KEY POINTS

1. We believe peak work from home is behind us, and that the pendulum has begun to swing.

2. High quality and premier office space is differentiated from traditional office space.

3. Tenants gain increased power in today’s environment to seek out a well-financed building.

Boston – It’s no surprise to many that the market is extremely pessimistic about office real estate today. Office real estate investment trusts (REITs) have underperformed the general REIT Index by 27.65% over the last year (as of April 30, 2023).1 Office REITs are trading at historically cheap levels. We believe the market is wrong, due to a number of factors; most notably, replacement costs are rising as environmental standards become more stringent and the availability of premier office space becomes more limited. However, as is often our message regardless of sector, selectivity among office REITs is key.

Return to office, through a combination of perks and mandates, continues to gain momentum. Earlier in the pandemic, there were more incentives such as free lunch and parking reimbursements, and as we enter the post-pandemic era, required days in office mandates have become more common. A number of tech and financial giants, including Amazon, Apple, BlackRock, JP Morgan and Goldman Sachs, are mandating between three and five days a week in office. We believe peak work from home is behind us, and that the pendulum has begun to swing. Management teams are focused on in-person collaboration, mentoring and general rebuilding of firm culture.

Workers face repercussions in changing office environment

In today’s market, there are repercussions for workers who ignore mandates. Some observers acknowledge that recent rounds of technology company layoffs have disproportionately affected remote workers, as companies seek to define revenue per employee, a concept easier to determine for employees in-office. Major employers are also beginning to align compensation with attendance.

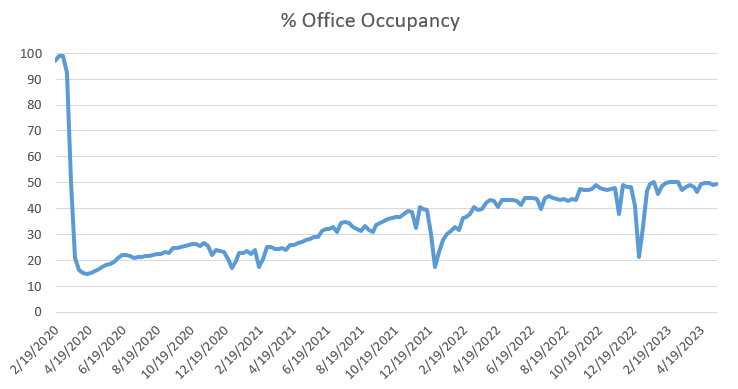

Additionally, we view the Kastle Systems Back to Work Barometer to provide a proxy for in-office attendance. The nation’s largest managed security services provider to commercial businesses features anonymized aggregated building access data from Kastle-secured properties in 10 major cities to better understand office occupancy patterns following COVID-19. Kastle releases weekly data on whether badge swipes have increased, decreased or moderated. Through their data and anecdotally, we know that not all office days are as popular, however, Tuesday serves as a good proxy for one of the more prevalent days for in-office attendance. The average occupancy on Tuesdays in April was 57.9%, nearly nine points higher than April 2022, as of May 12, 2023.

Kastle’s “Back to Work” Barometer

Aggregated building access data from Kastle-secured properties in 10 major U.S. cities

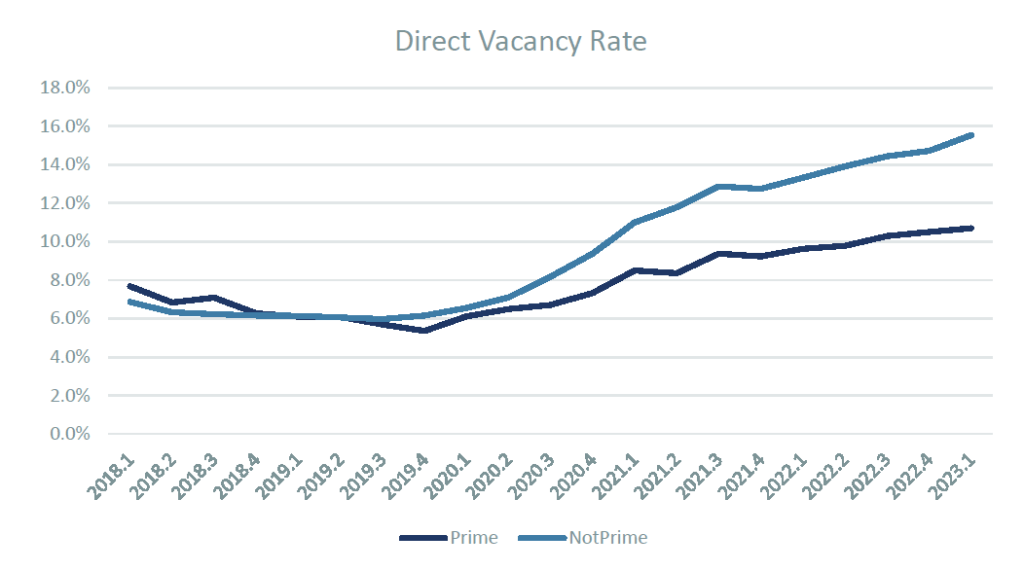

Not all office space is equal, tenants make demands

While there is a greater push back into the office, we are still not back at 2019 levels of demand for office space. Now more than ever, there is a focus on flight to quality and a flight to capital in the office market. High quality and premier office space is differentiated from traditional office space, and as we look across the office space (from coastal big cities to sunbelt properties), occupancy rates are superior for prime assets compared to non-prime assets.2 Tenants have more power in today’s environment to seek out a well-financed building. Tenants want to know that the building owner has deep enough pockets to maintain and improve the building. They don’t want to occupy a building that is foreclosed on by a lender, as this disrupts a tenant’s day-to-day business.

Average direct vacancy rate for five selected downtowns (%)

Bottom line: We believe we are experiencing the strongest pull for the office to be the primary place of work since the start of the pandemic. Still, we believe tenants have more power in terms of the space, and not all office companies will win out. We are bottom-up investors, looking for leading companies priced at a discount to their intrinsic value. The pursuit for companies that exemplify this drives our interest in finding value in premier office space. Our experience leads us to believe there are excellent opportunities with the right management teams in this environment. As always, selectivity remains key for active management.

J. Scott Craig, Real Estate Equity Analyst, contributed to this analysis.

1 MSCI US REIT Index.

2 CBRE. As of April 30, 2023.

Risk Considerations: The value of investments may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The value of equity securities is sensitive to stock market volatility. Changes in real estate values or economic downturns can have a significant negative effect on issuers in the real estate industry including REITs. Smaller companies are generally subject to greater price fluctuations, limited liquidity, higher transaction costs and higher investment risk than larger, more established companies. Diversification does not eliminate the risk of loss. Active management attempts to outperform a passive benchmark through proactive security selection and assumes considerable risk should managers incorrectly anticipate changing conditions.