With 26% of the S&P 500 earnings reported, third-quarter results have been mixed, although they generally have come in better than expected, risks remain. Thus far, 70% of companies beat on top line while 59% beat earnings expectations.1 The improvement is due in part to downward adjustment in expectations, which reflects slowing economic growth. At the start of Q3, analysts expected earnings growth of 2.4%, which would be the lowest figure reported by the S&P 500 index since Q3 2020, according to FactSet.

Key Takeaways

- 59% of S&P 500 companies have beaten earnings estimates, and 70% topped revenue expectations.

- Communication Services and Health Care contributed the most to overall earnings growth for the S&P 500 index.

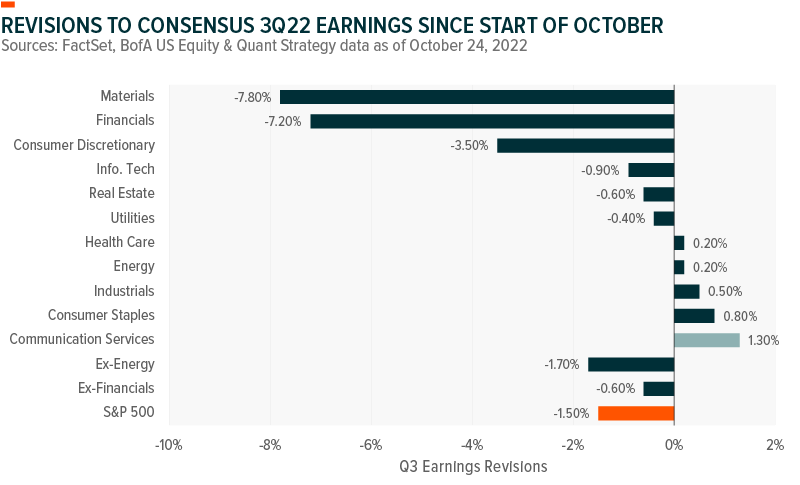

- Downward revisions to estimated earnings and negative earnings surprises have been led by the Materials, Financials, and Consumer Discretionary sectors.

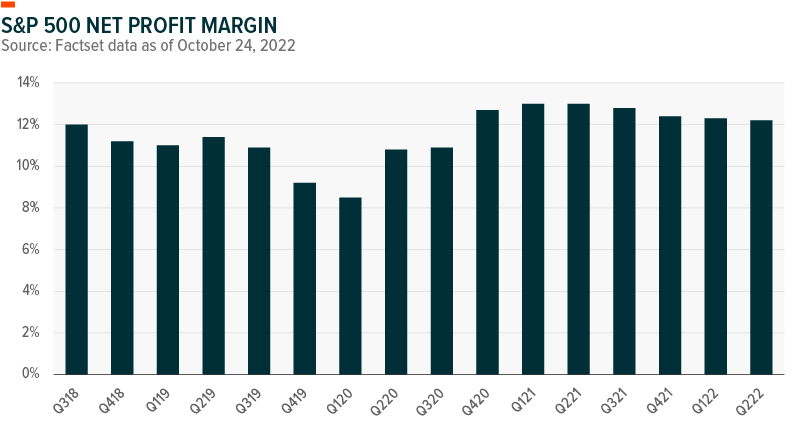

- Blended profit margins for the S&P 500 in Q3 is on track to mark the fifth straight quarter of declines, driven by high producer prices.

The combination of rising interest rates, strong US dollar, and high inflation have weighed on analyst sentiment going into Q3. Six out of nine sectors are forecasted to see earnings decline in Q3, led by Materials, Financials, and Consumer Discretionary, according to FactSet. The Communication Services sector had the largest increase in earnings expectations, which contributed to recent disappointments. And excluding Energy, downward revisions to Q3 earnings have been greater than the index.

Year-over-year earnings growth has been led by the Energy sector, driven by high oil prices. However, downward revisions to revenue estimates for Energy companies have contributed to the decline in overall revenue growth rate for the S&P 500 index since September 30.2

Top Line Improvement

Blended top-line growth of 9% is on track to beat forecasts of 8.7% year-over-year. 70% of S&P 500 companies have beaten revenue expectations in Q3. On the sector level, 90% of Health Care companies reported revenue above expectations, compared with 83% of Materials companies, and 80% of Energy companies over the same period.

Despite recent improvement, both the number and magnitude of positive earnings surprises are below their 5-year and 10-year averages. However, those averages are skewed higher recently because of strong earnings growth coming out of COVID-19 lockdowns over the past year, according to FactSet.

Margins Under Pressure

US producer prices rose by 8.5% year-over-year in September, which negatively impacts corporate profits. So far, blended profit margins for the S&P 500 in Q3 is 12%, on track to mark the fifth straight quarter of declining profit margins for the index.3 And over the past three months, 412 companies have cited “inflation” on earnings calls, which is the second highest count in more than 10 years.

Still, Energy was one the seven sectors that reported net profit margins above their five-year average, increasing to 14.6% versus 8.9% in Q3 2021. On the other hand, Financials have led the decline in overall profit margins (down to 14.9% in Q3 versus 16.5% in Q3 2021), followed by Materials (down to 11.4% versus 14.2% in Q3 2021).

Rising labor costs have also been a headwind for corporate profit margins. US wage growth has accelerated across all industries this year, most notably in Transport and Leisure.4 Other cyclical industries such as Manufacturing and Construction have seen high wage growth, which reflects tight labor conditions.

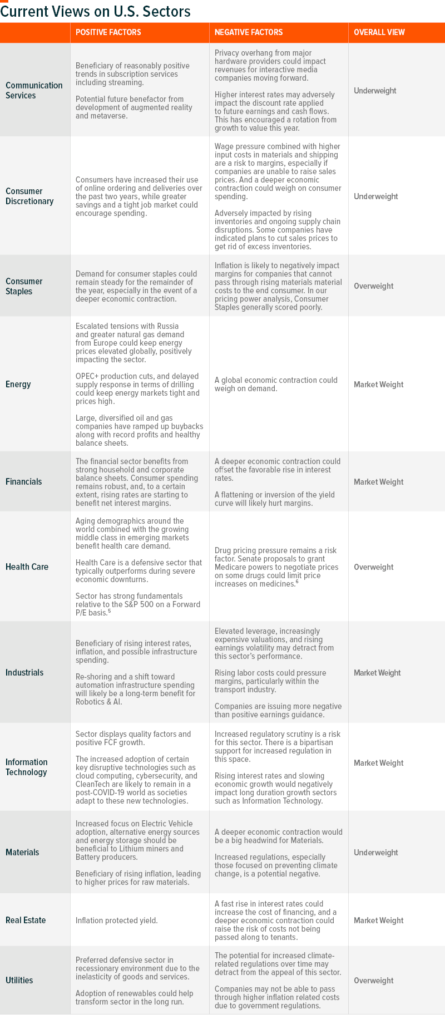

Corporate margin expectations are still relatively high and will likely decline as earnings reflect rising labor costs. As such, a tilt toward defensive and quality sectors such as Health Care and Consumer Staples and lower exposure to cyclical sectors such as Industrials/Transports can mitigate downside risks in a portfolio. In previous cycles, a trough in S&P 500 margin estimates has occurred around market lows.

Our sector views table below provides more detail on sector positioning and the current tailwinds and headwinds for each sector.

FOOTNOTES:

All data sourced from FactSet unless otherwise noted.

1. Bloomberg, Q3 2022 Earnings Tracker: Margins Under Fire, October 24, 2022

2. FactSet, S&P 500 Earnings Season Update, October 21, 2022

3. FactSet, S&P 500 Reporting a Lower Net Profit Margin for 5th Straight Quarter, October 24, 2022

4. US Bureau of Labor Statistics, Job Openings and Labor Turnover Summary, October 4, 2022

5. BofA, When Alternatives Go Mainstream RIC Report, August 9, 2022

6. CNBC, ‘Once-in-a-generation’ Prescription Drug Pricing Reform Could be Coming, July 29, 2022