Boston – While spreads have ground tighter this year in almost every sector of the bond market, there is one AAA-rated sector that has bucked the trend and now sits at cheaper levels than in January. We are referring to the second most liquid bond market in the world (behind U.S. Treasurys) — the agency mortgage-backed securities (MBS) market.

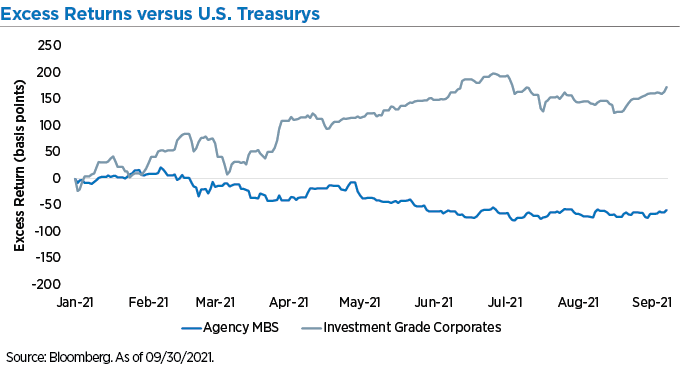

For many investors in the agency MBS market, summer 2021 could not end soon enough. Excess returns relative to Treasurys began deteriorating in early May as talk of the Fed potentially tapering its asset purchases picked up steam, causing MBS spreads to widen by more than 20 basis (bps). Meanwhile, spreads across most other high-quality fixed income sectors like investment grade (IG) corporates saw little change, which resulted in a large relative performance gap.

Agency MBS have underperformed IG corporates so far in 2021

We believe that after this summer’s underperformance, agency MBS look cheap relative to other high-quality areas of U.S. fixed income, and the sector warrants a second look from bond investors who want to go up in quality and yield at the same time.

Why have MBS spreads been widening?

The prospects of the Federal Reserve slowing its current monthly pace of $40 billion in new MBS purchases has certainly been a headwind for the sector in recent months, as other investors will have to absorb reduced demand from the Fed. Falling long-end Treasury yields often suggest lower mortgage rates and faster prepayment activity, which can also lead to wider MBS spreads.

We feel that the market has exaggerated this second impact in recent months. Yes, rates have fallen since the start of the summer, but the average 30-year mortgage rate is still 20 bps higher than the all-time lows we hit back in February.

We also believe rates are likely to rise this fall as additional Treasury supply comes into the market and the labor market continues to heal. As a result, we don’t expect another wave of refinancing activity, which the market seems to be pricing in.

Some might ask, “Why should I invest in agency MBS when the Fed is going to pare back their purchases in the market? Shouldn’t I be selling?” We have believed that the Fed would taper their MBS and Treasury purchases by the end of 2021, and now this seems likely to occur at the November FOMC meeting. We would keep in mind that the MBS market — like every market — is forward looking: Events get priced in long before the day they happen.

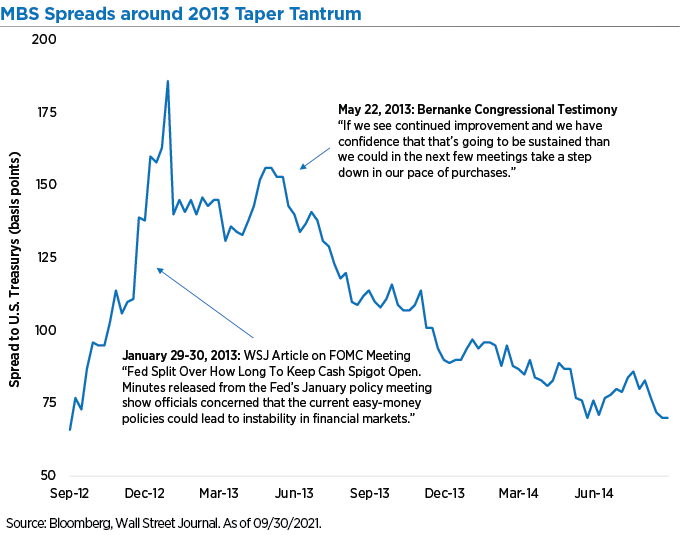

How did MBS perform during the last taper cycle?

History gives us a good guide into this when we look at the taper tantrum in 2013. Agency MBS spreads actually widened relative to Treasurys well before then-Fed Chair Ben Bernanke mentioned the word “tapering” on May 22. MBS tapering wasn’t officially announced until the December FOMC meeting. By the time tapering actually started in early January 2014, MBS spreads had almost completely retraced all their pre-taper widening. Admittedly, history doesn’t have to repeat itself, but it often rhymes.

MBS spreads widened long before and actually tightened after Bernanke’s announcement

How did MBS perform during the last taper cycle?

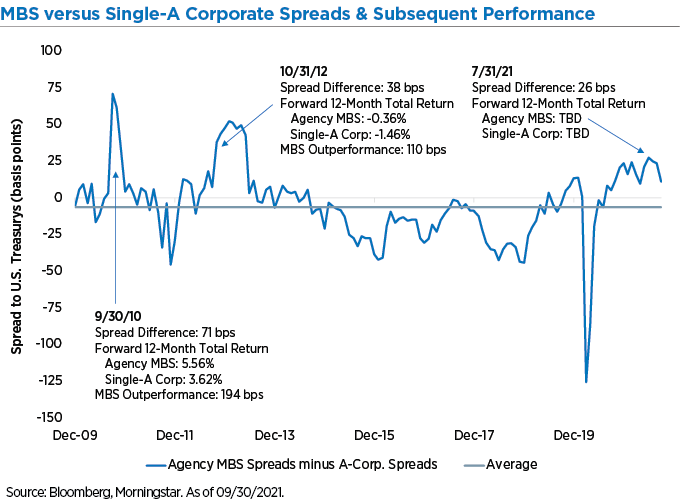

The recent moves in the agency MBS and IG corporate markets have pushed spreads into rare territory. Since 2010, agency MBS spreads have traded on average roughly 6 bps tighter than single-A rated corporate bonds, which might be expected since agency MBS are AAA-rated, government-guaranteed securities.

However, the headwinds we have discussed recently pushed spreads on agency MBS to more than 25 bps wider than single-A rated corporates — a spread differential that has only been breached twice since 2010. And each time, agency MBS went on to outperform single-A corporates over the ensuing 12 months.

Agency MBS have outperformed IG corporates after spreads widened

What would cause agency MBS spreads to tighten?

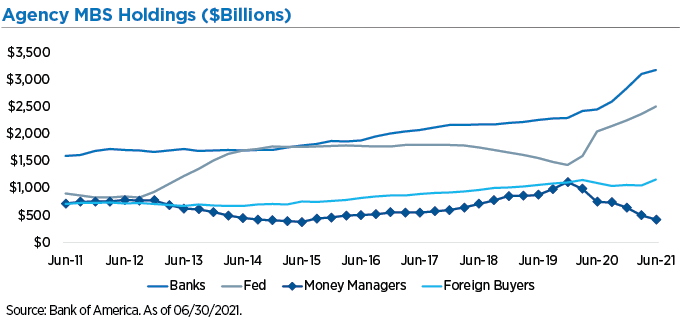

Many scenarios could cause agency MBS spreads to tighten. We think the most obvious catalyst would be U.S. money managers covering their massive underweight in agency MBS. They have been net sellers of more than $600 billion of agency MBS over the past two years and now sit at their lowest allocation since the beginning of 2016.

Money managers have reallocated away from agency MBS

Many moved into IG corporates for core bond funds over that period, which has worked out well for money managers. But we suspect the ability to go up in yield and quality could prove too compelling for them to pass up going forward.

The second tailwind that could provide a nice boost for the agency MBS market would a backup in Treasury yields. Supply has been running two to three times normal levels on a daily basis — thanks to not only a strong housing market but also near record-low mortgage rates, which have boosted refinancing activity.

We expect even a small backup in long-end Treasury yields and mortgage rates would likely shut off much of the refinance supply that has been flooding the MBS market. In our view, the decreased supply resulting from a backup in mortgage rates will likely be far greater than the reduced demand from the Fed — and prove to be a net positive for the agency MBS market.

Bottom line: With numerous headwinds now priced into the agency MBS market, and most other sectors seemingly priced-to-perfection, we think the relative value opportunity appears very compelling.