As real-time payments become a norm in Southeast Asia, corporate treasurers are revamping their financial processes to stay competitive.

As the pandemic unfolded, shopping worldwide went online, accelerating a trend that had already started in Asia. According to Nielsen IQ, online shopping now accounts for 20% of retail sales in Asia Pacific. This happened against the backdrop of the introduction of real-time payment systems and surge in real-time payment volumes across the region.

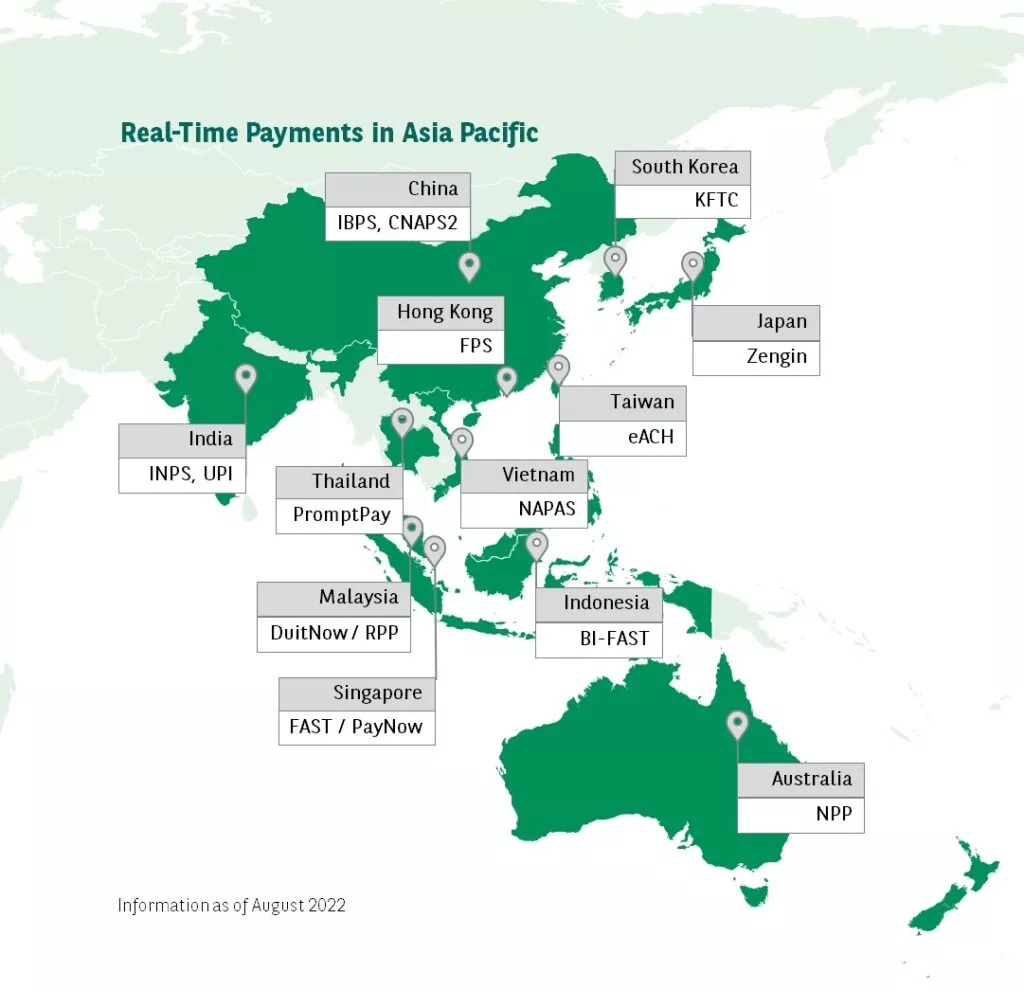

According to ACI Worldwide, Asia Pacific is the key driver for global real-time payments volume and adoption. The growth is particularly significant in the Southeast Asia (SEA) region, home to some of the most developed payment networks like PayNow in Singapore and PromptPay Thailand, as well as newer systems such as NAPAS in Vietnam, and BI-FAST in Indonesia, which was launched in December 2021.

Southeast Asia leading the way in real-time payments

“Many Southeast Asian countries have seen rapid declines in cash usage since the pandemic, accelerating the adoption of digital alternatives,” said Edwin Chan, Head of Cash Product Management, Transaction Banking APAC at BNP Paribas. “These real-time payment methods are now widely adopted by consumers and we are also seeing a gradual uptake in the corporate space in recent years.”

The development of these real-time payment systems is driven by the central banks, keen to promote a cashless economy and enhance efficiency for businesses. The high adoption rate has delivered clear benefits: ACI Worldwide estimates that Thailand, the world’s fourth largest country in real-time transaction volumes in 2021, realised cost savings of US$1.3 billion for businesses and consumers, which helped to unlock US$6 billion of additional economic output for the country.

How does real-time payments impact corporate treasurers, particularly for those in the SEA region? “There is a clear shift to real-time payments for consumer and retail sectors at the moment,” explained Chan. “Internal stakeholders, like sales and procurement teams, as well as suppliers are expecting commerce to be much faster than before – and that requires a more responsive feedback from treasurers to support day-to-day operations.”

There is also a gradual adoption for business-to-business payments. The adoption is slower as there is an upper limit on real-time payment amount. However, as and when these limits are raised or lifted, it is expected that the uptake by corporates will accelerate, given the clear benefits of real time payments and availability of instant transaction data.

How can treasurers benefit from real time payments? Firstly, instant transactions enhance supplier and vendor relationships. “Treasurers can also enjoy better visibility on payment charges, turnaround time, and they can share information on delays, for example,” Chan explains. “Access to this information in a real-time manner can avoid a lot of misunderstandings between buyers and sellers.”

Real-time payments are key drivers for treasurers to adopt real-time treasury where treasury operations – liquidity management, reconciliation, cash-flow forecasting or FX management – become aligned in real-time instead of spreading out over several mismatched days. The visibility of liquidity position and payment status will benefit from the transition to real-time. It also means that treasurers no longer need to pay in advance; they can reduce the days payable outstanding and days sales outstanding, thus accelerating their order-to-cash cycle and improving cash flow. Funding for corporate liquidity, domestically and in the future cross-border, can also be in real-time.

Realising the real-time vision

The benefits of real-time treasury are clear, and building blocks are available. The question is ‘how’. “Treasurers are redesigning their financial operations and expecting real-time information from their banks and service providers to support the real-time ambition,” said Chan. “We are seeing the shift from weekly or monthly batch processes, to intra-day, which gives them instant visibility to their transactions, obligations and cash position.”

The use of APIs [application programming interfaces] is also a game changer, facilitating real-time reporting and workflow management systems for better transaction predictability and visibility, beyond B2C industries.

“With APIs, treasurers can now break down their existing workflow into chunks and they can redesign to how it suits them,” Chan explained. For example, foreign exchange (FX) can now be embedded at any stage of the transaction process, with dynamic information. The treasurer can decide when and what FX rate is applied to their cross-currency transactions, through a streamlined process that is configured to match their current workflows.

Looking ahead

In addition to domestic real-time payments, Southeast Asian countries have also started to introduce linkages between national systems to create cross-border opportunities. For example, the Monetary Authority of Singapore and the Bank of Thailand have launched the linkage of Singapore’s PayNow and Thailand’s PromptPay real-time retail payment systems in 2021.

For MNCs with global operations, Asia Pacific is often seen as a diverse and disparate region. The introduction of new cross-border real time payments corridors in Southeast Asia, can eventually offer greater flexibility for corporate treasurers looking to manage their pan-region payments and receipts from a single entity or shared service centre in one designated location. This potentially further streamline the treasury operations and liquidity management in the region.

Mission possible

The rapid development in the industry, coupled with the accelerated pace of digitalisation in the last two years have laid the foundation for real-time treasuries. “Real-time treasury is no longer a distant goal,” added Chan. “Treasurers are revisiting their entire operation to adapt, with their accounts payable, accounts receivable and cash flow forecasting all transitioned to the new rhythm to drive competitive advantage for their business.”

This will be a collaborative journey, with the involvement of their technology team, banking partners, and other financial service providers to develop a progressive, pragmatic roadmap for the implementation of this vision.