Luca Evangelisti says that European banks are much better prepared to navigate a slowing economy, and this adds to the “through the cycle” risk-adjusted appeal of CoCos.

Markets have started to price-in a certain recession premium across fixed income markets. One of the areas where we can see the greatest dislocation between fundamentals and valuations is the European banking sector.

Current valuations imply that banks are a cyclical business, and that customers may struggle to repay their loans as economic conditions deteriorate further. Whilst a deterioration in banks’ asset quality in 2023 is likely, our view is that banks have significantly improved their fundamental position over the last 15 years, including a strengthening in lending standards, liquidity levels and capital position. In our view this will allow them to absorb any increase in defaults, given their solid balance sheet position.

In fact, the banking sector in Europe is now in a place that we have almost never seen before in terms of balance sheet quality. Banks have been deleveraging ever since the Global Financial Crisis (GFC), selling underperforming assets, as demonstrated by average non-performing loan exposures decreasing from 4.5% five years ago to below 2% currently.

This is to a large extent driven by tighter regulation than before the GFC, with rules such as Basel 3 forcing banks to accumulate a substantial amount of capital and to reduce risk.

Credit risk has shifted, higher rates are supportive

One important dynamic we have noticed in recent years is also the shift in credit risk from banks’ balance sheets to Investment Grade corporate bonds. The reason for this is that until recently bank financing was more expensive for corporates than bond market financing. So rather than seeking loans, corporates — mostly investment grade — have taken advantage of the multi-year zero interest rate environment to issue bonds, hence propelling the growth of the IG bond market. Banks kept their lending standards high therefore letting the additional credit risk shift to the broader bond market.

The other dynamic which has characterised 2022 and will continue to be very important next year is the trajectory of interest rates. Higher interest rates are positive for bank earnings, and this has already been reflected in banks’ strong third-quarter earnings. We would expect this to continue into Q4 and in 2023, allowing banks revenues to continue to increase. On the other hand, it is likely that in 2023 asset quality for banks will start to deteriorate due to the weaker economic conditions and as higher interest rates increase the repayment burdens for borrowers. Whilst the sub-investment grade corporate sector might suffer the most from economic slowdown, we consider it prudent to favour large and systemically important institutions with ample capital buffers and diversified balance sheet. Whilst smaller, second-tier banks in Europe have strengthened their fundamental position in recent years, they are more vulnerable to an asset quality deterioration.

Locking in yields

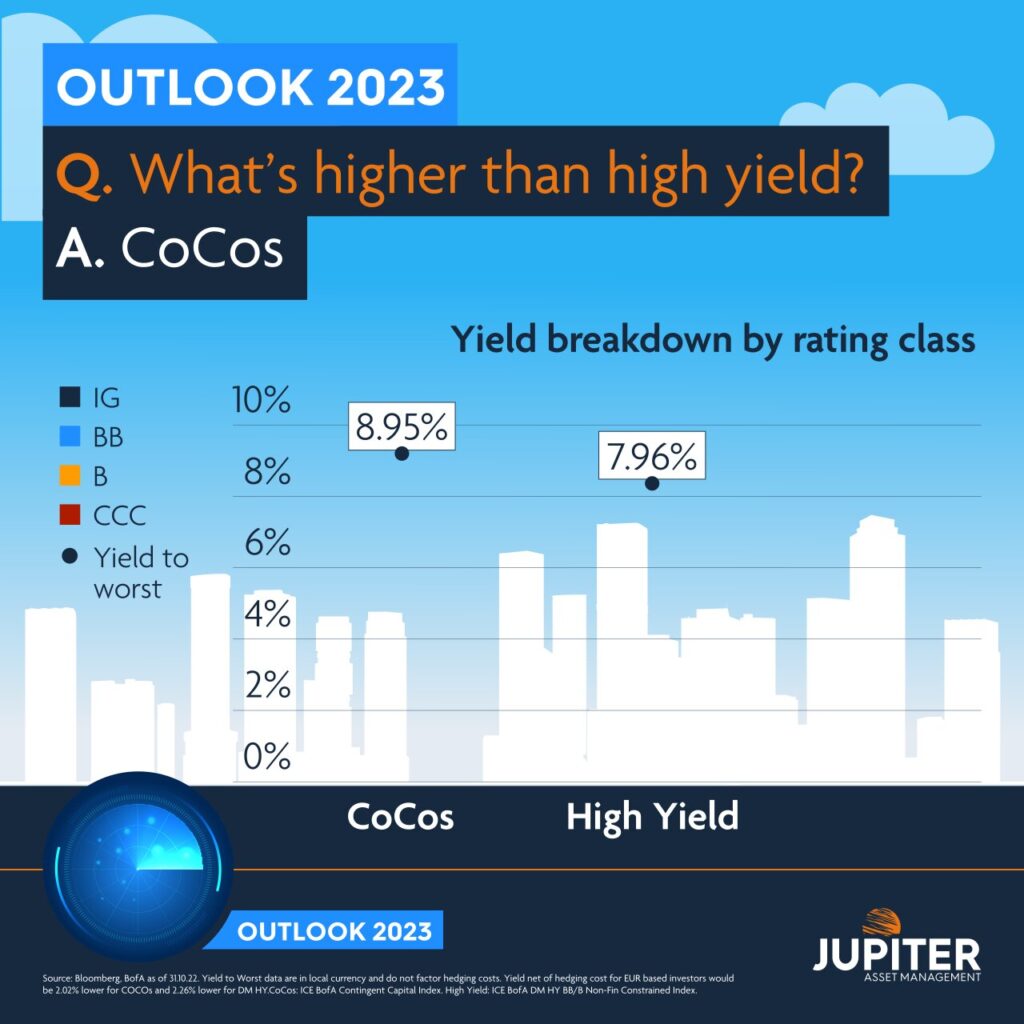

What does this mean for the contingent capital or CoCos issued by banks and other financial institutions? CoCos have been punished this year along with most fixed income assets and equities. In our view, the CoCos sector is currently trading cheaply on a historical perspective with a yield-to-worst of around 10%, which is the highest we have ever seen for this asset class. Current risk-adjusted valuations are very attractive especially compared to the riskier European and US high yield corporate sector and also to US bank preference shares

In terms of our CoCos strategy, we think it makes sense to look at gradually increasing duration as we expect that central banks will have to shift to a more dovish rates policy in 2023 as the economy weakens and inflation pressure eases. We also think that credit selection is of paramount importance, and it is a good time to own higher quality CoCo issuers — to sacrifice a little yield if necessary to stay with the strongest institutions. We think that this will potentially allow CoCo investors to lock-in very good yields without taking excessive risks in an uncertain macro environment and volatile markets.