The Organization for Petroleum Exporting Countries and its partners (OPEC+) rarely fail to surprise when oil markets appear to have become complacent. In its first physical meeting since the Covid pandemic, the oil cartel provided a statement to reassert its importance in the global oil market.

On 5th October 2022, the Organization for Petroleum Exporting Countries and its partners (OPEC+) said it will cut its oil production by 2 million barrels per day starting from November 2022. It cited worries about a global economic downturn reducing demand for oil. In its pursuit to keep the oil market in balance, it justified this cut. Although we suspect the move is more driven by maintaining high prices that OPEC+ has become accustomed to. This is a meaningful move, and the largest supply cut by the oil cartel since April 2022. Bearing in mind that the cartel controls approximately 45% of global crude oil supply, this could significantly tighten up the market. In the lead up to this meeting, oil prices rallied strongly in anticipation of a significant cut. Since the announcement, the price gains have stuck, and we expect that there could be further upside.

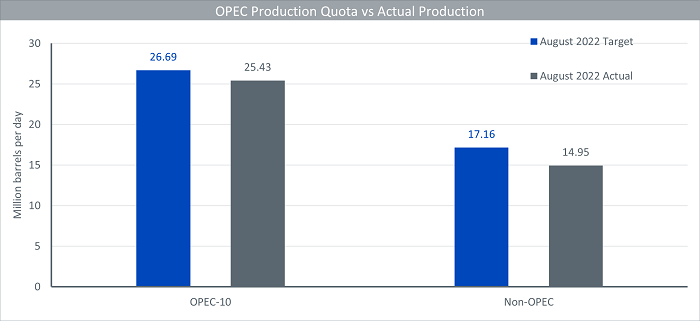

The announced cut doesn’t translate to a 2 million barrel per day reduction from today’s production levels. Rather, 2 million barrels per day lower than target production in August. As we have previously highlighted, OPEC+ had not been able to meet its current quota, given the lack of spare capacity in most members (outside of Saudi Arabia, United Arab Emirates, Russia). Saudi Arabia and the UAE are unwilling to raise production to compensate for other members and Russia is facing sanctions from numerous countries.

Source: WisdomTree, International Energy Agency. OPEC = Organization for Petroleum Exporting Countries and partner countries. OPEC 10 = Organization for Petroleum Exporting Countries that have a quota (note Iran, Libya and Venezuela are OPEC members but are exempt from the quota). Non-OPEC countries include Russia, Azerbaijan, Kazakhstan, Oman, Bahrain, Brunei, Malaysia, Sudan and South Sudan).

Historical performance is not an indication of future performance and any investments may go down in value.

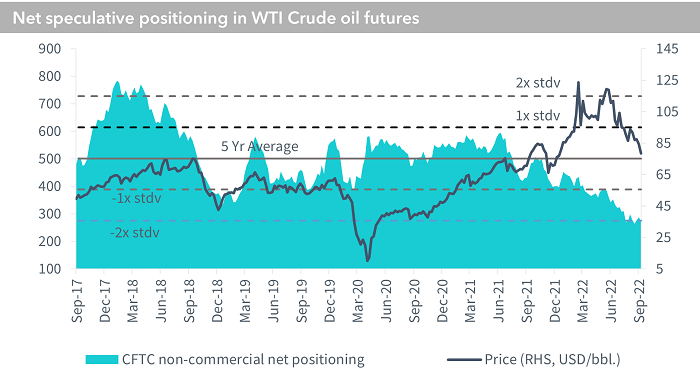

Although the actual production cut numbers may disappoint relative to the headline (for oil bulls), we believe prices could continue to rally as short positions are unwound. Net speculative positioning in WTI crude oil futures is lower today than in the run-up to the oil crash in 2022. In fact, it’s more than a standard deviation below the five-year average. Shorts are at a 6-week high at the last reporting date (30 September 2022), so there is room for a short-covering rally. But longs which are at a decade low (i.e. since August 2012), have ample room to restore.

Source: Bloomberg, Commodity Futures Trading Commission (CFTC), WisdomTree as of 27 September 2022.

Historical performance is not an indication of future performance and any investments may go down in value.

OPEC may continue to cut production in coming months if prices fail to meet their expectations. Saudi Arabia had been very vocal about how the futures markets pricing seemed out of kilter with the physical spot market. Moreover, each OPEC nation is facing a cost-of-living crisis as well. If prices of goods they consume are rising by 10%, they want a 10% increase in revenue from their major export. The group has become comfortable with oil prices around $90 a barrel. Seeing prices fall significantly below this, as we saw in recent weeks, made members uncomfortable with their fiscal obligations. We may find $90 a barrel becoming the new $60 barrel, that for many years people thought was the long-term equilibrium.

Obviously, oil importing nations will be upset with higher oil costs heaped on top of an already untenable energy crisis. The Biden Administration in the US, which had begged OPEC for higher supplies, only received a token increase in September, which was reversed by October and now these deep cuts are in place from November. Inflation: higher for longer, and potentially secular, is a theme we have explored in our Autumn Outlook, published last week.