek out high-yield bonds, which they see as undervalued. Overall, the portfolio will have an average investment-grade rating (BBB-) and include no more than 50 bonds, most of which will be held to maturity, resulting in lower turnover. For bonds that mature prior to the 2026 maturity of the fund, the proceeds will be reinvested only in the most attractive alternatives identified by the team.

The end result

The Fixed Maturity Fund aims to produce a low-turnover, diversified and high-quality portfolio that will deliver yield over a five-year period. Although there is a fixed maturity to the fund, investors are not locked-in for the full term and can redeem their holdings prior to the maturity date, thus making the fund a liquid way to invest in emerging market corporate bonds. Furthermore, the Fund is SFDR Article 6 compliant and, therefore, encompasses ESG risk integration and multiple sector exclusions. The goal of the fund is to generate a yield of around 4.7% (in USD) over a five-year period whilst managing credit and other risks to deliver excess returns.

Ready, set, deliver: Don’t miss your chance to invest

A fixed maturity investment, in this environment, gives an investor predictability with a clear roadmap to the returns they can expect over a set period of time. With the excess spread available in EM corporate bonds, the yield on offer is higher than with developed market peers. This is why, on the back of our proven track record of emerging market solutions, we are offering you a fixed maturity EM corporate bond fund that will be open to subscription for a limited period of time.

Emerging market corporate bonds webinar

For more on emerging market corporate bonds please join Sergey for a webinar on 12 October 2021. Where he will discuss with you ways how to generate consistent yields from emerging market corporate bonds within a fixed maturity framework.