Overweight equities, around neutral in property, commodities and bonds

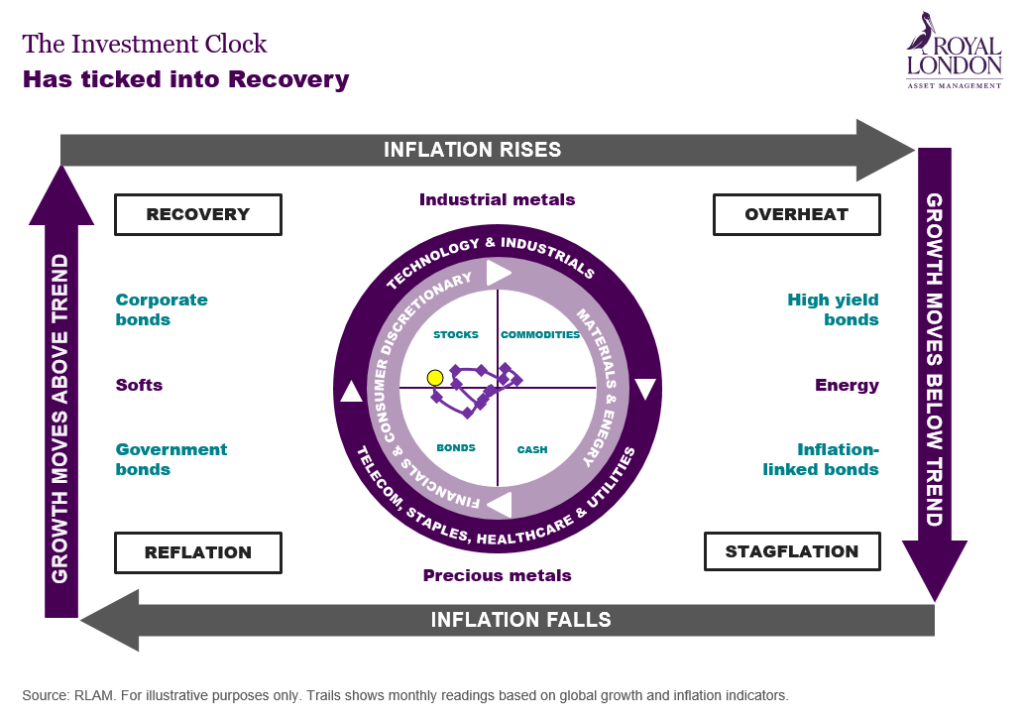

Our proprietary Investment Clock is indicating we are in the stage of the economic cycle when growth is improving (if slowly), and interest rates can be cut as inflation weakens.

The US has been the best performing major economy while Europe and China have patchier growth pictures. So far, markets seem to be expecting sustained US economic outperformance with a new Trump administration but trade wars could change expectations for the global economy negatively. Germany appears to have stagnated for two years, France has significant economic and political challenges, China is now taking action to stimulate its economy but much depends on whether significant tariffs on exports to the US will be faced next year. Given this patchy but still somewhat improving global growth and inflation backdrop, we are positioned positively in our multi asset funds and have benefitted from an overweight position in equities. We are around neutral in bonds and commodities given ‘spikeflation’ risks are still present even if interest rates have begun to fall. We are around neutral in property as it has recovery prospects in the current environment.

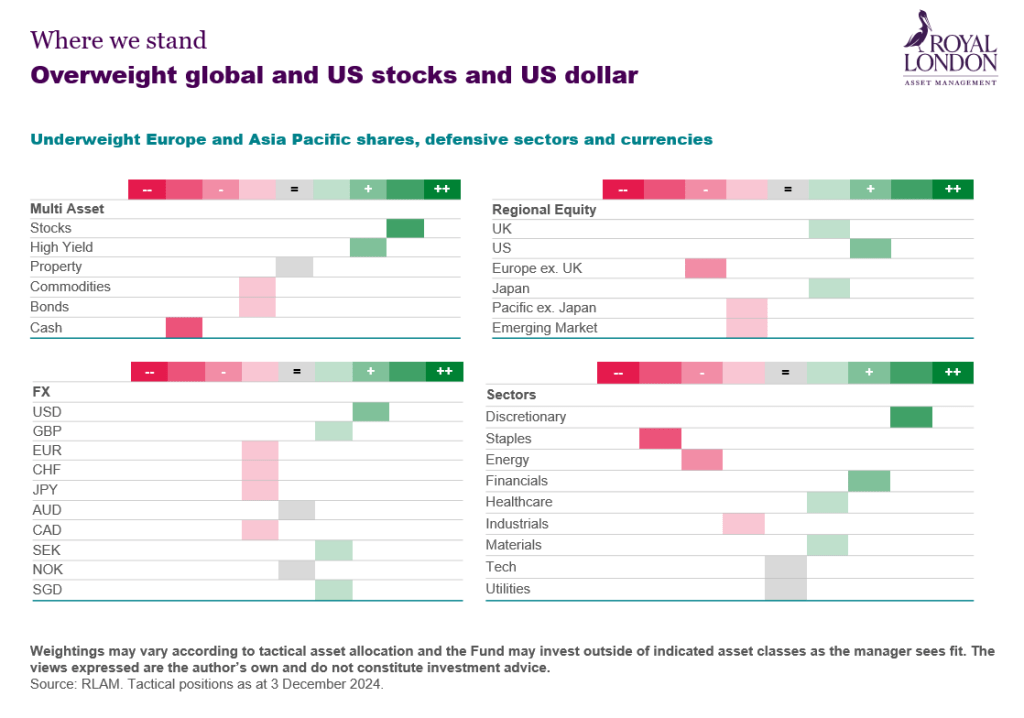

Cross asset:

- Equities: overweight given a slowly improving macro environment, easing monetary conditions globally and signs of earnings growth recovering.

- Commodities: around neutral given ongoing geopolitical and now additionally trade war risks which could easily lead to ‘spikeflation’.

- Property: around neutral as interest rates are on a gradual downward trend.

Government bonds: around neutral as the market responds to the start of an interest rate cutting cycle. - Credit: constructive, but watchful for signs of stress.

Equity regions:

- Overweight US equities given superior economic performance in US, compared to Europe, and the strength of tech-related earnings.

- Overweight Emerging market equities now that China is very active in trying to stimulate its economy.

- Underweight UK, Europe given weaker relative economic performance compared to the US.

- Underweight Asia Pacific, preferring emerging markets for now.

Currencies:

- Overweight the US dollar given relative weakness in the euro.

- Underweight the euro given economic and political challenges in Germany and France.

- Around neutral sterling where rate cuts are likely to be less aggressive than in the US.

Sectors:

- Overweight the interest rate sensitive consumer discretionary sector given rate cuts expected.

- Underweight utilities given we are not in a defensive period, but growth is improving.

- Neutral on technology given elevated valuations (but not underweight given growth potential).

This is a financial promotion and is not investment advice. Past performance is not a guide to future performance. The value of investments and any income from them may go down as well as up and is not guaranteed. Investors may not get back the amount invested. Portfolio characteristics and holdings are subject to change without notice. The views expressed are those of the author at the date of publication unless otherwise indicated, which are subject to change, and is not investment advice.