The semi-annual review and rebalance of the Bessemer Venture Partners (BVP) Nasdaq Emerging Cloud Index provides a window into recent developments in cloud companies— with a fresh pipeline of new additions following their beginning to trade in public markets. This dynamism is critical to capturing the cloud computing megatrend.

The BVP Nasdaq Emerging Cloud Index follows a rules-based methodology that resets constituents and weights back to equal weight in February and August. This simple, yet effective, approach provides significant exposure to fast-growing, emerging businesses that are often overlooked or diluted in market cap-weighted benchmarks.

The August 2021 rebalance illustrated robust initial public offering (IPO) and merger & acquisition (M&A) activity, with a steady inflow of public market entrants and an outflow of recently acquired cloud companies.

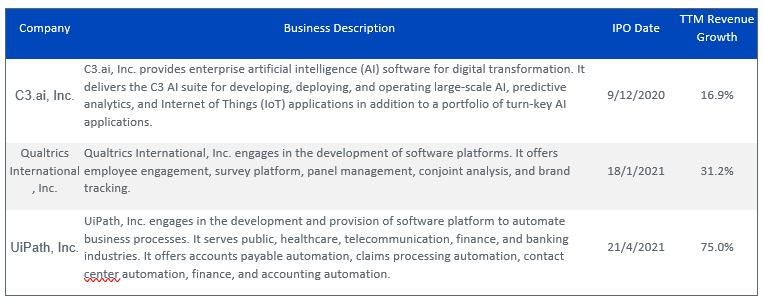

The Additions – All IPOs

The three additions to the BVP Nasdaq Emerging Cloud Index were UiPath, Inc., C3.ai, Inc, and Qualtrics International, Inc.1. Each one of these companies was once named on the Cloud 100 list, a definitive ranking of the top 100 private cloud companies by Bessemer Venture Partners, Forbes, and Salesforce Ventures. Following the August 2021 rebalance, 29 of the 58 companies in the BVP Nasdaq Emerging Cloud Index are Cloud 100 graduates.

The most recent IPO addition from April 2021 was UiPath, a company focused on automating business processes across various departments of an enterprise. More specifically, UiPath’s software platform uses artificial intelligence (AI) to perform tasks, like logging into applications, extracting information from documents, moving folders, filling in forms, and updating information fields and databases. Deloitte is an example of a company that has leveraged UiPath’s robotic process automation (RPA) platform and its digital workforce to execute repetitive and mundane tasks.

Another artificial intelligence add was C3.ai, Inc. which went public in December 2020 and provides cloud software that enables enterprises to develop and deploy AI applications. One of the many customers the company highlights is a Fortune 500 commercial lender with a legacy credit assessment process that took weeks on average. Using C3.ai’s Smart Lending software application the lender was able to use machine learning to reduce the average assessment timeline by 30%. C3.ai offers customers the ability to build customized enterprise AI applications, as well as families of turnkey AI applications that target various industry verticals, like Financial Services, Manufacturing, Utilities, Oil & Gas, and Aerospace and Defense.

Qualtrics International, Inc. went public in January 2021 and offers a single software platform for enterprises to manage their customers, employees, products, and branding. As an example, JetBlue partners with Qualtrics for customer experience management that merges data on purchase drivers, experience, and satisfaction into a centralized hub. This feedback loop helps JetBlue make impactful macro-level (ex: the introduction of new pricing structures for all passengers) and micro-level decisions (ex: accommodations specific to an airport, terminal or gate that address decision customer dissatisfaction).

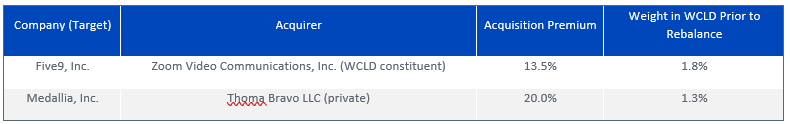

The Drops – All Mergers and acquisitions (M&A) Targets

Similar to February 2021, all of the drops from the BVP Nasdaq Emerging Cloud Index are pending acquisition targets. It is especially reassuring that the removals are not because of failures to meet growth requirements, but instead because these businesses are attractive takeover candidates. This brings the tally up to 16 companies held within the BVP Nasdaq Emerging Cloud Index that have been acquired or are pending acquisitions at premium deal multiples.

One of the acquisitions involved two cloud constituents, Five9 as the target and Zoom Video Communications as the acquirer.

The End Results

The private and public cloud market are fast moving and the BVP Nasdaq Emerging Cloud Index’s semi-annual rebalance allows for the refreshing of constituents and weights for the latest in market developments.

From a fundamental perspective, there was not an overly significant change this rebalance. As expected with a reset back to an equally weighted basket, aggregate valuation and size modestly decreased across the portfolio. Meanwhile, revenue growth slightly increased which is a vote of confidence in the consistent growth rates achieved by the constituents, especially with a difficult year-over-year comparison to 2020 when many of the companies experience elevated expansion as their customers digitized their operations in earlier stages of the COVID-19 pandemic.

The BVP Nasdaq Emerging Cloud Index now Features ESG Screens

It is also notable that the August 2021 rebalance was the first time where the BVP Nasdaq Emerging Cloud Index included an ESG screening protocol within its methodology. Companies involved in tobacco, thermal coal, controversial weapons, or that don’t adhere to the standards of the UN Global Compact would no longer be able to be included. Thus far, the typical, software-focused companies in this approach have not tended to run afoul of these criteria, but it is still important to ensure that these values will continue to guide company inclusion into the future of the strategy.

1 As of 8/19/2021 WCLD held 1.7% of its total weight in each of UiPath, Inc., Qualtrics International, Inc., and C3.ai, Inc.

Related blogs

+ Key Takeaways from the Cloud 100

+ Cloud Giants: Meeting Daniel Dines, co-founder and CEO at UiPath

Related products