The globalised nature of our food systems and their fragility have pushed food prices to historical high levels. Food inflation is hitting the most vulnerable the hardest. We need to set the path for a fair food system as soon as possible.

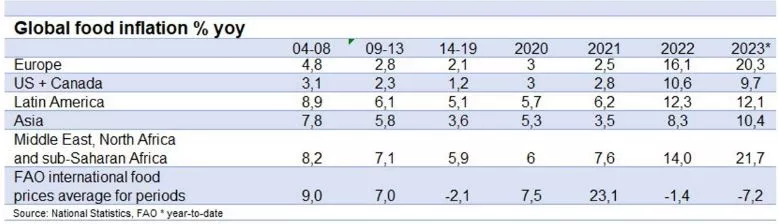

Galloping food inflation is a threat to social stability. According to Politico, since 2022 more than 12,500 protests in 148 countries have been over food and cost of living. The largest waves took place in Western Europe and in Africa and that is understandable because food prices in these regions reached historical highs (see table). When people cannot afford to feed their families, individual worries can turn into collective descent and governments can easily lose support. This is one of the reasons why during COVID and the war in Ukraine, subsidies for food import bills, fertilisers and energy surged. And in some countries, food supply is so critical that governments ended up announcing export bans, including for wheat and rice, to protect domestic consumers.

Risk of surging food prices

Even though international food prices, measured by the Food and Agriculture Organisation (FAO), appear to have peaked, it may still take time for domestic food prices to follow. This has been the case in the past (see table). More importantly, the risks that international food prices will surge again are high because supply chains remain fragile, particularly given the uncertainty surrounding Russia’s wheat supplies to world markets, an increasingly fragmented world with rising protectionism and extreme weather conditions.

To make supply chains more resilient, we also need to prepare for events like El Niño, while making government policy fit to drive sustainable food chains. For instance, by regulating the mostly negative external costs of food production, including underpayment in the food sector and biodiversity

Transformation unavoidable

The food and agriculture sector is one of the largest global economic contributors in terms of labour and economic activity. It employs slightly more than a quarter of the global workforce and in some regions, it is the largest contributor to GDP, including in Africa, where it accounts for 16% of GDP.

At the same time, activity in the sector is putting pressure on the environment. Land degradation has already reduced the productivity of 23% of the world’s agricultural land and drivers linked to food production are causing 70% of global biodiversity loss. At the same time, agriculture is one of the most vulnerable sectors to climate change. Around half of the world’s production of wheat and rice comes from at-risk areas.

While population growth and the demand for food is expected to increase by 70% by 2050. Therefore, an urgent transformation of the sector is needed, not only to address the demands of our planet and those of eight billion people, but also to fix the rampant inequality in the form of food insecurity.

No easy fix, but a worthy challenge

Given the scope of the food transition, public financing – including multilateral financing – is not sufficient to meet this challenge. Private financing is essential to fill the gap. However, private investment in food systems traditionally takes a financial risk reduction perspective. This has benefitted large clients in countries and sectors with limited risks and has not considered negative externalities.

One negative consequence of this is that only 1% of (mainly) agribusinesses control more than 70% of the world’s agricultural land. Given that smallholder farmers, who are usually considered too small to be financeable, produce 70% of the world’s food, it is not only about channelling more capital, but also (and even more importantly) about using the limited available capital in the most impactful way.

For investors, the agri and food system is one of the greatest challenges and one of the greatest opportunities. As impact investors, investing in small holder farmers has paid off because local producers can adopt sustainable practices that are appropriate for their local environments, while also providing stable incomes for households. In sub-Saharan Africa, for instance, more than two million smallholder farmers are already growing drought-tolerant corn varieties that build resilience in local food systems.

And by financing technology in the sector, the food transition can be accelerating. Many successful investments in sustainable food and agriculture involve a combination of microfinance and education, to provide farmers with (knowledge of) innovative technology with which they can address scale and climate risks and improve their management skills.

It pays off, for instance, to providedigital connection to farmers in emerging markets, to create the necessary strength in numbers, increasing their negotiation capacity. Apollo Agriculture, a Kenyan company financed by Triodos Investment Management, is a good example in this regard. It leverages mobile technology, satellite data and machine learning to support subsistence farmers in becoming more profitable and scalable.

Innovation and technology are not the silver bullet, however. Farmers must also be encouraged to adopt methods that conserve and recycle natural resources by avoiding artificial fertilisers and pesticides.

Producers, consumers and investors must work in a more targeted and holistic way, aligning on the priorities for a sustainable food system. When this occurs, workers throughout the food value chain will be paid fairly for their contribution to society and enjoy good and safe working conditions, food security will advance and consumers will have access to healthy food produced within planetary boundaries. Impact investors like us will multiply and come together to finance sustainable food systems. Only then will we be fit for a fair future.