Portfolio manager Alison Porter discusses the concept of the metaverse, its evolution and revolution and the significance for investors.

Key takeaways

- The metaverse has some very disruptive characteristics, but remains evolutionary, with revolution likely over time

- The advantages that benefit large platforms should serve as key catalysts in the shift to the metaverse, but over the long term may also challenge these companies

- While wary of short-term hype, the metaverse will drive broader opportunities for tech investors

- Digitisation and virtual, rather than physical consumption could become powerful enablers for decarbonisation

Everyone is talking about the metaverse. We view this with a sense of a déjà vu, having over the years witnessed companies and investors lured by the latest thematic that helps to sell an investment story. But will this time be different? The metaverse is a nebulous term; investors have created a wide range of definitions and declared who the ‘winners and losers’ will be. Fundamentally, we see a long runway for growth and some very disruptive characteristics, but it is important to point out that in the near term, the metaverse is evolutionary, with revolution likely unfolding over the longer term.

Defining the metaverse

Technology adoption continues apace, driven by the convergence of multiple long-term secular growth themes. The ultimate manifestation of this convergence of some internet transformation themes, namely augmented reality (AR), virtual reality (VR) and platform proliferation is the metaverse. A virtualised digital world, parallel but also interacting with, the physical world, with secure living and working experiences.

Metaverse versus the internet: key differences

- Persistent

- Synchronous and live

- Decentralised – no limit to concurrent users

- Each user has an individual sense of presence

- Fully-functioning economy

- Virtual or augmented, an experience that spans both the digital and physical world, private and public networks, and open and closed platforms

- Unprecedented interoperability of data, digital items/assets and content

Figure 1: the metaverse experience

Essential background knowledge

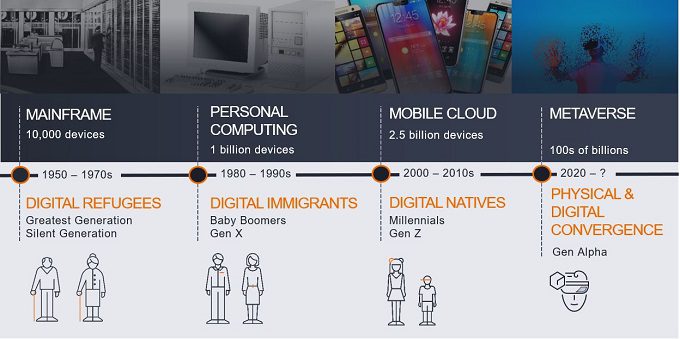

Facebook’s rebranding to Meta Platforms was a catalyst for the emergence of the metaverse as a theme. We have often discussed the waves of tech innovation (figure 2) from the mainframe, to PC internet, and to the mobile cloud at present. Artificial intelligence (AI) and the Internet of Things (IoT) have long been described as the fourth wave, but AI has become more of an extension of big data, facilitating exponential learning using existing infrastructure, and aimed at improving how we operate in the physical world. The global pandemic created a new dynamic and school of thought – what if the next wave of innovation is in fact within the digital world itself, is not only about the convergence of technology themes, but also about the convergence of physical and digital presence?

Figure 2: the waves of tech innovation

Evolution and revolution

We view the metaverse as evolutionary, like the prior shifts to the internet, mobile and cloud. The shift to the metaverse will also revolutionise certain industries with numerous potential causalities within both the tech sector and beyond. The metaverse’s link to blockchain and becoming the next iteration of the internet (Internet 3.0), with less centralised networks is potentially very disruptive to existing platform companies and it will open up sizeable, addressable markets for technology to disrupt over the next 20 years. The addressable market for the metaverse has no structural ceiling, instead it is limited by the preference for digital versus physical experiences and could extend to trillions of dollars.

The emergence of multiple use cases, devices and platforms will lead to many new and exciting companies becoming leaders in the metaverse, as well as reinvent existing tech ‘winners’. The proliferation of new wearable technologies and IoT will increase use cases. The developing use of blockchains, digital twins and digital identities will drive broader disruption in socialising, entertainment, education, construction and real estate, as well as finance. We are already seeing accelerating demand for technologies such as mapping and asset tracking, which manage the interaction of the digital and the real world, enabling omni-channel shopping and lifecycle management of goods. In fact, many Millennials and Generation Z (Gen Z) are already living in a partial parallel digital universe.

Linked to sustainability

The evolution to the metaverse also has a very interesting link to sustainability. In an inflationary resource-constrained world, virtual rather than physical consumption could become a powerful enabler for decarbonisation. Digital consumption, particularly if occurring on net carbon zero platforms of large hyper scale companies like Microsoft and Alphabet (Google), might have significant environmental benefits. However, such increased digital consumption and less need for physical goods and experiences could create challenging social consequences, which will have to be closely monitored.

What the metaverse means for investors

In the long term, the advantages that benefit large platforms such as Apple and Alphabet may be challenged, but in the short to medium term they are likely to serve as key catalysts towards the shift to the metaverse. Competition between the mega cap technology names for positioning in the metaverse will be fierce, with their financial strength used to invest in the opportunities that the metaverse presents. We believe this will become more evident in the next 18 to 24 months. Meta Platforms is investing heavily in an effort to create a new platform that unlike Facebook, Instagram or WhatsApp, does not have to run on devices and operating systems controlled by Apple (iOS) or Google (Android). The investment is both offensive and defensive of its core business (like Meta’s previous acquisitions of WhatsApp and Instagram).

Furthermore, the metaverse may not require a closed operating system, and it may not want a controlled app environment (ironically, security and privacy measures may benefit Facebook in forming a path forward). Microsoft appears well positioned for the workplace and industrial shift to the metaverse, while for consumers, Apple, Google and Facebook have an advantage. For example, Apple has precedent in leading technology shifts and integrating its hardware and software expertise, with consumers and developers eagerly awaiting an introduction to AR/VR wearables.

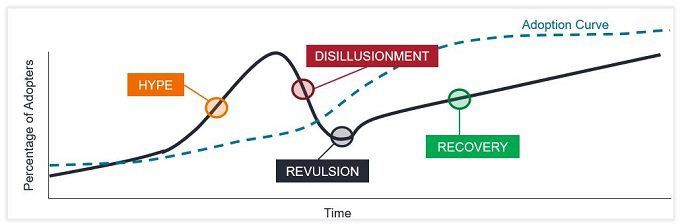

The predictions of trillions of dollars of addressable market will prove irresistible for start-ups and new platforms like Unity, EPIC and Roblox. All of the prior waves of innovation have been associated with hype cycles, lending to overexuberant valuations, from the dot com boom to robotics. We expect the metaverse to be no different.

Figure 3: navigating the technology hype cycle

While the metaverse offers significant new investment opportunities we expect that there will be over enthusiasm in investor expectations of the pace of adoption (see Figure 3 solid black line) while consumer acceptance of the metaverse will be much more consistent (dotted blue line). We are wary of the short-term hype around the metaverse, but over the longer term we view it as a shift towards the digitisation of everything, driving an increasingly broader set of opportunities for tech investors.

Notes:

Internet 3.0/Web 3.0, also known as the third-generation internet, is the next evolution of the World Wide Web. It is a data-driven Semantic Web utilising a machine-based understanding of data to develop a more intelligent and connected web user experience.

Internet of Things (IoT) describes the network of physical objects, or things that are embedded with sensors, software, and other technologies to enable the connection and exchange of data with other devices and systems over the internet.

Digital identity is the body of information about an individual, organisation or electronic device that exists online. This information is often used by website owners and advertisers to identify and track users for personalisation and to serve them targeted content and advertising. A digital twin is a virtual representation of an object or system that spans its lifecycle, is updated from real-time data, and uses simulation, machine learning and reasoning to help decision-making.

Hyper scale is the ability of a technology architecture to improve and scale as required as more demand is added to the system, ie, efficiently scale from a few servers to thousands of servers. Hyperscale computing is usually used in environments such as big data and cloud computing.

Net carbon zero refers to a state in which the greenhouse gases going into the atmosphere are balanced by removal out of the atmosphere.

Hype cycle represents the different stages in the development of a technology from conception to widespread adoption, which includes investor sentiment to that technology and related stocks during that cycle.

Technology industries can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants and general economic conditions. A concentrated investment in a single industry could be more volatile than the performance of less concentrated investments and the market as a whole.

Foreign securities are subject to additional risks including currency fluctuations, political and economic uncertainty, increased volatility, lower liquidity and differing financial and information reporting standards, all of which are magnified in emerging markets.

These are the views of the author at the time of publication and may differ from the views of other individuals/teams at Janus Henderson Investors. Any securities, funds, sectors and indices mentioned within this article do not constitute or form part of any offer or solicitation to buy or sell them.

Past performance does not predict future returns. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.