Ed Perks, CIO of Franklin Templeton Investment Solutions, outlines what factors should likely support economic growth, how he views inflation, why US equities remain attractive, and where income-seeking investors should look for potential opportunities.

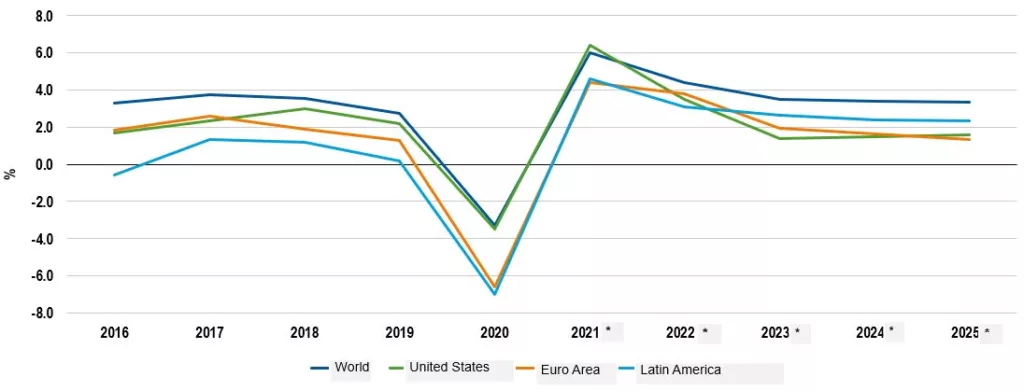

Amid the reopening of economies and recovery from the pandemic, we see some robust shifts in economic activity. The rebound in consumer participation is an important part of the growth story we’ve seen in 2021, with accommodative monetary and fiscal policies also playing an important role. Going forward, we see these forces continuing to drive growth—albeit with some moderation—as consumers are in a strong place to spend and policy accommodation seems likely to continue over the next 12 to 18 months.

GDP Growth Expected to Revert to Pre-pandemic Levels, Supported by Consumer Spending and Policy AccommodationIMF

Real Gross Domestic Product (GDP) Growth Projections, As of April 2021

Sources: FactSet, International Monetary Fund. *Estimate. There is no assurance that any projection, estimate or forecast will be realized. Most recent data available.

CONSUMER STRENGTH AND INFLATION

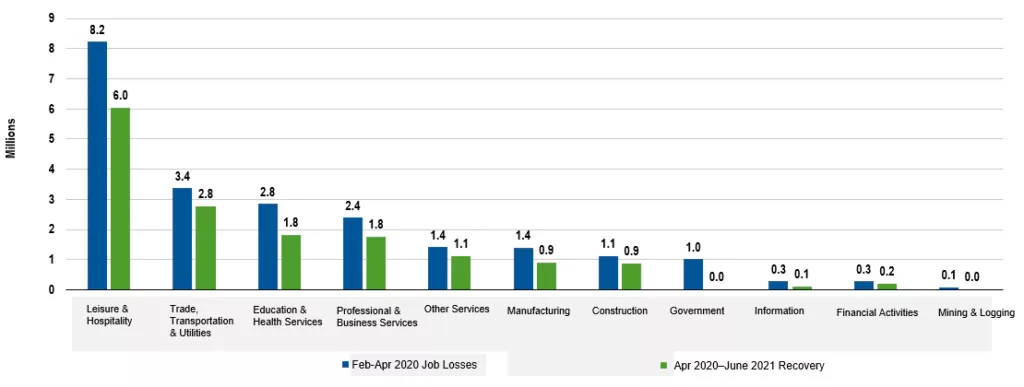

As lockdowns ended, we saw a lot of pent-up consumer demand unleashed. Policy accommodation—government programs and monetary policy support—has helped consumers come through the pandemic in a fairly healthy position in terms of balance-sheet strength. Many have significant excess savings driving robust spending on a variety of goods and services. The labor market has also rebounded sharply. We continue to see real upside in terms of job growth and creation, as well as some nascent signs of wage gains, which are expected to be an important part of economic activity and growth as we move forward. The July US employment report reflected these dynamics, adding 943,000 non-farm payroll gains and a 0.4% month-over-month rise in hourly wages. While there are still some seven million jobs that are yet to return from pre-pandemic, we believe the recent trend in jobs recovery is likely to continue. While the Delta variant adds risks to the outlook, overall we see some healthy tailwinds for the US consumer.

Recovery in Jobs Is Likely to ContinueUS Employment

Changes By Industry, Net Change

Sources: FactSet, Bureau of Labor Statistics.

Inflation is the other side of the coin, with messaging from the US Federal Reserve (Fed) referring to the “transitory” nature of recent elevated inflation prints. We are seeing price pressures related to economic reopening, but this is a very unique time historically. Economic activity essentially came to a halt with COVID-19-related shutdowns; restart of activity created supply chain bottlenecks and pockets of inflationary heat.

Nevertheless, there is a lot of focus on what exactly “transitory” means. While we are starting to see some signs of cooling in price increases in the United States—as reflected in the July Consumer Price Index data—we still have concerns that some inflationary pressures will potentially last longer. But how long can we observe “transitory” inflation before fears develop in the markets that it may be more persistent? This is an important consideration as it relates to one of the key pillars that’s driving economic activity—policy accommodation. The Fed is still buying Treasuries and mortgage-backed securities and has kept interest rates near zero. Longer-term, we do expect the Fed to move away from its highly accommodative position. But initially, any tapering could materialize in the form of reduced asset purchases, or the Fed could provide more clarity around when it intends to raise short-term interest rates. We will be watching the Fed and monetary policy globally in the second half of 2021 and as we enter 2022 to shape our views of the markets.

OPPORTUNITIES AND RISKS IN US EQUITIES AND FIXED INCOME

As we entered the pandemic period and economies were shuttered, there was tremendous divergence in performance within equity markets. Initially, we saw strong performance from a very narrow group of companies—the growth-oriented beneficiaries of the pandemic that included largely technology and e-commerce firms. At the same time, more cyclical segments of the market, for example, energy and financial sector companies, experienced a more challenging backdrop at the start of the pandemic. As we made our way through the pandemic and vaccines were developed and economies reopened, we saw the latter catching up and converging with the early winners. Today, as we look across equities, we see a more equitable landscape with a broad set of investment opportunities.

In terms of a general outlook for equities, companies have needed to grow into their recent valuations. We have seen this happen, especially with the strong second-quarter 2021 corporate earnings season. As we look forward into the next six to 18 months, we see these favorable tailwinds likely to continue.

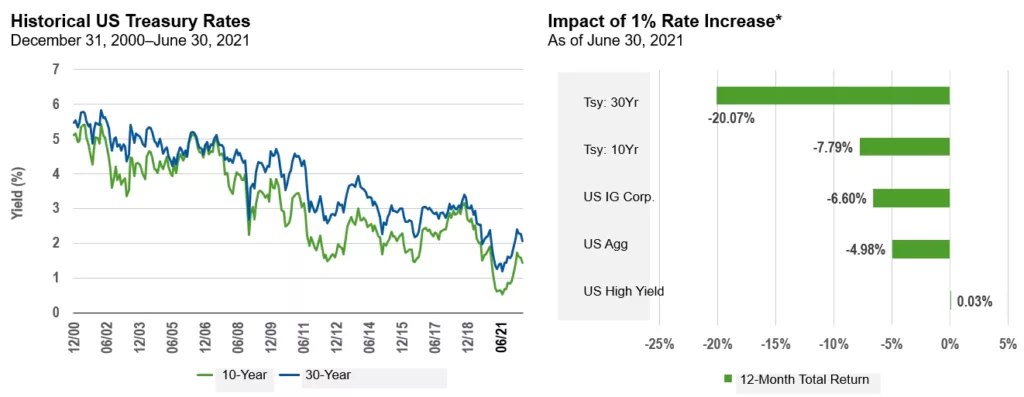

As it relates to fixed income, we see a stark contrast to equities—while interest rates have increased after bottoming in August 2020, they are still at relatively low levels and prospects for attractive total return are therefore somewhat limited.

Hypothetically, if we were to see an instantaneous 100-basis point increase in interest rates across the curve, longer-duration Treasuries would likely bear the brunt of that shock. Moving to shorter-duration assets, and more importantly into credit spread sectors within fixed income, the outcome looks a bit more benign, but still represents a challenged backdrop for fixed income securities from the standpoint of total return expectations. That said, we do see pockets of opportunities amid favorable corporate fundamentals, particularly in high-yield corporate bonds.

The Path to Normalization Continues to Imply Total Return Risk

Sources: FactSet, Bloomberg, Macrobond. For illustrative purposes only and not reflective of the performance or portfolio composition of any Franklin Templeton fund.

* Assumptions include an immediate, parallel shift in the yield curve, and that bonds are held until maturity. Total return is the sum of the calculated price return and the annualized yield to worst. Treasuries are represented by the Bloomberg Barclays US Treasury Bellwethers Indexes, US Investment Grade Corp by the Bloomberg Barclays US Corporate Investment Grade Index, US Aggregate by the Bloomberg Barclays US Aggregate Index, US High Yield by the Bloomberg Barclays US Corporate High Yield Index. Indexes are unmanaged and one cannot directly invest in them. They do not include fees, expenes or sales charges. Performance data represents past performance, which does not guarantee future results.

MULTI-ASSET INCOME APPROACH

As we think about investing for income, we believe flexibility in asset allocation and rigorous security selection can be a benefit. We believe having the flexibility and being nimble in taking advantage of any dislocations that may occur in evolving markets is important, especially against the current backdrop of generally full valuations across many financial assets.

Given the current environment and the challenge of maintaining an attractive and consistent level of income in a multi-asset portfolio, again, we think flexibility is of utmost importance. As we progressed through the pandemic and experienced the bifurcations within financial markets, it was very important, in our view, to have a broad scope in looking for opportunities, to be able to tactically shift the portfolio and to be targeted in pursuing the income goal.

Looking forward, we will continue to pay very close attention to policy changes, growth trends and inflationary pressures and what kind of dynamics they can create within the markets, while continuing to look for opportunities that deliver attractive income as well as a strong profile in terms of total returns relative to risk.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Investments in lower-rated bonds include higher risk of default and loss of principal. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Changes in the credit rating of a bond, or in the credit rating or financial strength of a bond’s issuer, insurer or guarantor, may affect the bond’s value. High yields reflect the higher credit risk associated with these lower-rated securities and, in some cases, the lower market prices for these instruments. Convertible securities are subject to the risks of stocks when the underlying stock price is high relative to the conversion price (because more of the security’s value resides in the conversion feature) and debt securities when the underlying stock price is low relative to the conversion price (because the conversion feature is less valuable). A convertible security is not as sensitive to interest rate changes as a similar non-convertible debt security, and generally has less potential for gain or loss than the underlying stock. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.