It’s not only companies with the stellar sustainability ratings that matter. Those with the scope to improve will not only make a difference to the world, but also stand to generate attractive returns.

Hidden gems

As the 2008 oil shock loomed, a mid-sized oil company in Europe’s far northern reaches was preparing for a future without fossil fuels. Without much fanfare, Finland’s Neste had already started to produce bio-diesel. Now, rather than plunging all its resources into exploiting higher crude prices, it looked to expand capacity with new bio-fuel refineries both at home and abroad.

The strategy has proved a winner. Demand for Neste’s bio-diesel has continued to climb as governments insisted that an ever bigger proportion of transport fuel came from renewable resources. Neste’s products go a long way to cutting greenhouse gas emissions – by up to 90 per cent according to the firm.1 And it has now expanded into bio jet fuel as part of its focus on renewable energy.

The company may be doing good for the wider world, but its primary focus is doing as well as it can for investors – and here it is doing very well indeed. Earnings generated by its renewables division have soared while those of its oil products division have shrunk in the decade to 2021. And its share price has risen more than ten-fold since 2008, outpacing global equities by almost 600 per cent over that period.

Taking the blinkers off

Investors following strict environmental, social and governance (ESG) approaches will often exclude oil industry assets. Such narrow investment criteria keeps them out of companies like Neste, notwithstanding that Neste is doing more to improve climate change dynamics than many companies with stellar sustainability credentials. In many cases, those firms’ five star green ratings just boil down to the fact that they are services that incidentally don’t generate significant emissions.

But the challenge of sustainability goes much further than climate change. The UN outlined 17 sustainable development goals (SDGs) that need to be optimised to keep the world economy on a healthy course. Broadly speaking, these fall into three categories. The first is largely focused on environmental factors. The second on social factors. And the third on boosting economic potential.

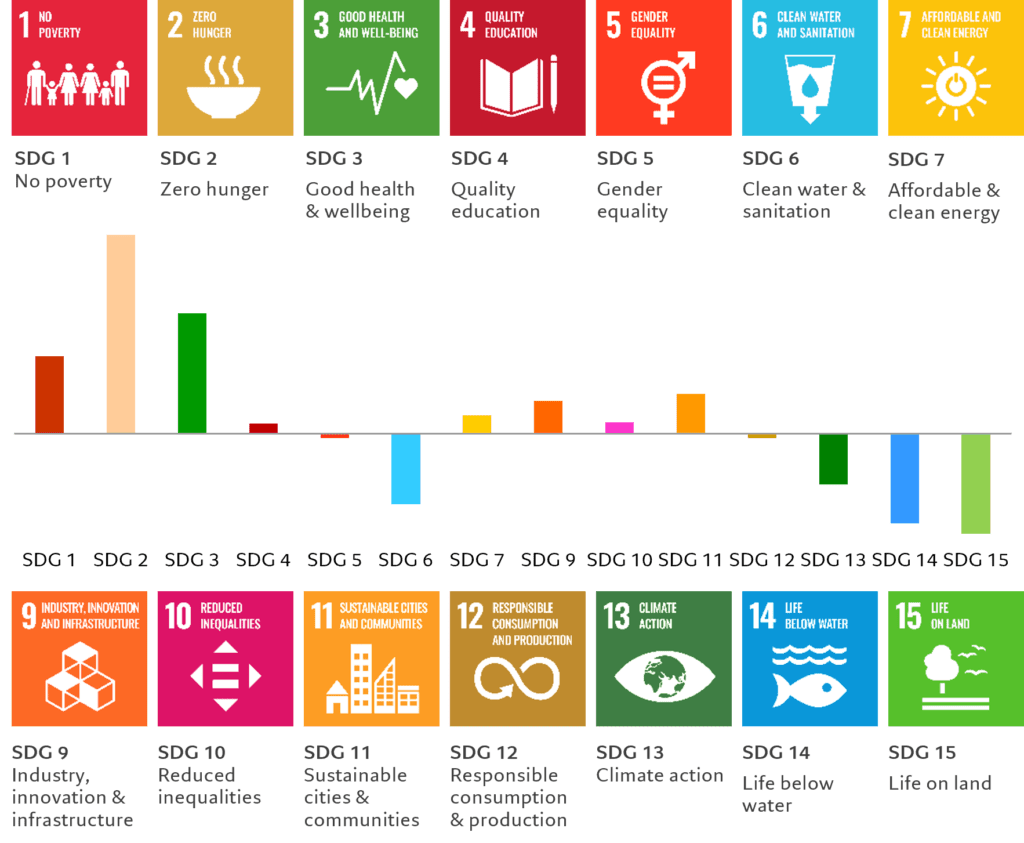

Fig. 1 – Measuring up

Example of assessment of SDG alignment generated by Pictet Proprietary Natural Language Processing tool, Mowi

These SDGs aren’t just targets for governments or big international institutions. As the UN notes, every enterprise needs to make an effort on these targets – albeit they will have varying degrees of relevance to different operations. And even where enterprises do well on some dimensions, there is often scope for further improvement.

Beyond ESG

Transition and improvement have significant investment implications too.

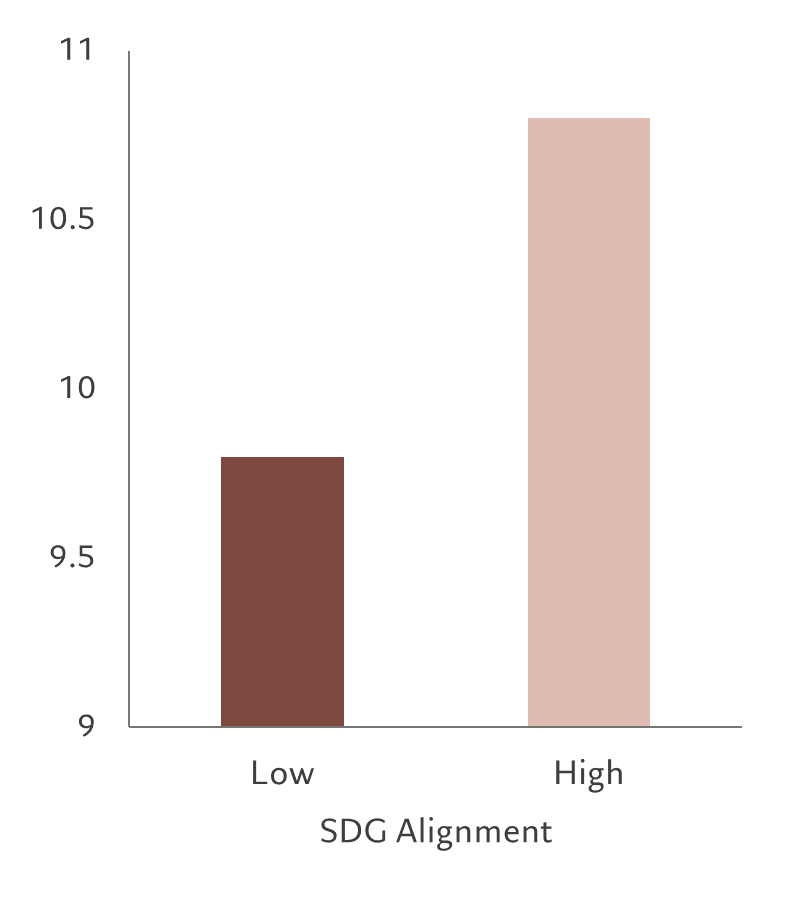

Our analysis shows that companies that succeed in aligning their operational set-up, products and services with the UN SDGs deliver superior investment returns over the long run, earning a valuation premium over their peers (see Fig. 2 and 3).

Firms producing goods and services that, within their sectors, meet the top quintile of alignment with the UN’s Sustainable Development Goals (SDGs) would generate some 100 basis points more in annual returns those in the bottom quintile.2 And these most aligned companies have lower cost of capital, with discount rates averaging 110 basis points below those in the bottom quintile.3Firms moving from the bottom quintile to the top quintile can be expected to generate gains of 50 per cent from an improvement in their discount rates and average returns.4 Furthermore, transitioning companies could additionally benefit from stronger customer demand and access to new markets.

A wealth of independent research tracking relevant proxies for SDG alignment corroborates our view. Studies have found that firms with the strongest environmental credentials have delivered outsized investment returns. And Morgan Stanley found that every 1 per cent increase in thematic purity adds a 1.15 percent valuation premium.5 That’s relevant because thematic classifications like energy efficiency, financial inclusion, health etc. often map directly onto UN SDGs.

Importantly, most of those additional returns accrue during a company’s ‘transition phase’, the period over which it makes significant advances in meeting SDG criteria. It could either already be making progress or be in a position to make the leap but yet to make notable inroads. Meanwhile, not only can companies that already rank highly boost valuations further, but, at the same time, the market consistently undervalues how long they can continue to generate superior returns.

When the market fails to recognise potential, shares tend to be undervalued. Careful, detailed bottom-up analysis of relevant firms helps to identify where the most additional value is likely to come from in each of these cases. In some cases the companies with the greatest potential for returns need encouragement or help in steering the best possible course, and then it’s important for an investor to engage actively with the firm’s management.

[3] As measured by Holt’s specific discount rates. Based on our analysis, a company that can improve over time from low impact alignment (the bottom 20 per cent of its sector according to our SDG Alignment Indicator) to high impact alignment (the top 20 per cent of its sector on the same measurement), can expect a c50 per cent increase in its share price from operations and market expectations alone. This figure is based on the difference derived in the HOLT warranted valuation when you adjust the CFROI and discount rate by the amounts mentioned above on a global, market-cap weighted portfolio.

[4] This figure is based on the difference derived in the Holt warranted valuation when you adjust the CFROI and discount rate by the amounts mentioned above on a global, market-cap weighted portfolio.

[5] ‘The Price of Purity: Valuation’, Morgan Stanley Research 01.03.2023. We use a proprietary quantitative score called “thematic purity”, which measures how specialised a company’s activities are within a particular industry or theme. The higher this rating, the more specialised a firm is.

Investing for a sustainable world

The SDGs are a nuanced framework for understanding a company’s potential – a mosaic of factors. Some of the SDGs relevant to a given firm will be obvious. Others might be obscure or even be counterintuitive.

So, for example, power utilities are essential to the functioning of economies and societies at all stages of development, but also account for 40 per cent of all carbon generation.6 The shift to sustainable sources of electricity will reduce energy poverty and enhance the industry’s impact across multiple value chains. Those in the service sector can also make these significant value chain improvements, like banks opening up financial services to greater numbers of people in emerging markets. Even companies already doing good can be steered towards reducing negative externalities. For instance, a healthcare firm may have an environmental footprint that can be reduced. Or one in the agricultural sector that is already helping to reduce hunger by improving crop yields can be encouraged to reduce any environmental damage its production processes cause.

One way to develop a full understanding of the SDG dimensions in a company’s products and services is to use the wealth of financial communication that’s made public by and about it. At this point, bottom-up analysis of its operations and financials, together with an appreciation of the possibilities thrown up by technological innovation can identify its potential for SDG improvement (see Fig. 1 for an example).

“To make a long term difference, not just to climate change, but to general human welfare, investors need to look at the wider investment universe. “

Public information about a company – be it marketing material, annual reports, investment research or press articles – all potentially contain insights into how its operations and products contribute towards UN SDGs. Given the volume of material that needs to be parsed, Pictet uses a proprietary natural language processing tool to generate a systematic and independent assessment for each firm within the investible universe. This helps determine where progress can be made and also offers a guide to informing fundamental analysis and outlining potential engagement objectives.

Some companies can particularly benefit from engagement with investors, not least those that may be earlier in their transition or where investors can help managers appreciate the importance of setting and meeting sustainability targets. Divesting from these stocks without making an effort to encourage them to change potentially misses out on big improvements made at moderate cost.

Engagement can help to encourage a company to accelerate its transition in two ways. First, by helping it to reduce doing what is bad, by choosing better alternatives. And second, through innovation.

The biggest impact

It’s become the norm to adopt ESG considerations into investments. And increasingly, funds are allocated to companies that make a positive contribution, by excluding those that aren’t. But this misses a crucial point. Firms in that category are a minority, often operating in specialised industries.

To make a long-term difference, not just to climate change but to general human welfare, investors need to look at the wider investment universe. It’s here that real change is needed. But this isn’t just a matter of philanthropy. Companies that make the transition towards sustainability are likely to reward their investors with superior returns. Some are already en-route. Some have potential but need to be guided, or prompted, by their investors. And some are already best in class in certain respects, but can nonetheless improve or do better across other SDG dimensions.

Investors who can identify this potential, with detailed ground up work and a thorough understanding of where a company sits on the multi-dimensional SDG spectrum, can generate attractive returns. And help make the world a better place.