Just when markets thought US inflation had peaked, it surprised once again to the upside in June. As prices are expected to remain elevated for longer, how can investors navigate the potentially bumpy path ahead?

Data released in June shows US inflation unexpectedly re-accelerated to 8.6% in May, confounding expectations that it had topped out in March when it reached 8.5%, then slowed to 8.3% in April. May’s figure was the highest reading for inflation in the world’s largest economy since 1981 – and what’s more, the rise in prices was broad-based.

The Ukraine war has pushed energy and food prices higher, but the latest US inflation figures also included significant increases seen in the cost of housing, used cars, airline fares and more.1

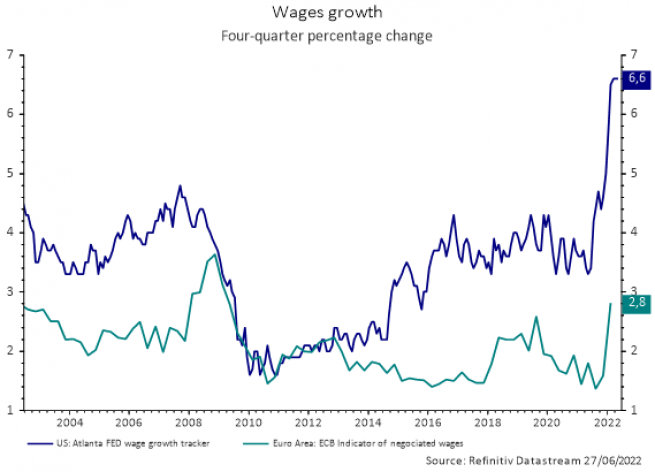

And it’s not just in the US. In June, Eurozone inflation jumped to a new record high of 8.6% and UK inflation increased to 9.1% in May, as prices rose at their fastest rate in 40 years.2 Broader inflation pressures could be strengthened by a tight labour market. We are already seeing rising wages in the US, as employees demand higher salaries to cope with inflation, while this move is starting to be seen in the Euro area.3

Even Japan, which has historically seen low levels of inflation, has reported its annual core consumer inflation above the central bank’s 2% target for two consecutive months.4

The peak is still to come

I believe we have still not yet seen peak inflation in the US and expect it to remain elevated for the coming 18 months even if it may eventually start to slow in the later part of 2022. I also believe the peak is still ahead of us in the Eurozone and UK.

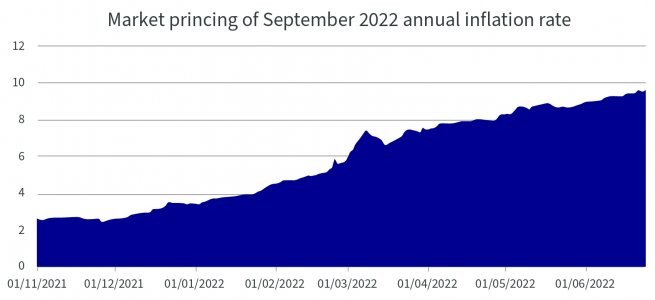

Eurozone inflation is now expected to reach 9.5% in September or October, before the pace starts to slow albeit at a moderate pace, creating the risk of an entrenched inflation. This is a far cry from forecasts made before Russia’s invasion of Ukraine – back then, Eurozone inflation had been expected to peak at 4.5% in Q2 2022. The balance of risks on Eurozone inflation continues to be tilted to the upside, taking into account Europe’s dependency on Russian gas, and with a weaker euro meaning higher import prices at a time when commodity prices are rising.

The chart below shows the market’s pricing of September 2022 inflation, in basis points, and demonstrates an increase of more than 5% over the year to date:

Central banks around the world have begun to raise interest rates in an effort to rein in inflation, with the charge led by the US Federal Reserve, which hiked the Fed Funds Rate (FFR) by 75 basis points (bp) in June, following a 50bp increase in May. The FFR is now expected to breach 3% this year (on the median expectation of the Fed’s own interest rate outlook, or ‘dot plot’), considerably more than the 1.9% envisaged three months earlier.1

We believe the coming quarter will be difficult for central banks as they navigate the sometimes very fine line between rate hikes designed to cool both inflation and the economy, and the risk of tipping over into stagflation or even recession.

Transitioning from long inflation breakevens to long inflation-linked bonds

In the short term, particularly in markets where we have not yet reached peak inflation, we see upside potential for inflation breakevens – the difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked bond.

But as stagflation risks increase and inflation stops accelerating, but remains historically elevated, we expect short-term inflation-linked bonds to outperform long-term inflation breakevens. Short-term inflation-linked bonds are indexed to the full inflation reading, including food and energy prices, which we expect to remain high but have limited duration that should help cope with the elevated volatility.

As the principle of an inflation-linked bond is linked to inflation, holding short-maturity inflation-linked bonds could also provide a buffer against higher interest rates, which are likely to increase as central banks continue to tighten monetary policy.

Investors who have not already entered this market may question whether they have missed the ‘inflation trade’. As mentioned above, we see limited potential for breakevens in the short term, and short duration inflation-linked bonds may be more attractive to consider.

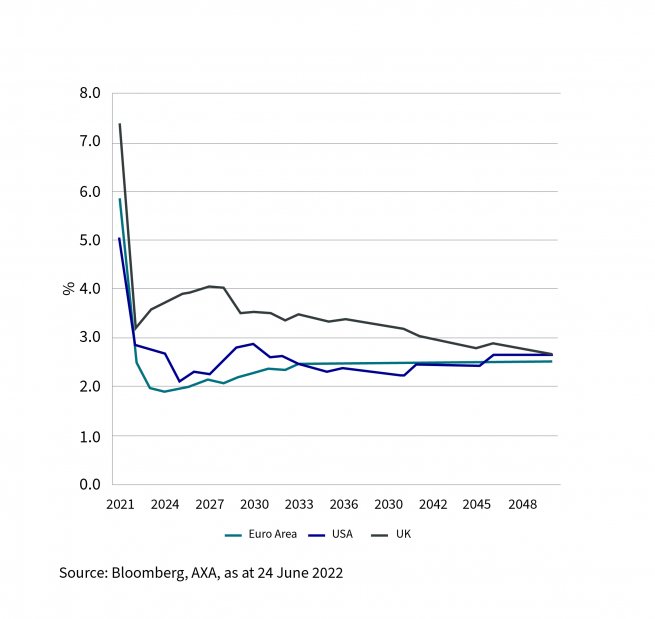

In the longer term, while there are growing risks that inflation proves longer lasting than expected, the market is still pricing in inflation to be transitory (see chart below).

[1]

A bumpy path, but positive outlook

We see the most likely downside risk to be from lower commodity prices, but as the war in Ukraine continues and as we start to approach winter, we expect energy prices to remain high, while other commodities could remain expensive as demand picks up after coronavirus-related lockdowns and ongoing supply chain bottlenecks.

Longer-maturity inflation-linked bonds could also potentially continue to enjoy an historically elevated income thanks to higher real yields and solid inflation indexation. While we believe that the extra yield picked up would be modest compared to short duration inflation linked bonds, for considerably more interest-rate sensitivity and therefore more risk. These are potentially more attractive for investors who are prepared to take a longer-term view as real yields have increased significantly since the beginning of the year. Long maturities inflation-linked bonds should also benefit from a so-called “stagflation” scenario where economic growth is sluggish but inflation stubbornly high.

Investors should be prepared for some volatility in the short term, as has been the case since the beginning of the year. Central Banks will increasingly find themselves between a rock and hard place as inflation should remain very elevated from an historical perspective, but economic growth is already slowing – as suggested by European and US Purchasing Managers’ Indices published at the beginning of July 2022, and recession fears are increasing. However, as real yields move back into positive territory in step with interest rates hikes, I believe that the outlook for inflation-linked bonds continues to be potentially compelling.

[1] a. b. Consumer Price Index Summary – 2022 M05 Results (bls.gov)<br>

[2] Euro indicators – Eurostat (europa.eu) / Consumer price inflation, UK – Office for National Statistics<br>

[3] U.S. labor market keeps Fed on aggressive rate hike path | Reuters<br>

[4] Japan’s inflation tops BOJ target for 2nd month in test of monetary stance | Reuters

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Risk Warning

The value of investments, and the income from them, can fall as well as rise and investors may not get back the amount originally invested.