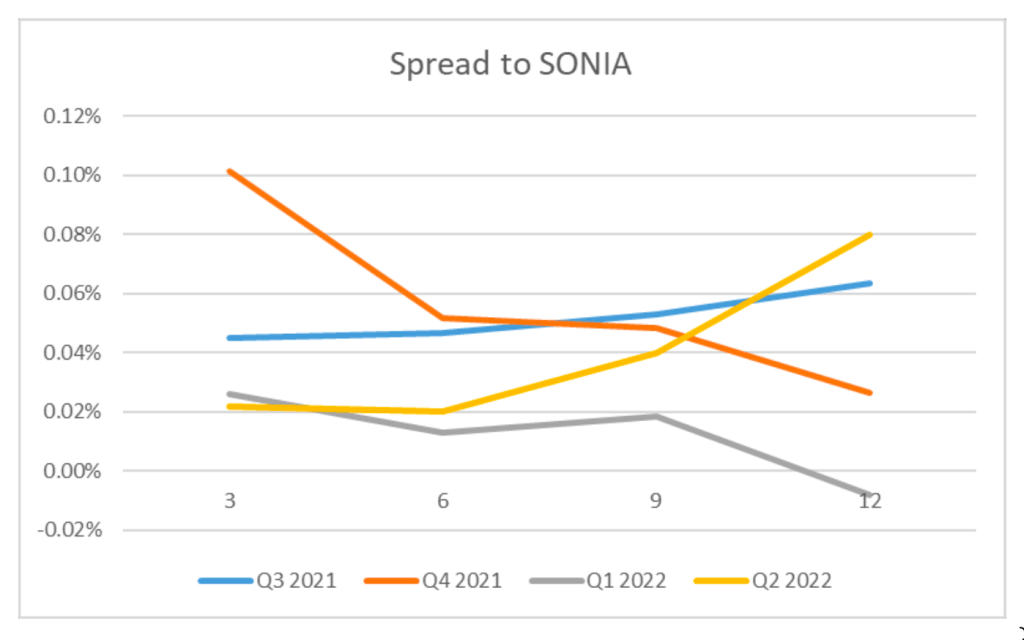

Repo rates are expressed relative to SONIA, and the chart below displays the average repo rates that we have achieved over the past four quarters for three, six, nine and 12-month repos, shown as a spread to average SONIA levels at the time. Repo conditions remain good with plenty of liquidity available and active Quantitative Tightening still in the future.

Despite higher yields and margin movements resulting in a larger requirement for funding and repo, conditions have remained easy throughout the second quarter. Competition between banks has served to keep repo spreads tight to SONIA, albeit the volatility seen in SONIA has meant some variation between intraday and close pricing. As in prior quarters, the spread to SONIA for a standard bond has changed little from the third quarter of 2021, with perhaps a little more term structure (i.e. longer dated repo pricing higher than shorter dated repo) seen in the longer maturities to factor in the uncertainty around projected rate hikes. The reason that achieved repo spreads in the most recent quarter are below that from Q3 2021 is due to the ‘specialness’ or high demand for certain bonds, which we can therefore use for repo collateral to reduce the cost to our clients. Typical repo rates for a ‘special’ bond vary but have been as low as SONIA minus 0.44%, thus reducing our average repo spread to SONIA. The cause of bonds being viewed as ‘special’ are twofold, firstly there is limited natural supply as the Bank of England owns the vast majority in their APF holdings; secondly, as the base rate has risen, the corridor between this and the Standing Repo Facility (SRF) where banks can borrow these bonds in order to settle them has grown ever wider. However, the most recent rate hike in May held the difference between the two unchanged, thus reducing the impetus for these bonds to become even more scarce and in- demand.