Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The Liontrust Strategic Bond Fund returned -0.1%* in sterling terms in May. The average return from the IA Sterling Strategic Bond sector, the Fund’s comparator benchmark, was -0.9%.

The macroeconomic emphasis of financial markets shifted in May from only worrying about inflation to adding concerns about growth. In conjunction with this, expectations for where US interest rates will peak in this cycle came off their top. We have been using the 1-year/1-year forward rate as a good proxy for peak rates as it measures expectations of where short-term rates are going after we have seen lots of rises already in the first year. This measure reached 3.4% in April, got as low as 2.8% during May and finished the month around 3.1%.

Our view is that the Federal Reserve will rapidly raise rates towards neutral, currently in the 2.25-2.50% band according to their dot plots. Barring some very significant new shock to the markets, 50 basis point rate hikes for the next two meetings look to be a certainty. What does the Federal Reserve do once they’ve reached this level? This is where the consensus between the hawks and doves on the FOMC breaks down and the state of the US economy in autumn time will sway the marginal Fed voting member. US headline inflation will be falling; the key for the Fed though will be whether inflation expectations are also falling. This is the main reason all members are happy being hawkish at present, they are desperate for high inflation expectations to not become embedded in the system. Examining 10-year US inflation breakevens, they peaked just above 3.0% in April and by the end of May they were down to 2.65%.

The US labour market remains very strong with roughly two openings available for every unemployed person. It will be a least a few quarters before the heat comes out of the labour market, but it will be driven by both the numerator and denominator of the openings/unemployed ratio. Firstly, on the numerator, the Fed’s hawkish speak and tightening financial conditions will discourage firms from hiring as many people as they would have done otherwise. Secondly, higher rates will lead to the classic economic creative destruction – as some companies fail, their staff will unfortunately enter the unemployment pool.

The US consumer remains strong and the higher socioeconomic demographic groups have excess savings accumulated during the pandemic. For lower socioeconomic groupings, the wallet substitution effect of higher commodity prices is already occurring, hence the desire for wage inflation. One other factor that will dampen demand is a large fall in housing market activity. Prime US mortgage rates have gone up from 3.1% to 5.2% this year. Cooling real estate inflation will feed through, with a lag, to the owner equivalent rents part of core CPI, meaning a current tailwind for inflation should shift to being a headwind towards the end of 2022.

Monetary policy will also be tightened via QT (quantitative tightening – the unwinding of some QE), which has now started. There is a $30bn monthly cap for the run-off of Treasury securities for 3 months, before ramping up to $60bn/month thereafter. Similarly, the Fed has initiated the run-off of mortgage-backed securities (MBS) with a $17.5bn monthly cap for three months, before ramping up to $35bn. Note though that current higher mortgage interest rates mean it’s unlikely the Fed will hit the $35bn cap in most months. Is it estimated that every $1 trillion of QT is equivalent to tightening monetary policy by 25 basis points.

Overall, it will be difficult for the Fed to engineer a soft landing, but there’s a huge area between a soft landing and a deep recession. Furthermore, there are plenty of opportunities for the Fed to alter its trajectory as it adapts to incoming economic data. We believe the US economy is robust enough to cope with rates being higher for longer in the 2-3% range, but rates much above 3% won’t stick.

Rates

While the commentary above focuses on the Fed, another central bank worthy of mention during May is the Reserve Bank of New Zealand (RBNZ). It raised rates by 50bps to 2.0% as anticipated by both the market and the vast majority of economists. The RBNZ’s sentiment is similar to the Fed’s but it started acting sooner and is prepared to go further. The minutes state: “…monetary conditions need to act as a constraint on demand until there is a better match with New Zealand’s productive capacity. A larger and earlier increase in the OCR [official cash rate] reduces the risk of inflation becoming persistent, while also providing more policy flexibility ahead in light of the highly uncertain global economic environment.”

We have had a strategic long of kiwi bonds in the strategic bond funds based on New Zealand being far further through the monetary cycle than other developed market economies. We took half of the (relative) profits a couple of weeks ago before the RBNZ meeting and are left with 0.25 years exposure. We’d increase the position size on any meaningful selloff.

Our strategic rates exposure was beneficial during May. The US Treasury market, where the majority of the Fund’s duration is, significantly outperformed European and UK bond markets. Our preference for the 5-year maturity area was also a boon.

Given the aforementioned growth concerns, we started to see a return to traditional correlations, namely that sovereign bonds were rallying on risk-off days with the opposite applying when equities were having good days. It is an early sign: if this negative correlation holds for the next few months then it is a good market signal about the growth versus inflation debate.

We took the Fund’s duration up to 4 years when 10-year US Treasuries were above 3% yield. Whilst we are still below our neutral level of 4.5 years, we are the longest we have been in many years. This reflects the view that parts of the sovereign bond universe are now offering value, but one still needs to be selective rather than just buying the whole array.

Allocation

After a torrid few months in credit markets there was a big change in sentiment towards the end of May with spreads tightening, particularly in US high yield. There was no single catalyst for this, rather it seemed to be a combination of the more sanguine outlook for peak US interest rates and a recent clear-out of positioning. Outflows from fixed income funds had either reduced, or fresh buyers emerged, which led to the buyside (fund managers) being net purchasers of credit over the week; simultaneously the sell side (investment banks), who up until recently had clearly found themselves longer on their trading books than they wanted to be, started running out of bonds to sell. So, we had the flip from bid prices being low as dealers protected their books, to a shortage of bonds and the resultant jump up in prices. How long this improved tone persists for will depend on macro factors and asset class flows. As a reminder, when valuations improved in Q1 to price in mild recession, the Fund was moved from being underweight to overweight credit. With the upcoming slowing in economic growth, one should not be surprised to read that we retain our quality defensive stance within credit.

The Fund remains neutrally allocated to investment grade corporate bonds with a 50% weighting (55% physical holdings and a minus 5% risk-reducing overlay). We prefer to spend the risk budget on high quality, high yield. The Fund has a 30% weighting, above our 20% neutral level but still below the 40% maximum allocation.

Selection

Although asset allocation was unchanged during May, we did undertake some stock rotation within the Fund. We switched bonds issued by Level 3 (a subsidiary of telecommunications company Lumen) into Goodyear Tyres for very similar spreads. Lumen is not migrating to its growth fibre business as quickly as we’d like, while the aftermarket for tyres provides a solid defensive backbone for Goodyear.

We took the last of our profits on Neptune Energy, whose bonds had held up very well compared to most other credit. The proceeds were reinvested topping up favoured holdings including AdaptHealth and Heibos.

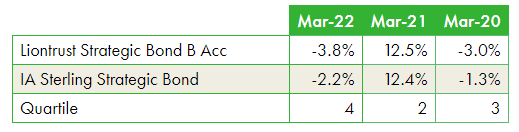

Discrete 12 month performance to last quarter end (%)**:

Past performance does not predict future returns.

*Source: Financial Express, as at 31.05.2022, accumulation B share class, total return (net of fees and income reinvested.

**Source: Financial Express, as at 31.03.2022, accumulation B share class, total return (net of fees and income reinvested. Discrete data is not available for five full 12-month periods due to the launch date of the portfolio (08.02.18).

Fund positioning data sources: UBS Delta, Liontrust.

†Adjusted underlying duration is based on the correlation of the instruments as opposed to just the mathematical weighted average of cash flows. High yield companies’ bonds exhibit less duration sensitivity as the credit risk has a bigger proportion of the total yield; the lower the credit quality the less rate-sensitive the bond. Additionally, some subordinated financials also have low duration correlations and the bonds trade on a cash price rather than spread.

Past performance is not a guide to future performance. The value of an investment and the income generated from it can fall as well as rise and is not guaranteed. You may get back less than you originally invested.

The issue of units/shares in Liontrust Funds may be subject to an initial charge, which will have an impact on the realisable value of the investment, particularly in the short term. Investments should always be considered as long term.

Investment in the Strategic Bond Fund involves foreign currencies and may be subject to fluctuations in value due to movements in exchange rates. The value of fixed income securities will fall if the issuer is unable to repay its debt or has its credit rating reduced. Generally, the higher the perceived credit risk of the issuer, the higher the rate of interest. Bond markets may be subject to reduced liquidity. The Fund may invest in derivatives. The use of derivatives may create leverage or gearing. A relatively small movement in the value of a derivative’s underlying investment may have a larger impact, positive or negative, on the value of a fund than if the underlying investment was held instead.

DISCLAIMER

This is a marketing communication. Before making an investment, you should read the relevant Prospectus and the Key Investor Information Document (KIID), which provide full product details including investment charges and risks. These documents can be obtained, free of charge, from www.liontrust.co.uk or direct from Liontrust. Always research your own investments. If you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.

This should not be construed as advice for investment in any product or security mentioned, an offer to buy or sell units/shares of Funds mentioned, or a solicitation to purchase securities in any company or investment product. Examples of stocks are provided for general information only to demonstrate our investment philosophy. The investment being promoted is for units in a fund, not directly in the underlying assets. It contains information and analysis that is believed to be accurate at the time of publication, but is subject to change without notice. Whilst care has been taken in compiling the content of this document, no representation or warranty, express or implied, is made by Liontrust as to its accuracy or completeness, including for external sources (which may have been used) which have not been verified. It should not be copied, forwarded, reproduced, divulged or otherwise distributed in any form whether by way of fax, email, oral or otherwise, in whole or in part without the express and prior written consent of Liontrust. Always research your own investments and if you are not a professional investor please consult a regulated financial adviser regarding the suitability of such an investment for you and your personal circumstances.