As companies look to relocate business operations closer to home, Mexico’s close proximity to the US suggest the central American country will benefit significantly from this shift.

Fast reading:

- Manufacturing exports account for 40% of Mexico’s GDP. However, its US$400bn exports to the US are smaller than China’s almost US$600bn1. The country is forecast to seize a further US$150bn of export value in the next five years.

- The US Inflation Reduction Act, which privileges companies producing electric vehicles in the US-Mexico-Canada free trade zone, could also benefit Mexico, particularly considering existing labour shortages and wage pressures in the US.

- The expansion of Mexico’s manufacturing sector could, however, be hindered by insufficient electricity generation capacity, a quandary hindered by the government’s hostility towards private operators in the energy sector.

Over the last two decades, globalisation has encouraged the offshoring of production across the world on the back of lower labour costs. This trend has led to hyper-specialisation in global supply chains. However, the fragility of this global trading system has been exposed in recent years by the US-China trade war and the Covid-19 pandemic, as well as Russia’s invasion of Ukraine.

These upheavals have accelerated a shift towards ‘nearshoring’ – the practice of transferring business operations to a nearby country as opposed to further away – and several developing countries stand to benefit from this shift, including Mexico.

The pandemic exacerbated long-standing social issues in Latin America’s second-largest economy; poverty and regional inequality remain high. While Mexico’s institutions ensured the economy has remained stable, the country’s medium-term growth prospects have nonetheless taken a hit.

Members of the Federated Hermes Global Emerging Markets team recently visited Mexico to see for ourselves how the nearshoring trend might boost the country’s growth rate over the medium- to long-term. We went to Monterrey, the industrial heartland in the north, and spent some time in the capital, Mexico City, where we visited numerous industrial parks and manufacturing facilities.

Nearshoring – sometimes referred to as ‘friend-shoring’ because production typically moves to countries which are politically aligned – was a hot topic in Mexico and was happening faster than we anticipated, presenting some interesting long-term investment opportunities.

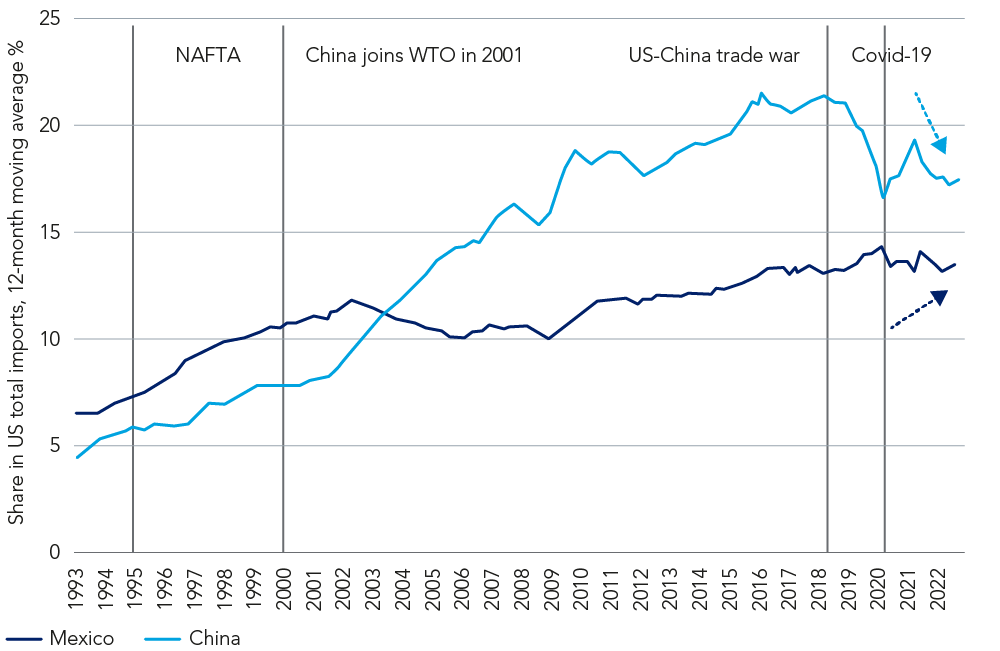

Mexico – which has nominal GDP per capita of about $10,0002 – posted real GDP growth of 2.7% in 20223. The country’s 130 million population includes 72% people below 45-years-old4. It has solid macroeconomic fundamentals, including an independent central bank and stable fiscal accounts. While the entrance of China, with its low labour costs, to the World Trade Organisation (WTO) in 2001 curbed the growth of Mexico’s exports to the US, the rise in nearshoring opportunities, as companies reconfigure supply chains, should help Mexico regain market share.

Figure 1: Share of total US imports (12 month moving average %)

Source: BofA Global Research, Haver, US Census Bureau, as at January 2023. Reprinted by permission. Copyright © 2023 Bank of America Corporation (“BAC”). The use of the above in no way implies that BAC or any of its affiliates endorses the views or interpretation or the use of such information or acts as any endorsement of the use of such information. The information is provided “as is” and none of BAC or any of its affiliates warrants the accuracy or completeness of the information.

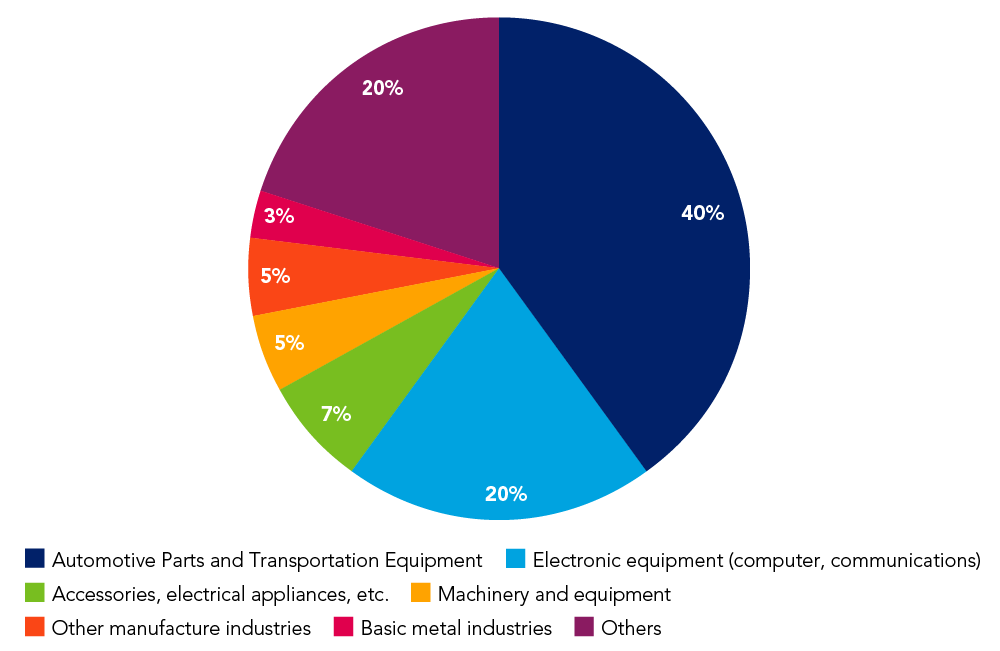

Figure 2: Mexico’s export distribution by category

Source: Banco de México, as at 2021.

US President Joe Biden’s Inflation Reduction Act, which privileges companies producing electric vehicles in the US-Mexico-Canada free trade zone, could also benefit Mexico, particularly in light of existing labour shortages and wage pressures in the US.

Indeed, a handful of companies have already decided to open up plants and increase EV production in Mexico; the last month alone has seen BMW announce an €800mn investment7 in EV manufacturing and Tesla confirm plans to build a new factory in Monterrey, which will be the company’s first in LatAm. CATL, the world’s largest battery manufacturer, is also reportedly eyeing up two large facilities in the north of the country. This latest wave of investment supports the government’s ongoing aim to establish Mexico as a principal beneficiary for nearshoring.

Nearshoring picking up pace

During our visit, the companies we met – including Cemex, Vesta, WEG, Nemak, Banregio, Traxion and Banorte – all shared the view that nearshoring is picking up pace. The industrial parks we visited in Monterrey were at full capacity and warehouses under construction had contracts signed to lease on completion.

Mexico’s ongoing integration with the US remains a significant advantage. The NAFTA trade treaty, which was updated and rebranded as USMCA in 2018, is a legal framework that also gives certainty to investment and trade flow among the US, Mexico and Canada. Several industries could take advantage of the trend, as Mexico’s share of the auto, electronics, medical equipment, and industrial machinery sectors increases. There are also opportunities in the semiconductor, furniture, toys, and textiles space.

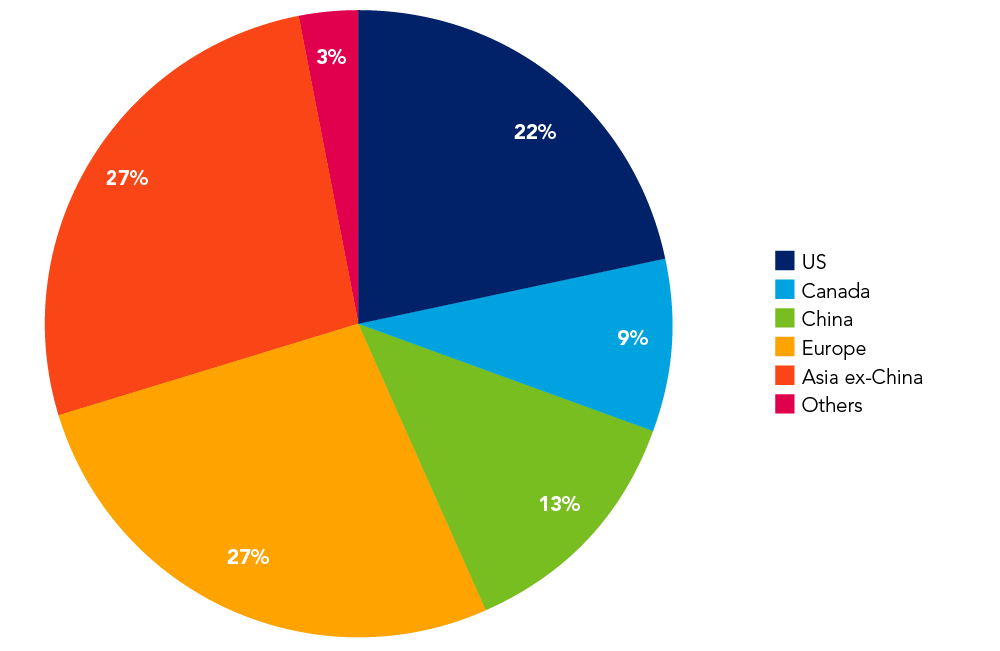

Figure 3: US and China not only ones investing in Mexico

Source: News sources, company data, Morgan Stanley Research, as at January 2023.

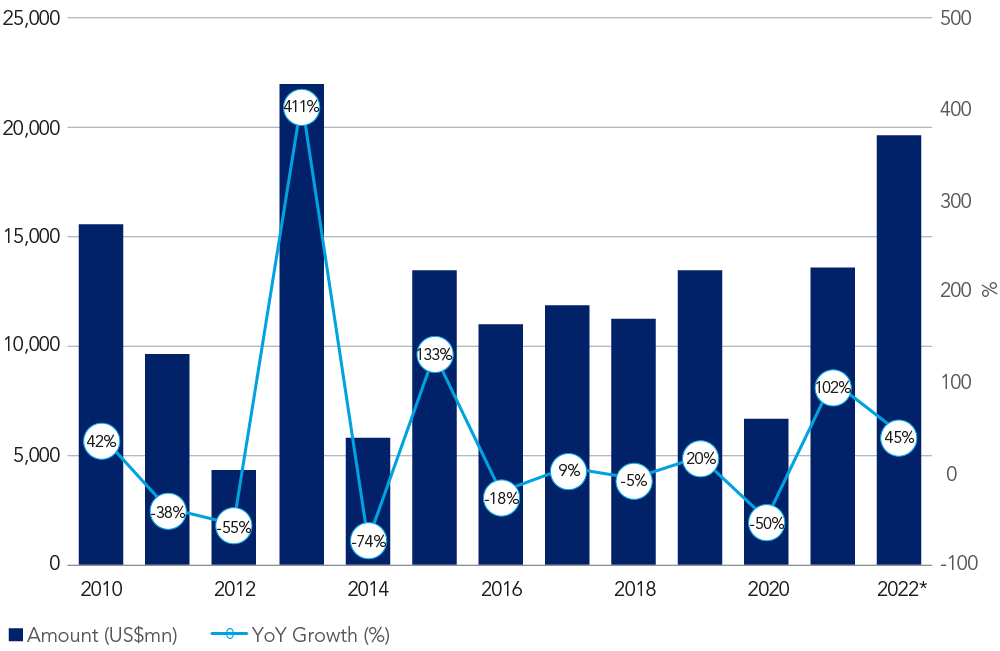

Figure 4: Mexico’s FDI – new investments are up 45% YTD

Source: Morgan Stanley, as at 2023.8

However, despite the medium-term prospects, the pathway could be bumpy because of political uncertainties and the pressing need for energy reforms. The expansion of the manufacturing sector could be hindered by insufficient electricity generation capacity, a quandary hindered by the Mexican government’s hostility towards private operators in the energy sector.

A landmark constitutional reform bill in 2013 opened the oil, gas and electricity sectors to wider competition. However, President Andres Manuel Lopez Obrador (known as AMLO), who was elected in 2018, is an opponent of the reforms and has sought to roll them back. His administration has introduced a law changing Mexico’s electricity grid rules to favour state utility CFE9– which is reliant on fossil fuel energy generation – at the expense of private enterprise.

Another headwind is the state of the country’s grid transmission infrastructure. Mexico lags other countries in the development of clean energy (although behind closed doors AMLO has reportedly been working with the US and Canada to develop a solar network in the north of Mexico).

Expanded credit

During our trip, we met with executives from Banorte, Mexico’s largest listed bank, who were optimistic about the group’s prospects in 2023.

Credit in Mexico is expanding against a backdrop of rapid wage income growth. The country’s unbanked population was one of the highest in the world and an impediment to the development of banking services in the country has been the high cost of onboarding new customers.

However, the roll out of digital banking services has cut costs significantly, allowing many people to open their first bank account. Mexican consumers are slowly moving away from cash, although there is still a long way to go. In Cancun, for example, many taxis now accept card payments, and this trend is only set to grow.

We also met with executives from Banco de México, the central bank, which forecasts growth of 1.8% in 2023. Although inflation is expected to moderate markedly, it is projected to remain uncomfortably above the central bank’s target of 3.0%. The government continues to call for double-digit minimum wage increases which, in the context of broad-based cost pressures, should continue to exert pressure on core inflation, particularly for services. Banco de México’s implicit acknowledgment of the troubling inflation outlook should hopefully encourage it to pursue a tighter policy stance. A healthy fiscal balance is a positive highlight relative to the rest of the region, while the currency remains stable.

The Mexican general election is scheduled for July 2024. The next 12 months should help determine whether the opposition is capable of challenging AMLO’s Morena party. The president has an approval rating above 50% despite an underwhelming response to the Covid-19 pandemic and a lack of fiscal incentives in 2020 and 2021. As it stands, we expect AMLO and Morena to win next year on the back of ramped up government spending on social programmes and because the opposition alliance remains fragile.

A severe recession in the US (not our base case) is Mexico’s biggest risk. Weakness in the manufacturing sector could spread to cyclical channels: first exports, then related services, and then employment growth. A fall in remittances from the US to Mexico would compound these downward forces, adding a further drag on demand.

However, such a scenario looks unlikely. On balance, Mexico’s low-beta nature, strong company fundamentals, positive consumption trends, nearshoring opportunities, and supportive remittances bolster our view that Mexico occupies a relative ‘safe haven’ position in emerging markets.

For further analysis on the prospects for emerging markets in 2023 and beyond, please see our Global Emerging Markets: Outlook 2023 report.

For more information on Global Emerging Markets Equity please click here.

1 Morgan Stanley Research: Mexico’s Nearshoring Opportunity & Challenges Amid a New Era of Geopolitics, as at October 2022.

2 Mexican Secretariat of the Treasury and Public Credit

3 National Institute of Statistics and Geography (INEGI)

4 National Institute of Statistics and Geography (INEGI)

5 National Institute of Statistics and Geography (INEGI)

6 Morgan Stanley Research: Mexico’s Nearshoring Opportunity & Challenges Amid a New Era of Geopolitics, as at October 2022.

7The Financial Times, as at 3 February 2023.

8 ‘Wave Watching: Data Confirms Bullish View On Nearshoring’, Morgan Stanley Research, as at 3 January 2023

9 Comisión Federal de Electricidad