24

98%

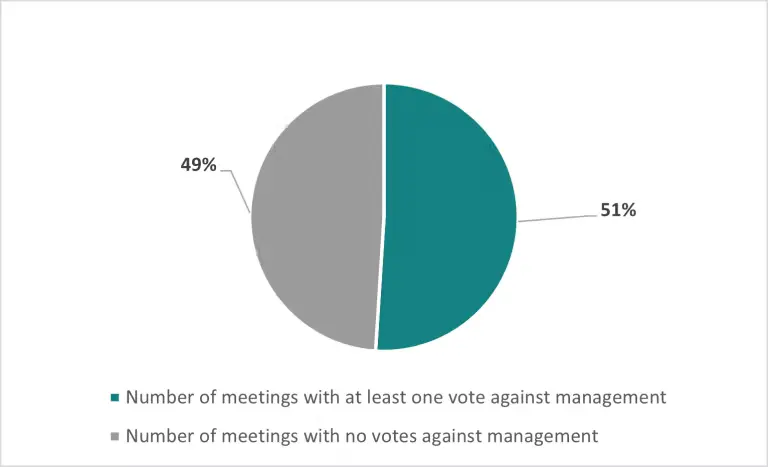

51%

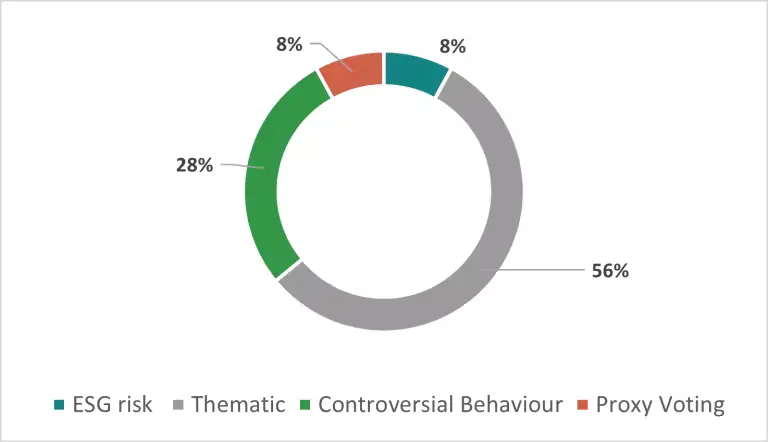

Carmignac held 24 engagements in the second quarter of 2022:

Q3 2022 engagement activity

In Q3 2022, Carmignac voted against the management of our investee companies at least once at 51% of meetings voted:

Meetings voted for/ against management

Dabur India

Sector: Consumer staples

Region: South Asia

The company is held in a number of Carmignac’s equity funds1 .

Engagement objective(s)

In August 2022, before casting our vote at its Annual General Meeting (AGM), we reached out to the company to seek clarifications on its executive remuneration plan. The company’s explanation led to a vote of support for the two remuneration resolutions2 on the agenda of the AGM. We however cast a vote against one family representative sitting on the board of the company3 to signal our concerns around the low level of board independence. Following our vote, we engaged with the company to provide feedback on these two topics.

Engagement method

In September 2022, we held a videocall with the company’s investor relations representatives.

Engagement summary

On executive remuneration, we asked for more transparency on the long-term incentive grants as well as more clarity around the various elements of the pay package. We highlighted to the company our expectation to see a clear link between the remuneration levels and the performance.

On board independence, the slow refreshment of the board means that only 29% of the board was considered independent4 at the date of the AGM. We consider this level to be low even for a controlled company where our expectation would be for 33% independence as a minimum5 . We welcomed the presence of a woman on the board and asked the company that it continues to grow its gender diversity levels on the board. The company acknowledged our comments and explained that it is in the process of refreshing the board but that these changes take time.

Lastly, we discussed with the company our expectations around sustainability commitments and reporting. In particular, while we welcomed its ambitious carbon neutrality target by 2040, we asked them to provide a roadmap in next year’s reporting. We found the company’s disclosures on governance, environmental and social topics weak and asked the company for more transparency.

Outcome and next steps

Following the call and after reviewing the case with the lead investment analyst, we decided to downgrade the company’s governance rating as well as its overall rating in our internal proprietary ESG scoring tool, START6 to reflect our assessment of the Following the call and after reviewing the case with the lead investment analyst, we decided to downgrade the company’s governance rating as well as its overall rating in our internal proprietary ESG scoring tool, START to reflect our assessment of the company’s practices.

We will continue to monitor the evolution of the company’s practices, especially around transparency and reporting.

1As at the date of the engagement reported below (September 2022) and the date of publication of this case study (December 2022). Equity funds are Carmignac Emergents, Carmignac Portfolio Emergents, Carmignac Portfolio Emerging Patrimoine, FP Carmignac Emerging Markets, FP Carmignac Emerging Patrimoine

2 Resolutions 8 and 9 – Approve Reappointment and Remuneration of Pritam Das Narang as Whole Time Director Designated as Group Director – Corporate Affairs; Approve Revision in the Remuneration of Mohit Malhotra as Whole Time Director and CEO

3Resolution 4 – Reelect Saket Burman as Director

4As per ISS’ definition of independence

5In line with our voting guidelines. Please refer to our Voting Policy for more information: https://carmidoc.carmignac.com/SRIVP_INT_en.pdf

6The proprietary ESG system START combines and aggregates market leading data providers ESG indicators. Given the lack of standardisation and reporting of some ESG indicators by public companies, not all relevant indicators can be taken into consideration. START provides a centralised system whereby Carmignac’s proprietary analysis and insights related to each company are expressed, irrespective of the aggregated external data should it be incomplete. For more information, please consult our ESG Integration Policy: https://carmidoc.carmignac.com/SRIIP_INT_en.pdf