Portfolio Manager Jonathan Coleman discusses how to navigate the risks that are impacting small-cap growth companies amid current volatility.

Key takeaways

- As we’ve seen across other asset classes, a volatile environment has created risks in small-cap growth equities.

- Inflation in particular is a key risk being fuelled by a litany of uncertainties across the economy, including labour supply, wages, input shortages, shifting monetary policy and the Russia/Ukraine war.

- Amid heightened volatility, we have seen significant repricing this year, providing potential opportunity for investors seeking smart growth at reasonable valuations.

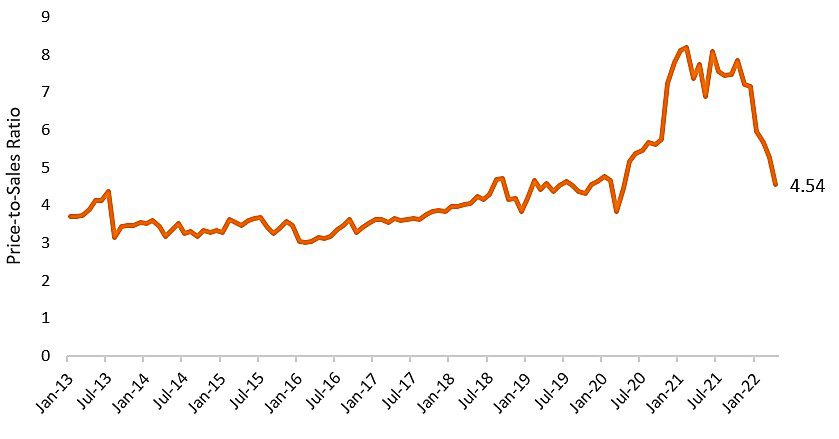

Stocks have continued to fall further into correction territory as inflation concerns, more hawkish Federal Reserve (Fed) policy and the Russia/Ukraine war have overshadowed generally positive earnings, a brisk job market and an improved COVID-19 health situation. As the Fed shifts course, swiftly rising interest rates have led investors to reassess elevated valuations, particularly for the high-growth, often money-losing stocks that outperformed in the small-cap space for much of the previous two years. Due to the large range of potential outcomes stemming from these factors, valuations in the Russell 2000® Growth Index have declined significantly this year.

Russell 2000® Growth Index Price-to-Sales Ratio

After hiking its benchmark rate by 25 basis point (bps) in March, the Fed moved more aggressively at the May meeting with its first 50 bps rate hike since 2000, which we see as an acknowledgement that policymakers feel they are behind the curve in addressing structural inflation. The central bank has signalled that it will continue to move aggressively in the coming months as necessary, but it remains to be seen whether they will stay the course if the economy starts to slow significantly due to global pressures and the unwinding of stimulus. Indeed, we see a palpable risk of stagflation – an inflationary environment with no real economic growth.

Inflationary pressure from many angles

In addition to the tremendous amount of liquidity that was pumped into the market through COVID-related monetary and fiscal stimulus, other forces are pressuring inflation higher. Although payrolls continue to grow, a shortage of qualified labour is weighing on businesses. The most recent data from the US Labor Department showed that both the number of job openings and the number of times people quit their jobs reached all-time record highs in March. A significant gap between the number of people seeking jobs and the number of job vacancies has forced wages higher. While rising wages can be generally positive for the economy as consumers have more money to spend, they can also lead to higher prices as businesses seek to offset increased labour costs.

At the same time, strong household and corporate balance sheets have kept demand vigorous and nagging supply chain issues have kept supplies generally low. For example, supply shortages in critical components such as semiconductors are taking longer than expected to resolve, a concern we have heard repeatedly from companies. Ongoing COVID lockdowns in China impacting manufacturing only complicate the situation, adding to near-term uncertainty and cost pressures. Simultaneously, soaring commodity prices stoked by the Russia/Ukraine war have raised concerns over how input disruptions and sanctions on Russia might impact economic growth.

Investing through the risks

These inflationary risks underscore our preference for companies with established supplier relationships and strong competitive positioning that may help them pass along higher input costs so as not to sacrifice current profit margins. To date, strong demand and short supply have allowed companies to largely pass labour and raw material cost increases on to consumers. However, as labour comes back to the workforce and supply chains are repaired ‒ pushing costs back down ‒ it will be important to closely watch company profitability and how businesses navigate a new pricing environment.

As we look ahead, we see potential for continued volatility as investors try to assess the trajectory of Fed policy, the Ukraine/Russia conflict and other forces impacting economic growth, supply chains and inflation. What’s next is not certain, but we think that investors would be well-served to focus on factors that have proven to be crucial for long-term growth. Differentiated, well-managed and reasonably valued growth companies with track records of innovation and profitability may be better able to navigate near-term market uncertainty while they capitalise on long-term trends. We believe that significant repricing this year has provided potential opportunity at reasonable valuations for these smart growth companies.

Monetary policy: The policies of a central bank, aimed at influencing the level of inflation and growth in an economy. It includes controlling interest rates and the supply of money.

Price-to-Sales Ratio: The price-to-sales ratio is a valuation ratio that compares a company’s stock price to its revenues. The price-to-sales ratio is an indicator of the value placed on each dollar of a company’s sales or revenues.

Basis point (bp) equals 1/100 of a percentage point. 1 bp = 0.01%, 100 bps = 1%.

Smaller capitalisation securities may be less stable and more susceptible to adverse developments, and may be more volatile and less liquid than larger capitalisation securities.

Growth stocks are subject to increased risk of loss and price volatility and may not realize their perceived growth potential.

Volatility measures risk using the dispersion of returns for a given investment.

Russell 2000® Growth Index reflects the performance of U.S. small-cap equities with higher price-to-book ratios and higher forecasted growth values.