In recent years alternative fixed income assets such as loans, infrastructure financing and private debt have become increasingly popular with professional investors. They can provide opportunities to increase portfolio yield when the (often lower) liquidity of these assets is not a constraint. This is particularly the case for long-term investors, such as pension funds and life insurance companies.

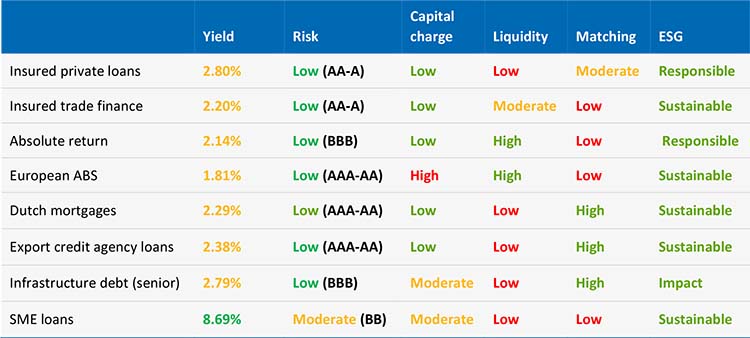

In this paper we show the variety of alternative fixed income strategies in terms of yield, risk, capital charge, liquidity, duration matching and ESG factors. Investors have an opportunity to select those assets which best fit their particular investment requirements, by taking the different characteristics into account. In the table below we show some of the characteristics of options within the alternative fixed income spectrum. It is important to note that the scores on the different dimensions can and do shift over time and that the assessment is sometimes based on qualitive instead of quantitative measures (the ESG assessment being an example). Capital charges are determined with the standard formula of the Solvency II regulations.

TABLE 1: COMPARING DIFFERENT ALTERNATIVE FIXED INCOME STRATEGIES

In the full paper (see below), the different characteristics of each asset class in Table 1 are discussed in more detail.

The main conclusions of this paper are:

- The alternative fixed income asset class is highly diverse, embracing private debt, consumer loans, mortgage investments, insured loans, loans to small and medium-sized enterprises (SMEs), infrastructure debt and asset-backed securities (ABS). These assets can offer enhanced yields compared to government and corporate bonds, along with relatively low correlations to traditional assets.

- An alternative fixed income allocation can offer investors practical exposure to a wide variety of return drivers, many of which also have an environmental, social and governance (ESG) focus.

- Alternative fixed income is particularly attractive for long-term investors, including pension funds and life insurance companies.

- An interesting feature of many alternative fixed income assets are the additional safety measures compared to traditional corporate loans, such as covenants and guarantees.

- Alternative fixed income strategies exhibit great variety in terms of spread, risk, capital charge, liquidity, duration matching and ESG impact. This enables investors to choose those assets which best fit their particular investment needs, by taking the different characteristics of these assets into account.