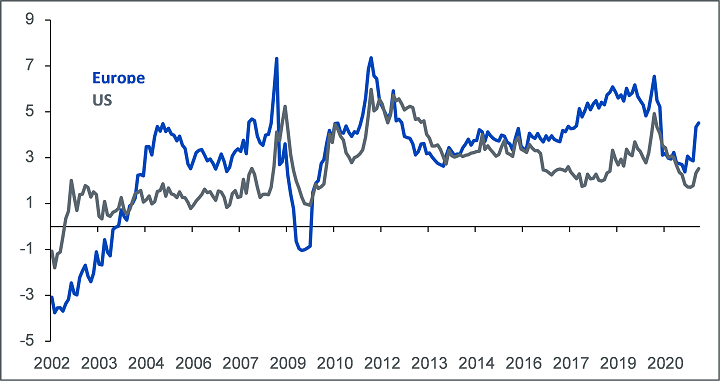

The global macro environment appears shrouded in uncertainty, owing to renewed concerns about the spread of the delta variant, peak growth and an earlier-than-expected taper by the US Federal Reserve. The bond markets are clearly reflecting these growing concerns. However, the equity and bond markets appear to be telling us a contradictory story. Global equity markets led by Europe and the US continue to make new highs, buttressed by stronger earnings. Evident from the chart below, equity risk premiums (difference between earnings and bond yields) in Europe have risen to a 15-month high of 4.5%, which continues to suggest European equities remain attractive relative to bonds and other global equity markets.

Figure 1 – Equity risk premiums favour Europe

Source: Bloomberg, WisdomTree as of 30 July 2021 The equity risk premiums is calculated as the difference between earnings yields and bond yields.

Q2 reporting season in Europe has been strong

European companies are witnessing the best earnings revisions of all global regions reflecting a strong snapback in economic activity. Strong 2Q 2021 results and full-year guidance upgrades are pushing the earnings growth rate to 31%1 over the next two years compared to 24% at the start of the year and the net revision ratio (upgrades minus downgrades) to 50%1, its highest level since H2 2017. Cyclical sectors such as energy, materials, financials, and consumer discretionary have been key contributors to the earnings revision cycle. Defensive sectors have seen limited changes to their forward earnings per share (EPS) estimates (around 5%1), while their revision ratios are substantially lower versus cyclicals. Europe1 has delivered a strong breadth of EPS net beats2 at 64%, with the breadth of sales beats even higher at 68%. Consumer-related companies are performing well, with 70%1 reporting higher sales than in 2019. Europe’s transcript mentions for “buybacks” (i.e. the number of times that buybacks are mentioned in earning reports produced by companies following their respective earning calls) were at the top of their 5-year range which suggests that more buybacks in Europe could provide a positive catalyst for the European equity market. In addition, Free-Cash-Flow (FCF) is up 8%1 year to date, and current dividend estimates look conservative as the payout ratios at FCF level stand at 52% versus 61% in 2019, opening the possibility of high dividend payments.

US – recovery hits peak

US companies second-quarter EPS improved slightly over the prior quarter (up 4%)3 with 80% of companies beating EPS consensus estimates3. Positive surprises reported by companies in the financials, information technology and communication services sectors were the largest contributors to the overall increase in earnings this quarter. US revenues, led by energy, consumer discretionary and health care, exceeded expectations. The Q2 2021 blended revenue growth rate of 24.7% is well above the 5-year average growth rate of 4.5% and the 10-year growth rate of 3.4%. US companies posted robust margins, with Q2 net margins (excluding financials) jumping to a new high of 13.1%, exceeding the prior quarter’s 12.5%. Despite the strong results, price action has once again shown a slight negative skew suggesting the good news was largely priced in. Companies citing accelerating cost inflation has been a key theme. Consensus margin expectations for H2 2021 are now reflecting this risk, with margins forecasted to moderate to 12.6% next quarter. Mentions of inflation jumped 900% to an annual record high in Q2 earnings reports, including mentions of supply chain and labour inflation were most cited by the industrial, materials and staples sector. Owing to the highly elevated revision rate throughout the first half of 2021, we find it difficult to imagine an acceleration of earnings in the US going forward. As the peak in the acceleration phase of the US macrocycle has likely passed in Q2, we expect earnings to start to moderate going forward.

Sources

1 Represented by 85% of companies on the Stoxx Europe 600 Index that have reported Q2 2021 earnings results. Source: Bloomberg

2 EPS beat/miss defined as +/- 2% from Bloomberg consensus estimates

3 Represented by 91% of companies that have reported in the S&P 500 Index. Source: Bloomberg