Real estate trends and opportunities in the European life sciences market

A large part of economic activity takes place within buildings. Therefore, real estate must meet the needs of the real economy as it develops and grows. The life sciences industry and its real estate demand are on the rise, aided by demographics and scientific progress. Thus, real estate focused on meeting the increasing needs of this part of the economy represents an attractive risk-adjusted investment opportunity for value-add and core investors alike.

Increases in the demand for products and services made by the life sciences industry are likely to drive demand for life science real estate assets. This includes companies seeking premises to conduct R&D, manufacturing and other support processes to meet said demand. On the macro level, there are two important drivers for the life sciences industry (and its demand for life sciences real estate): demographic forces and growing income.

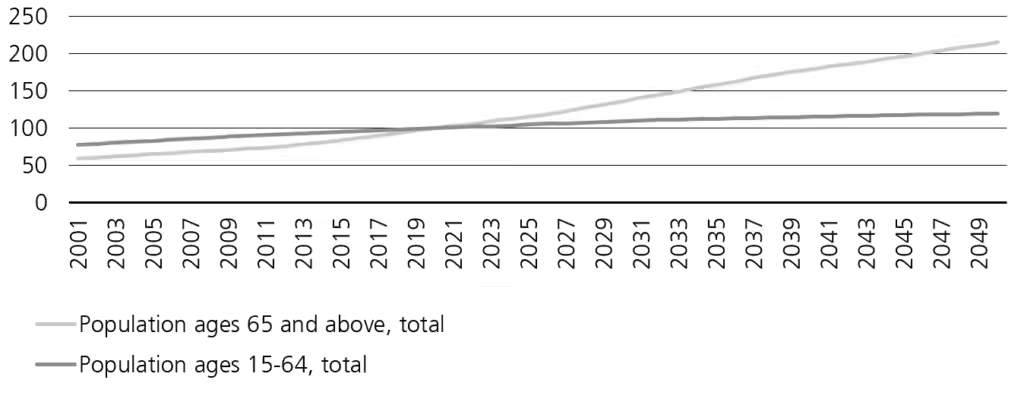

Figure 1: World population by age (index, 2020 = 100)

This chart illustrates the demographic development. We can see that the key age group that is the primary consumer of life sciences products i.e., 65 and above, is growing at a much faster rate than the working age population.

Looking at the demographic development (see Figure 1), we can see that the key age group that is the primary consumer of life sciences products i.e., 65 and above, is growing at a much faster rate than the working age population. This raises of course multiple questions for economies and societies, ranging from the sustainability of pension systems to how to transform the housing stock to better meet the need of a new demographic distribution.

For the life sciences industry, it creates a long-term growing demand for its products as the key consumer group grows much faster than the overall population. And as the demand for life sciences products grows, so does the life sciences industry’s need for real estate that can meet its requirements.

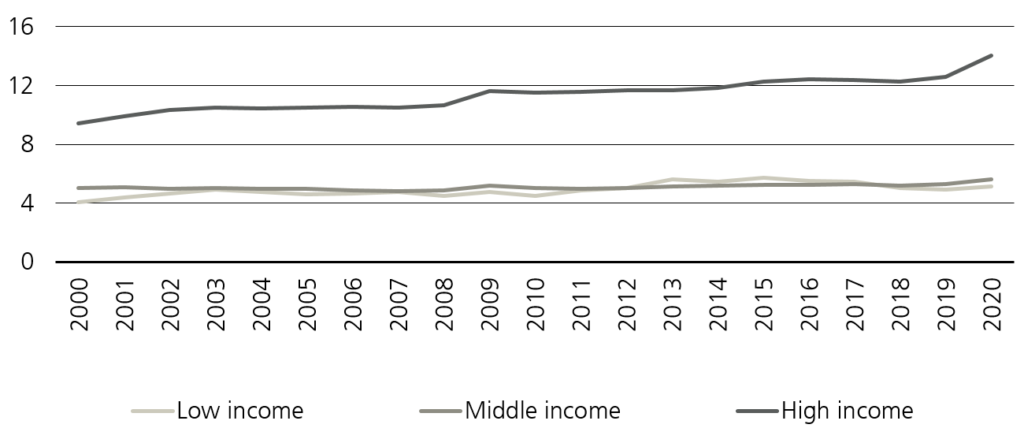

Another important factor that drives the demand for life sciences products, is the fact that the world’s population is getting wealthier (see Figure 2). According to the World Bank, high-income countries spend up to three times more than middle- and low-income countries on healthcare, including bioscience products, as share of their income. This means that healthcare and bioscience goods and services have a high-marginal income elasticity of demand. If consumers’ disposable income increases by 1%, their consumption of said goods and services increases by more than 1%.

Figure 2: Countries’ healthcare spend of income (%)

This chart illustrates that according to the World Bank, high-income countries spend up to three times more than middle- and low-income countries on healthcare, including bioscience products, as share of their income.