Opportunities and challenges abound in fixed income investment grade (IG), with the current market backdrop ripe for investors to reengage with this asset class.

However, understanding the relationship between inflation and interest rates is crucial in order to make informed investment decisions within this space. Within investment grade, core rates are a key driver of returns and inflation can have a significant impact on this.

Inflation picked up dramatically in 2021 as during COVID there was a build-up of household savings after central governments eased financial conditions to counter the detrimental economic impact of the virus. Legislation such as the Inflation Reduction Act in the US pumped fiscal stimulus into their domestic market, with similar initiatives undertaken across the UK and Europe. As the pandemic faded many consumers rushed to spend their savings leading to a huge increase in demand and a consequent jump in prices as suppliers struggled to adjust.

Then followed the Russian invasion of Ukraine in 2022, which drove up prices for domestic staples like food and energy – causing a massive spike in inflation, and in reaction central banks raised interest rates on both sides of the Atlantic. As the world adjusted to these shocks and the impact of higher interest rates it affected both companies and consumers, and inflation eased considerably.

This type of action doesn’t mean prices reverse and start falling, but it does dampen the speed with which they rise to a more sustainable level although inflation levels in both the US and Eurozone still remain elevated in comparison to their pre-2021/22 levels.

What does this all mean for bond yields?

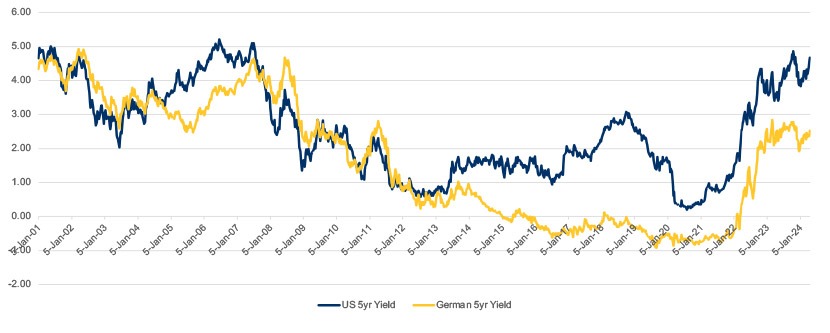

At the start of 2022, 10 year Euro government bonds were below zero, and 10 year US government bonds were at 1.5%; with rates sharply rising through 2022 and into 2023. Both US and Euro bond yields have now returned to pre-2008 financial crisis levels, i.e around 3% in the Eurozone and 5% in the US, presenting a much more attractive entry point for investors than at any other point over the last 15 years.

Figure 1: Government bond yields are returning to pre-crisis levels

At the start of this year, market consensus forecast a significant number of rate cuts for 2024 on both sides of the Atlantic, this pace of reductions would normally only be seen if these economies were entering a severe recession.

This isn’t the scenario that has played out, and core rates have risen having a negative impact on bond prices, however, total returns over this period have been supported by the coupon income and also, in the case of investment grade credit, tightening credit spreads as the economic backdrop began to look less worrying.

Looking at today, the market is now pricing in that the European Central Bank (ECB) will start to cut rates before the US Federal Reserve (Fed); and that the ECB will cut three times before year-end.

Why should investors care?

We believe many investors are currently cautiously positioned in their asset allocation, with a large proportion of their portfolios in money market funds (MMFs), with some reports estimating USD$9 trillion1 is presently allocated to MMFs globally.

In the current investment environment, this makes sense in terms of the income profile of these investment vehicles, which is between roughly 3% and 5% dependent on the MMF currency of choice. However, if the monetary policy and inflation backdrop shifts as anticipated in the second half of this year, we would expect the income on these investment vehicles to drop significantly lower, presenting a far less attractive investment for investors.

For fixed income, the nature of bonds means that investors are “paid to wait” by virtue of the ongoing coupon stream. Over the last 12 months even though core rates have risen, we have seen some IG strategies generate total returns of 8%, with investors benefitting from coupon payments and alpha generation.

Why now?

Credit spreads widen when markets appear strained and there are heightened default concerns. However, recent economic data and the subsequent movement in government bond yields suggest that the global economy is not entering a recession.

We research and analyse many companies who have investment grade credit ratings and the vast majority are painting a healthy picture when it comes to their current business activities. The broader market conversation has moved on from a soft or hard landing to no landing at all; and this scenario can result in tightening credit spreads that can benefit investors in investment grade bonds.

By taking an active approach, it allows investors to gain exposure to the bonds of companies that should benefit from the current economic environment. It also allows greater flexibility to potentially avoid those companies that could have their business models challenged by the increase in interest rates that has occurred over the last three years. In contrast, if investors take a passive approach, by investing in a benchmark-tracking fund, they will not benefit from this analysis that attempts to sift the winners from the losers and thus their investments could underperform an actively managed fund.

In the current backdrop, investors would do well to consider gaining an exposure to actively-managed investment grade fixed income funds.