Sustainable investors have typically avoided investments in defence. Geopolitical developments, and the evolution of a more nuanced view of what matters for sustainability, have now brought the sector into focus: sustainability criteria and investing in defence can be aligned as autonomy, resilience and security emerge as key investment themes, writes Sindhu Janakiram.

Peace, stability and a predictable future can be seen as fundamental prerequisites for sustainable development. In fact, United Nations Sustainable Development Goal 16 emphasises the need for ‘peace, justice and strong institutions’.

We believe defence companies with the right ‘guardrails’ can make a major contribution to the social and economic resilience that allow for sustainable growth. A poor defence infrastructure can expose a country or region to foreign aggression and terrorism, destabilising economies, displacing populations and halting or undoing development.

Accordingly, investing in companies that provide defence assets to countries upholding international law can be seen as contributing to global peacekeeping and stability.

We believe sustainable investors should rigorously screen for sustainability to differentiate between defence companies that support responsible policies and those that do not. Just as these investors have acted as catalysts for positive change in controversial areas such as mining and conflict diamonds, they can have a positive impact on the defence industry.

The financial case for investing in defence

As we have previously written, European defence stocks may offer investors compelling upside. Russia’s conflict with Ukraine and uncertainty over the US’s willingness to guarantee peace in Europe have rekindled a need for European nations to bolster their militaries after decades of underinvestment.

This has triggered a flood of spending plans including the EU’s EUR 800 billion commitment to increase defence outlays and re-arm. That has propelled shares in many companies involved in defence further. They had been rising already amid heightened geopolitical tensions and increased global military spending.

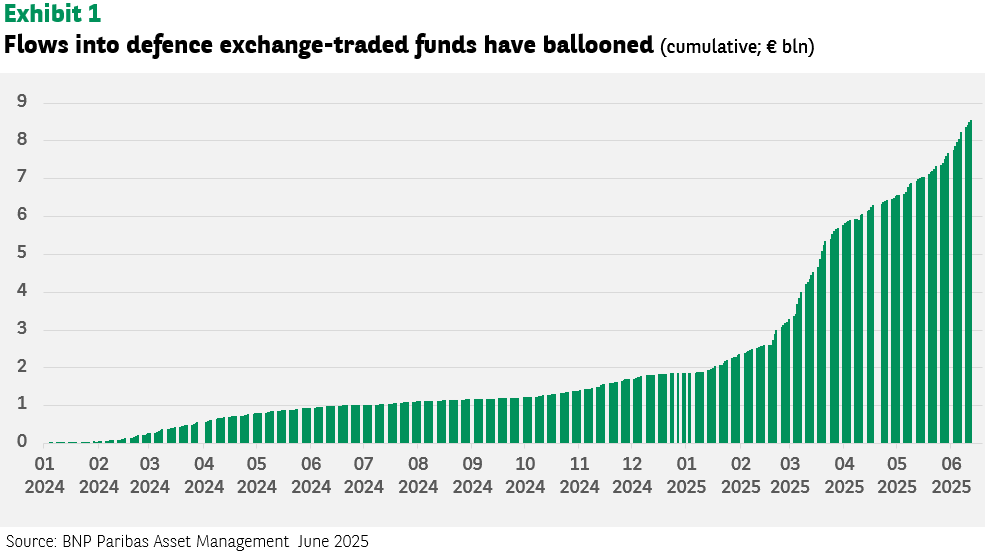

With over €1.6 trillion in investments1 planned by Europe over the next 10 years, it is becoming apparent to many investors that a long-running opportunity is emerging. ETF flows have reflected this. 2024 saw just under €1.9 billion in flows into defence ETFs. The pace has accelerated in 2025 with already over €8 billion in inflows1 so far this year (see Exhibit 1).

This growing investor appetite should underpin the case for further upside for defence shares after their striking gains in recent years.

The prospect of long-term European commitments to spend more on defence, already sizeable order backlogs and robust cash flows bode well for an extended run of share price gains. The fact that many European defence stocks appear attractively valued relative to similar firms based in the US is a further plus point.

Finally, many European investors have historically been cautious about investing in defence stocks due to sustainability concerns, but they have now started to reassess their stance, potentially unlocking broader institutional and end-investor demand.

Defence technologies – Driving innovations

One beneficial side-effect of defence spending is that historically, it has helped drive innovation in technologies that have gone on from the battlefield to widespread civilian applications: the internet, GPS and advanced materials such as carbon composites all have their roots in defence research.

There’s no reason to think that this will not continue to be the case. Many defence companies make substantial investments in advanced logistics, cybersecurity and artificial intelligence – all of which can be highly relevant for society as a whole.

Our approach to sustainability and investing in defence

We invest in defence companies as we recognise the important role they play in preserving sovereignty and stability. In doing so, we invest in line with the UN Global Compact: principles 1 and 2 state that businesses should respect the protection of human rights and make sure that they are not complicit in human rights abuses.

We adhere to our own responsible business conduct policy which ensures that we do not invest in companies involved in weapons that cause indiscriminate and thus undue harm to civilians. Such weapons include (but are not limited to) munitions banned by international treaties such as cluster bombs, anti-personnel landmines and chemical and biological weapons.

We believe that engaging with defence firms to improve their sustainability behaviour is a valuable tool for investors. Where necessary, we seek to steer companies towards improved transparency, ethical conduct and environmental responsibility.

The next steps for sustainable investment

The field of sustainable investing is maturing. Whereas many sustainable investors once saw industries in terms of being ESG-compliant or non-compliant, they are now increasingly considering the nuance, context and interactions that define what makes an investment eligible. In our view, defence companies can play an essential role in helping to build a secure and sustainable world.

At the same time, sustainability reporting and disclosure rules may need to be adjusted to track, for example, conventional and controversial weapons, and weapons manufacturers’ end-clients.

We believe sustainable asset managers can embrace a framework that emphasises the financial and non-financial advantages of investing in defence based on security as a core social good. It is obvious that they should also ensure that such investments continue to align fully with sustainability objectives.

ALSO READ ON VIEWPOINT

By investing in listed companies critical to Europe’s strategic autonomy and resilience, asset managers and retail investors can support market confidence, visibility and liquidity, write Mathieu Jourde and Lazare Hounhouayenou.

Defence-related investing has taken over as the dominant investor theme for thematic exchange-traded funds, writes Daniel Dornel.