It appears U.S. inflation has peaked, but the battle against inflation is far from over

- It appears U.S. inflation has peaked, but the battle against inflation is far from over, in our view. The U.S. labour market continues to show strong job creation and intense wage pressures, but we expect the pace of hiring to cool into yearend as rising interest rates bite into economic activity, notably housing.

- Because of our concerns about the three-to-twelve-month economic outlook, our portfolios remain tilted defensively. We are underweight to equities and fixed income, alongside a small underweight to duration, leaving our asset mix overweight of cash.

- Across regional equity markets, we are overweight of Canadian equities and remain neutral on U.S. and merging Market (EM) equities but underweight to Europe, Australasia, and the Far East (EAFE), which we think remains the most vulnerable to the ongoing macro backdrop.

- On a sector basis within the U.S equity market, we closed out our exposure to U.S. financials while adding to the energy on weakness. We remain overweight to healthcare and tech while also having a currency hedge against the U.S. Dollar. We reduced our credit exposure for our fixed-income heavy portfolios to reflect our more defensive view.

“The stock market has a 100% record, in the last 50 years, of predicting upturns in the economy. It’s never been wrong. It’s less than 50-50 on a downturn.” – Peter Lynch

Too Early for Fed “Pivot” when U.S. Job Market is Still Booming?

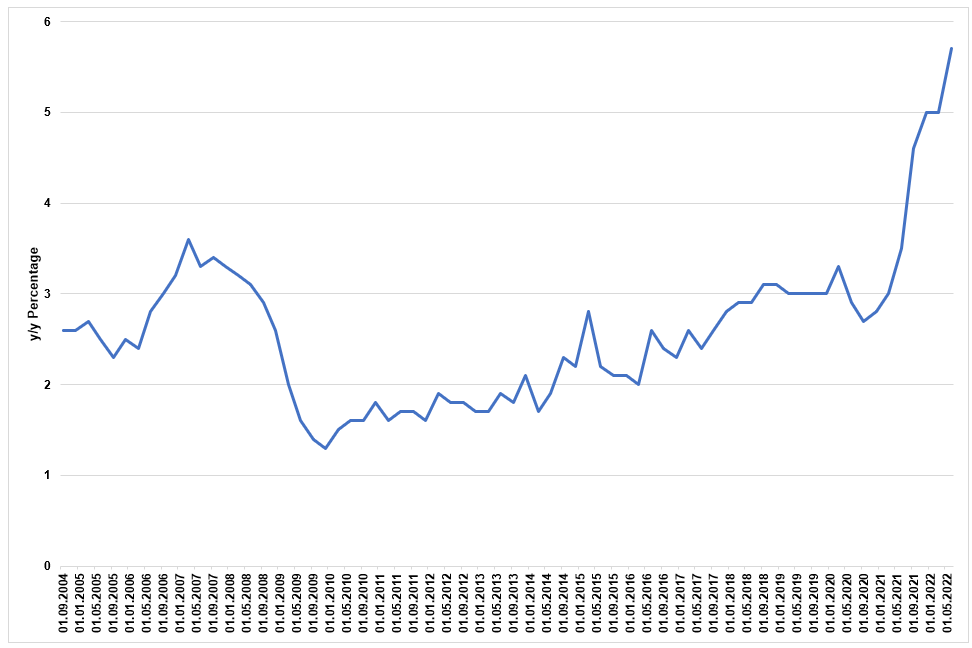

For all the fear of an upcoming recession, the U.S. labour market is not showing any signs of a much-needed cooling, which is a necessary ingredient to help ease ongoing inflationary pressures. The U.S. economy created 528k job in July and nearly 3 million job so far in 2022, defying expectations and fueling the ongoing debate about whether the U.S. is on the verge of a recession. Economic expansions don’t die of old age, but fast rising interest rates are very likely to cause some sort of landing for the economy over coming months. Besides the strong job creation, U.S. workers in private industries are seeing their wages and salaries rise at a strong pace (Chart 1), which adds to our concerns regarding the inflation and monetary policy outlook.

Chart 1: U.S. consumers feeling the misery* of high inflation

While headline U.S. inflation came down from its June peak (from 9.1% to 8.5%) and helped fuel the “peak inflation” narrative, policy makers at the U.S. Federal Reserve (the “Fed”) will find little comfort in their inflation outlook until the labour market and wage pressures show sustained signs of cooling over a few months. Meanwhile, economic activity, measured by the real gross domestic product (GDP), contracted at an annualized pace of 0.9% after contracting by 1.5% during the first quarter, thereby meeting the definition of a “technical” recession and ignited a heated debate amongst economists about whether the U.S. economy was already into a recession.

Because our recession scenario is largely mechanically driven by the aggressive monetary policy tightening, the biggest questions for investors, in our view, are i) whether asset prices reflect a recession scenario; and ii) whether the Fed will “pivot” early enough to avoid a harder-landing scenario. We think estimates of U.S. corporate earnings look too optimistic over the next twelve months while we think the bond market is too optimistic on expecting 2023 Fed rate cuts. Although inflation has peaked and will be cooling a bit more in coming months, inflation is likely to remain too hot and sticky for central banks.

Global Markets in July: The revenge of the nerds

Global equities (MSCI ACWI, +7.0%) rebounded sharply in July, led by the tech-heavy Nasdaq 100 (+12.6%) as the bar to beat earnings expectations was low enough to deliver a solid earnings season for investors. Duration-sensitive tech stocks were also helped by sharply falling yields on U.S. Treasuries. In general, U.S. equities outperformed their global peers by a wide margin as the S&P 500 (+9.2%) lead other major regional equity markets. U.S. small-caps (Russell 2000, +10.4%) also performed strongly. European equities (Euro Stoxx 50, 7.5%) lagged modestly and benefited from a good earnings performance, but that was partially offset by intensifying concerns over economic growth because of sanctions against Russia and the scope for energy shortage later this year. The overall Europe, Austral-Asian, and Far-East (MSCI EAFE, +5.0%) complex lagged more because of weaker performance from Japan (Topix, +3.7%) and the U.K. (+3.7%). Canada’s TSX (+4.7%) also lagged as energy prices weighed on the energy sector while the financials were held back by recession concerns and falling yields. Finally, emerging markets (MSCI EM, -0.2%) underperformed as Chinese (MSCI China, -9.4%) shares faced a set back from flares of COVID-19 and lingering concerns over the real-estate sector.

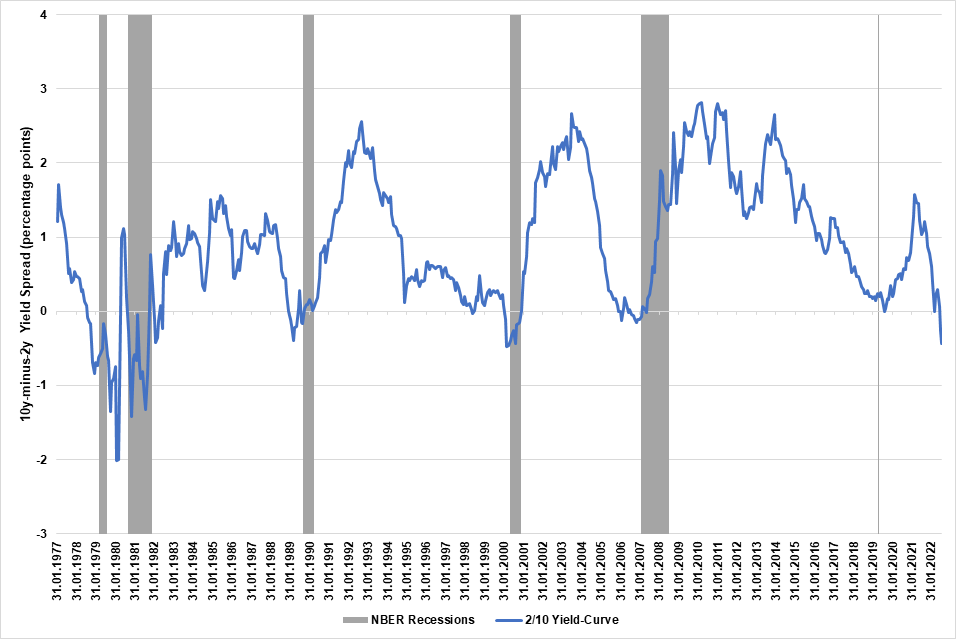

Global yields on government debt fell sharply in July on the view that the Fed and other major central banks would not only soon pause their hiking cycle, but turn to rate cuts by mid-2023 as economic activity is widely expected to cool into a recession by then. In Canada, the yield on the 10yr Federal bond dropped from 3.22% to 2.61% because of the fast-cooling 2022-23 economic outlook for Canada and the U.S. Another sign that investors expect the Fed and the Bank of Canada (BoC) to hike into a recession is the inversion of the two-versus-ten Treasury yield curve (Chart 2). If the Fed and BoC delay their “pivot” more than the market currently expects, the yield curve could steepen to levels not seen since the early eighties, a period where the Volcker-Fed was aggressively battling against inflation.

Chart 2: Thinking of Volcker Era? Hot Inflation and a Fed Dedicated to Bringing Down Inflation to 2% Could Weigh on the 2/10 U.S. Treasury Yield Curve

Oil prices fell from $105.76/bbl to $98.62/bbl in July on intensifying concerns over the demand outlook as global economic activity is cooling faster than expected. Although investors warmed up for a Fed “pivot”, the Greenback (DXY Dollar Index, +1.2%) continued to climb even as equities rallied sharply. The loonie gained some ground (+0.6%) as the Bank of Canada hiked its policy rate by 100bp, leaving the BoC as the most hawkish major central bank this year. The positive risk sentiment in markets helped narrow high-yield corporate spreads (vs Treasuries) from 5.69% to 4.69%. Finally, the VIX volatility index improved and ended the month at 21.3% (from 28.7%) as better-than-expected corporate earnings and scope for a Fed “pivot” fueled a powerful risk rally.

Inflation: Falling, but still hurting in places that matter to consumers

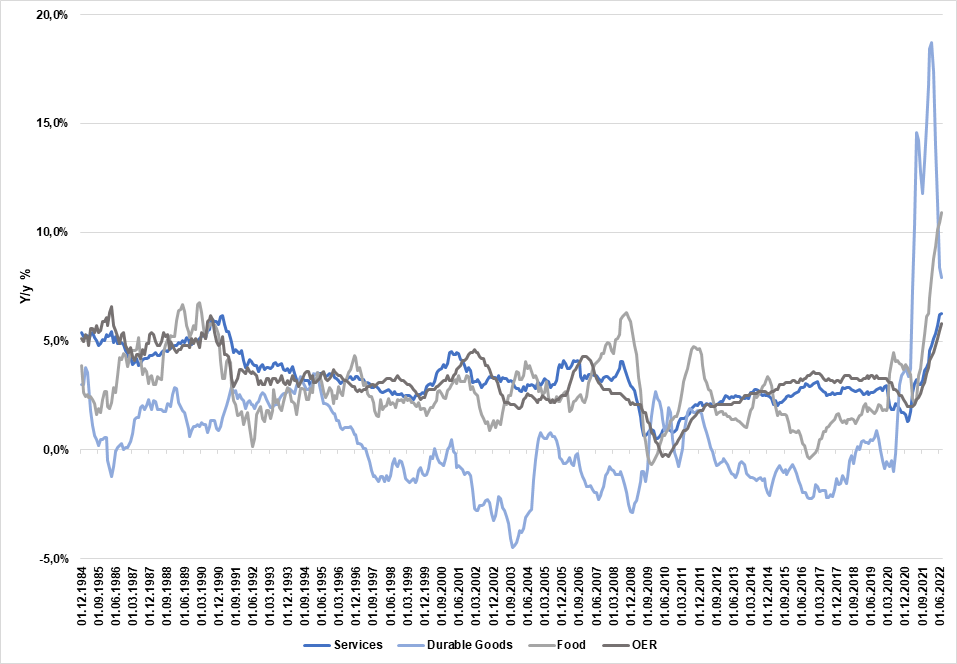

The “peak inflation” narrative intensified in early August with the U.S. headline inflation falling from its June hot pace. Although this is a welcomed development for inflation watchers, U.S. consumers are not out of the woods yet as key items of their consumption basket, which are hard to substitute for, are not only running high but are still trending up on a year-over-year basis (Chart 3). This should leave inflation as main area of concern for households and investors into 2023. The inflation pain should also support central-banks policy tightening while risking a recession. Meanwhile, this means investors should remain cautious in their equity and fixed-income outlook as both the peak of policy rates and the timing for a rate-cut cycle remain highly uncertain over the next eighteen months.

Chart 3: Key Consumer Items (Rent, Food, Services) Still Trending Higher and Hurting*

Canada: More resilient, but not immune to rising interest rates and global economic slowdown

During the first half of 2022, the Canadian economy grew by over 3% (annualized pace), in sharp contrast to the contraction registered in the U.S., supporting our bullish view on Canadian equities and the loonie. Although we expect the Canadian economy to cool in the second half of this year and into 2023, perhaps even contract as housing-related activity continues to cool because of rising borrowing rates, energy exports remain a key tailwind for the Canadian economy as major developed economies undergo a synchronized slowdown while thirsty for energy. 76k jobs were lost in June and July, but we think the labour market remains excessively tight and the lingering labour shortages should prevent a significant spike in the unemployment rate as the economy faces slower growth next year.

Recession Playbook: It’s always a long, tough, and uncertain process

If there is one thing different about this cycle, it’s how widely expected a recession is. When and how severe remain up for debate, but craks in the pace of economic growth from major developed economies are starting to emerge, including Canada. We expect macro indicators to continue cooling in coming months, especially advanced indicators such as the Purchasing Manager Indices (PMI) and the recent survey from the Institute for Supply Management (ISM) (Source: Reuters), which is likely to fall into contraction territory soon. However, we would not be surprised to continue see mixed signals, such as a resilient labour market for the U.S. But even there, we expect the pace of hiring to slow into yearend as rate hikes start to bite in the economy, most notably around housing activity.

Although the average length of a U.S. recession is about 10 months since World War II, the process of rolling and exiting form a recession is probably twice as long because investors debate the state of the economy. The reason is simple, we never get a clear reading that we are in or out of a recession until we are well passed that point. We usually slowly roll into recession, we don’t not crash into it—if you exclude the 2020 COVID-induced recession. A good example of this long process is the 2008 U.S. recession where the National Bureau of Economic Research (NBER), the official recession-dating committee for the U.S., declared the U.S. was in a recession only in December of 2008, a full year after the recession began. We think we are in the early days of this process and the debate about the economic outlook will intensify as the data cools while some areas of the economy remain resilient.

Outlook and Positioning: Cautiously patient as the global economy continues its landing

Although U.S. equities have rallied sharply since their June 16th low, the three-to-twelve month macro outlook remains highly challenging even as we could finally be passed peak inflation. Our portfolios remain cautiously positioned against unusual macro uncertainties fueled by high inflation and aggressive monetary-policy tightening, geopolitical concerns stemming from the Ukraine invasion to the fear of Taiwan suffering the same faith, and lingering COVID-19 lockdowns in China. We remain slightly underweight to both equities and fixed income, alongside a small underweight to interest-rate duration, thereby leaving our asset mix overweight to cash as we patiently wait for buying opportunities in either equities or bonds.

Across regional equity markets, we remain overweight of Canadian equities as we think Canada remains better positioned to face this global synchronized slowdown while we expect energy prices to remain elevated into 2023. We remain neutral on U.S. and EM equities and underweight to the EAFE block, which we think is the most vulnerable to the ongoing macro backdrop.

On a sector basis within the U.S equity market, we closed out our exposure to U.S. financials while adding to the energy on weakness. We remain overweight to healthcare and tech. We are maintaining a currency hedge against the U.S. Dollar. Finally, we began reducing our credit exposure for our fixed-income heavy portfolios to reflect our more defensive view.

Disclaimer:

BMO Global Asset Management is a brand name that comprises BMO Asset Management Inc. and BMO Investments Inc.

The viewpoints expressed by the Portfolio Manager represents their assessment of the markets at the time of publication. Those views are subject to change without notice at any time without any kind of notice. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

The portfolio holdings are subject to change without notice and only represent a small percentage of portfolio holdings. They are not recommendations to buy or sell any particular security.

Forward-Looking Statements

Certain statements included in this news release constitute forward-looking statements, including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions. The forward-looking statements are not historical facts but reflect BMO GAM’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although BMO GAM believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. BMO GAM undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

®/™Registered trademarks/trademark of Bank of Montreal, used under licence.